Jpmorgan Funds - Fundsupermart.com

Jpmorgan Funds - Fundsupermart.com

Jpmorgan Funds - Fundsupermart.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

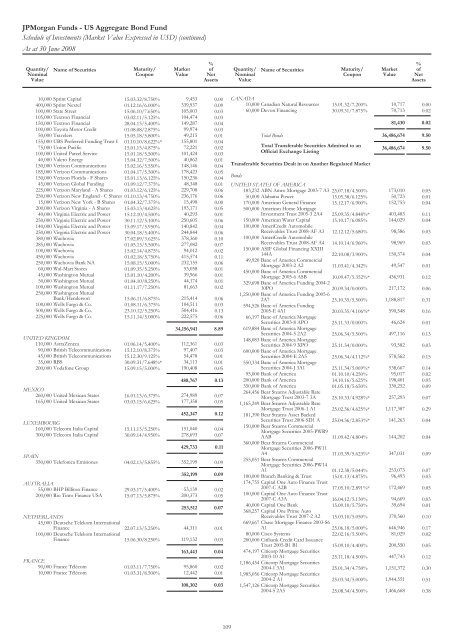

JPMorgan <strong>Funds</strong> - US Aggregate Bond Fund<br />

Schedule of Investments (Market Value Expressed in USD) (continued)<br />

As at 30 June 2008<br />

Quantity/<br />

Nominal<br />

Value<br />

Name of Securities<br />

Maturity/<br />

Coupon<br />

Market<br />

Value<br />

% of<br />

Net<br />

Assets<br />

10,000 Sprint Capital 15.03.32/8.750% 9,453 0.00<br />

400,000 Sprint Nextel 01.12.16/6.000% 339,937 0.09<br />

100,000 State Street 15.06.10/7.650% 105,003 0.03<br />

105,000 Textron Financial 03.02.11/5.125% 104,474 0.03<br />

150,000 Textron Financial 28.04.13/5.400% 149,287 0.04<br />

100,000 Toyota Motor Credit 01.08.08/2.875% 99,974 0.03<br />

50,000 Travelers 15.05.18/5.800% 49,215 0.01<br />

155,000 UBS Preferred Funding Trust I 01.10.10/8.622%* 155,801 0.04<br />

75,000 Union Pacific 15.01.15/4.875% 72,221 0.02<br />

100,000 United Parcel Service 15.01.18/5.500% 101,424 0.03<br />

40,000 Valero Energy 15.04.32/7.500% 40,862 0.01<br />

150,000 Verizon Communications 15.02.16/5.550% 148,146 0.04<br />

185,000 Verizon Communications 01.04.17/5.500% 178,423 0.05<br />

150,000 Verizon Florida - F Shares 15.01.13/6.125% 150,236 0.04<br />

45,000 Verizon Global Funding 01.09.12/7.375% 48,348 0.01<br />

225,000 Verizon Maryland - AShares 01.03.12/6.125% 229,708 0.06<br />

250,000 Verizon New England - C Shares 01.10.13/4.750% 236,176 0.06<br />

15,000 Verizon New York - B Shares 01.04.32/7.375% 15,498 0.00<br />

200,000 Verizon Virginia - AShares 15.03.13/4.625% 193,171 0.05<br />

40,000 Virginia Electric and Power 15.12.10/4.500% 40,293 0.01<br />

250,000 Virginia Electric and Power 30.11.12/5.100% 250,605 0.06<br />

140,000 Virginia Electric and Power 15.09.17/5.950% 140,842 0.04<br />

250,000 Virginia Electric and Power 30.04.18/5.400% 244,844 0.06<br />

380,000 Wachovia 17.02.09/3.625% 378,360 0.10<br />

285,000 Wachovia 01.05.13/5.500% 277,082 0.07<br />

100,000 Wachovia 15.02.14/4.875% 94,012 0.02<br />

450,000 Wachovia 01.02.18/5.750% 415,574 0.11<br />

250,000 Wachovia Bank NA 15.08.15/5.000% 232,155 0.06<br />

60,000 Wal-Mart Stores 01.09.35/5.250% 53,058 0.01<br />

45,000 Washington Mutual 15.01.10/4.200% 39,966 0.01<br />

50,000 Washington Mutual 01.04.10/8.250% 44,174 0.01<br />

100,000 Washington Mutual 01.11.17/7.250% 81,663 0.02<br />

250,000 Washington Mutual<br />

Bank/Henderson 15.06.11/6.875% 215,414 0.06<br />

100,000 Wells Fargo & Co. 01.08.11/6.375% 104,511 0.03<br />

500,000 Wells Fargo & Co. 23.10.12/5.250% 504,416 0.13<br />

225,000 Wells Fargo & Co. 15.11.14/5.000% 222,575 0.06<br />

34,156,941 8.89<br />

UNITED KINGDOM<br />

110,000 AstraZeneca 01.06.14/5.400% 112,361 0.03<br />

90,000 British Tele<strong>com</strong>munications 15.12.10/8.375% 97,407 0.03<br />

45,000 British Tele<strong>com</strong>munications 15.12.30/9.125% 54,478 0.01<br />

35,000 RBS 30.09.31/7.648%* 34,113 0.01<br />

200,000 Vodafone Group 15.09.15/5.000% 190,408 0.05<br />

488,767 0.13<br />

MEXICO<br />

260,000 United Mexican States 16.01.13/6.375% 274,989 0.07<br />

165,000 United Mexican States 03.03.15/6.625% 177,358 0.05<br />

452,347 0.12<br />

LUXEMBOURG<br />

160,000 Tele<strong>com</strong> Italia Capital 15.11.13/5.250% 151,040 0.04<br />

300,000 Tele<strong>com</strong> Italia Capital 30.09.14/4.950% 278,693 0.07<br />

