Top Low-Cost Franchises 2015

A look at the top Low-Cost Franchise Opportunities for 2015 based on owner satisfaction.

A look at the top Low-Cost Franchise Opportunities for 2015 based on owner satisfaction.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SPECIAL REPORT: <strong>Top</strong> <strong>Low</strong>-<strong>Cost</strong> <strong>Franchises</strong><br />

Continued from page 6.<br />

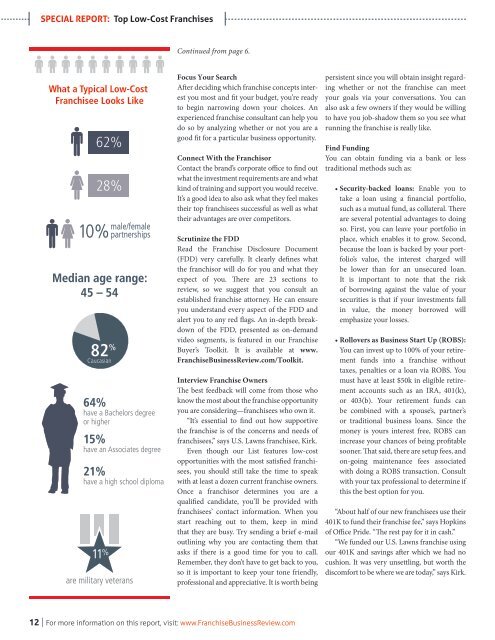

What a Typical <strong>Low</strong>-<strong>Cost</strong><br />

Franchisee Looks Like<br />

62%<br />

28%<br />

male/female<br />

10% partnerships<br />

Median age range:<br />

45 – 54<br />

82 %<br />

Caucasian<br />

64%<br />

have a Bachelors degree<br />

or higher<br />

15%<br />

have an Associates degree<br />

21%<br />

have a high school diploma<br />

11 %<br />

are military veterans<br />

Focus Your Search<br />

After deciding which franchise concepts interest<br />

you most and fit your budget, you’re ready<br />

to begin narrowing down your choices. An<br />

experienced franchise consultant can help you<br />

do so by analyzing whether or not you are a<br />

good fit for a particular business opportunity.<br />

Connect With the Franchisor<br />

Contact the brand’s corporate office to find out<br />

what the investment requirements are and what<br />

kind of training and support you would receive.<br />

It’s a good idea to also ask what they feel makes<br />

their top franchisees successful as well as what<br />

their advantages are over competitors.<br />

Scrutinize the FDD<br />

Read the Franchise Disclosure Document<br />

(FDD) very carefully. It clearly defines what<br />

the franchisor will do for you and what they<br />

expect of you. There are 23 sections to<br />

review, so we suggest that you consult an<br />

established franchise attorney. He can ensure<br />

you understand every aspect of the FDD and<br />

alert you to any red flags. An in-depth breakdown<br />

of the FDD, presented as on-demand<br />

video segments, is featured in our Franchise<br />

Buyer’s Toolkit. It is available at www.<br />

FranchiseBusinessReview.com/Toolkit.<br />

Interview Franchise Owners<br />

The best feedback will come from those who<br />

know the most about the franchise opportunity<br />

you are considering—franchisees who own it.<br />

“It’s essential to find out how supportive<br />

the franchise is of the concerns and needs of<br />

franchisees,” says U.S. Lawns franchisee, Kirk.<br />

Even though our List features low-cost<br />

opportunities with the most satisfied franchisees,<br />

you should still take the time to speak<br />

with at least a dozen current franchise owners.<br />

Once a franchisor determines you are a<br />

qualified candidate, you’ll be provided with<br />

franchisees’ contact information. When you<br />

start reaching out to them, keep in mind<br />

that they are busy. Try sending a brief e-mail<br />

outlining why you are contacting them that<br />

asks if there is a good time for you to call.<br />

Remember, they don’t have to get back to you,<br />

so it is important to keep your tone friendly,<br />

professional and appreciative. It is worth being<br />

persistent since you will obtain insight regarding<br />

whether or not the franchise can meet<br />

your goals via your conversations. You can<br />

also ask a few owners if they would be willing<br />

to have you job-shadow them so you see what<br />

running the franchise is really like.<br />

Find Funding<br />

You can obtain funding via a bank or less<br />

traditional methods such as:<br />

• Security-backed loans: Enable you to<br />

take a loan using a financial portfolio,<br />

such as a mutual fund, as collateral. There<br />

are several potential advantages to doing<br />

so. First, you can leave your portfolio in<br />

place, which enables it to grow. Second,<br />

because the loan is backed by your portfolio’s<br />

value, the interest charged will<br />

be lower than for an unsecured loan.<br />

It is important to note that the risk<br />

of borrowing against the value of your<br />

securities is that if your investments fall<br />

in value, the money borrowed will<br />

emphasize your losses.<br />

• Rollovers as Business Start Up (ROBS):<br />

You can invest up to 100% of your retirement<br />

funds into a franchise without<br />

taxes, penalties or a loan via ROBS. You<br />

must have at least $50k in eligible retirement<br />

accounts such as an IRA, 401(k),<br />

or 403(b). Your retirement funds can<br />

be combined with a spouse’s, partner’s<br />

or traditional business loans. Since the<br />

money is yours interest free, ROBS can<br />

increase your chances of being profitable<br />

sooner. That said, there are setup fees, and<br />

on-going maintenance fees associated<br />

with doing a ROBS transaction. Consult<br />

with your tax professional to determine if<br />

this the best option for you.<br />

“About half of our new franchisees use their<br />

401K to fund their franchise fee,” says Hopkins<br />

of Office Pride. “The rest pay for it in cash.”<br />

“We funded our U.S. Lawns franchise using<br />

our 401K and savings after which we had no<br />

cushion. It was very unsettling, but worth the<br />

discomfort to be where we are today,” says Kirk.<br />

12 | For more information on this report, visit: www.FranchiseBusinessReview.com