429,733 0.11<br />

SPAIN<br />

350,000 Telefonica Emisiones 04.02.13/5.855% 352,199 0.09<br />

352,199 0.09<br />

AUSTRALIA<br />

55,000 BHP Billiton Finance 29.03.17/5.400% 53,139 0.02<br />

200,000 Rio Tinto Finance USA 15.07.13/5.875% 200,373 0.05<br />

253,512 0.07<br />

NETHERLANDS<br />

45,000 Deutsche Telekom International<br />

Finance 22.07.13/5.250% 44,311 0.01<br />

100,000 Deutsche Telekom International<br />

Finance 15.06.30/8.250% 119,132 0.03<br />

163,443 0.04<br />

FRANCE<br />

90,000 France Télé<strong>com</strong> 01.03.11/7.750% 95,860 0.02<br />

10,000 France Télé<strong>com</strong> 01.03.31/8.500% 12,442 0.01<br />

108,302 0.03<br />

109<br />

Quantity/<br />

Nominal<br />

Value<br />

Name of Securities<br />

Maturity/<br />

Coupon<br />

CANADA<br />

10,000 Canadian Natural Resources 15.01.32/7.200% 10,717 0.00<br />

60,000 Devon Financing 30.09.31/7.875% 70,713 0.02<br />

81,430 0.02<br />

Total Bonds 36,486,674 9.50<br />

Total Transferable Securities Admitted to an<br />

Official Exchange Listing<br />

Market<br />

Value<br />

% of<br />

Net<br />

Assets<br />

36,486,674 9.50<br />

Transferable Securities Dealt in on Another Regulated Market<br />

Bonds<br />

UNITED STATES OFAMERICA<br />

183,232 ABN Amro Mortgage 2003-7 A3 25.07.18/4.500% 173,010 0.05<br />

50,000 Alabama Power 15.05.38/6.125% 50,723 0.01<br />

170,000 American General Finance 15.12.17/6.900% 152,753 0.04<br />

500,000 American Home Mortgage<br />

Investment Trust 2005-3 2A4 25.09.35/4.848%* 403,483 0.11<br />

150,000 American Water Capital 15.10.17/6.085% 144,029 0.04<br />

100,000 AmeriCredit Automobile<br />

Receivables Trust 2008-AF A3 12.12.12/5.680% 98,586 0.03<br />

100,000 AmeriCredit Automobile<br />

Receivables Trust 2008-AF A4 14.10.14/6.960% 98,969 0.03<br />

150,000 ASIF Global Financing XXIII<br />

144A 22.10.08/3.900% 150,374 0.04<br />

49,920 Banc of America Commercial<br />

Mortgage 2003-2 A2 11.03.41/4.342% 49,547 0.01<br />

450,000 Banc of America Commercial<br />

Mortgage 2005-6 ASB 10.09.47/5.352%* 436,931 0.12<br />

329,698 Banc of America Funding 2004-2<br />

30PO 20.09.34/0.000% 217,172 0.06<br />

1,250,000 Banc of America Funding 2005-6<br />

2A7 25.10.35/5.500% 1,188,817 0.31<br />

594,526 Banc of America Funding<br />

2005-E 4A1 20.03.35/4.106%* 590,548 0.16<br />

66,197 Banc of America Mortgage<br />

Securities 2003-8 APO 25.11.33/0.000% 46,624 0.01<br />

619,884 Banc of America Mortgage<br />

Securities 2004-5 2A2 25.06.34/5.500% 497,116 0.13<br />

148,083 Banc of America Mortgage<br />

Securities 2004-9 XPO 25.11.34/0.000% 93,582 0.03<br />

600,000 Banc of America Mortgage<br />

Securities 2004-E 2A5 25.06.34/4.112%* 578,562 0.15<br />

550,334 Banc of America Mortgage<br />

Securities 2004-J 3A1 25.11.34/5.069%* 538,667 0.14<br />

95,000 Bank of America 01.10.10/4.250% 95,017 0.02<br />

200,000 Bank of America 14.10.16/5.625% 198,401 0.05<br />

350,000 Bank of America 01.05.18/5.650% 330,252 0.09<br />

264,456 Bear Stearns Adjustable Rate<br />

Mortgage Trust 2003-7 3A 25.10.33/4.928%* 257,293 0.07<br />

1,165,249 Bear Stearns Adjustable Rate<br />

Mortgage Trust 2006-1 A1 25.02.36/4.625%* 1,117,387 0.29<br />

181,390 Bear Stearns Asset Backed<br />

Securities Trust 2006-SD1 A<br />

150,000 Bear Stearns Commercial<br />

25.04.36/2.853%* 141,263 0.04<br />

Mortgage Securities 2005-PWR9<br />

AAB<br />

360,000 Bear Stearns Commercial<br />

11.09.42/4.804% 144,202 0.04<br />

Mortgage Securities 2006-PW11<br />

A4<br />

255,051 Bear Stearns Commercial<br />

11.03.39/5.623%* 347,031 0.09<br />

Mortgage Securities 2006-PW14<br />

A1 01.12.38/5.044% 253,073 0.07<br />

100,000 Branch Banking & Trust 15.01.13/4.875% 96,493 0.03<br />

174,755 Capital One Auto Finance Trust<br />

2007-C A2B 17.05.10/2.891%* 172,469 0.05<br />

100,000 Capital One Auto Finance Trust<br />

2007-C A3A 16.04.12/5.130% 94,609 0.03<br />

40,000 Capital One Bank 15.09.10/5.750% 39,694 0.01<br />

368,257 Capital One Prime Auto<br />

Receivables Trust 2007-2 A2 15.03.10/5.050% 370,560 0.10<br />

669,667 Chase Mortgage Finance 2003-S6<br />

A1 25.06.18/5.000% 646,946 0.17<br />

80,000 Cisco Systems 22.02.16/5.500% 81,029 0.02<br />

200,000 Citibank Credit Card Issuance<br />

Trust 2005-B1 B1 15.09.10/4.400% 200,550 0.05<br />

474,197 Citicorp Mortgage Securities<br />

2003-10 A1 25.11.18/4.500% 447,743 0.12<br />

1,186,454 Citicorp Mortgage Securities<br />

2004-1 3A1 25.01.34/4.750% 1,151,372 0.30<br />

1,985,056 Citicorp Mortgage Securities<br />

2004-2 A1 25.03.34/5.000% 1,944,551 0.51<br />

1,547,126 Citicorp Mortgage Securities<br />

2004-5 2A5 25.08.34/4.500% 1,466,668 0.38