Jpmorgan Funds - Fundsupermart.com

Jpmorgan Funds - Fundsupermart.com

Jpmorgan Funds - Fundsupermart.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

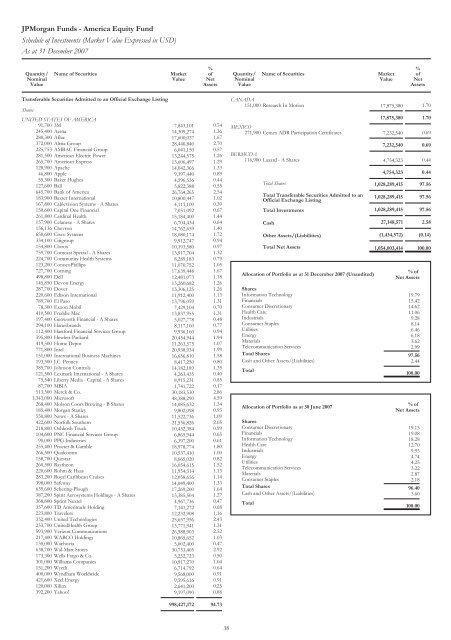

JPMorgan <strong>Funds</strong> - America Equity Fund<br />

Schedule of Investments (Market Value Expressed in USD)<br />

As at 31 December 2007<br />

Quantity/<br />

Nominal<br />

Value<br />

Name of Securities Market<br />

Value<br />

% of<br />

Net<br />

Assets<br />

Transferable Securities Admitted to an Official Exchange Listing<br />

CANADA<br />

Shares<br />

151,000 Research In Motion 17,875,380 1.70<br />

UNITED STATES OF AMERICA<br />

17,875,380 1.70<br />

91,700 3M<br />

245,400 Aetna<br />

280,300 Aflac<br />

7,843,101<br />

14,309,274<br />

17,600,037<br />

0.74<br />

1.36<br />

1.67<br />

MEXICO<br />

271,900 Cemex ADR Participation Certificates 7,232,540 0.69<br />

372,000 Altria Group<br />

225,753 AMBAC Financial Group<br />

281,500 American Electric Power<br />

265,700 American Express<br />

28,446,840<br />

6,041,150<br />

13,244,575<br />

13,606,497<br />

2.70<br />

0.57<br />

1.26<br />

1.29<br />

BERMUDA<br />

116,900 Lazard - A Shares<br />

7,232,540<br />

4,754,323<br />

0.69<br />

0.44<br />

128,900 Apache<br />

46,800 Apple<br />

14,042,366<br />

9,397,440<br />

1.33<br />

0.89<br />

4,754,323 0.44<br />

55,300 Baker Hughes<br />

127,600 Ball<br />

4,596,536<br />

5,822,388<br />

0.44<br />

0.55<br />

Total Shares 1,028,289,415 97.56<br />

645,700 Bank of America<br />

183,900 Baxter International<br />

167,800 Cablevision Systems - A Shares<br />

150,600 Capital One Financial<br />

26,764,265<br />

10,800,447<br />

4,111,100<br />

7,051,092<br />

2.54<br />

1.02<br />

0.39<br />

0.67<br />

Total Transferable Securities Admitted to an<br />

Official Exchange Listing<br />

Total Investments<br />

1,028,289,415<br />

1,028,289,415<br />

97.56<br />

97.56<br />

261,800 Cardinal Health 15,184,400 1.44<br />

157,900 Celanese - A Shares 6,704,434 0.64<br />

Cash 27,148,571 2.58<br />

156,136 Chevron 14,762,659 1.40<br />

650,600 Cisco Systems<br />

334,100 Citigroup<br />

18,080,174<br />

9,912,747<br />

1.72<br />

0.94<br />

Other Assets/(Liabilities) (1,434,572) (0.14)<br />

154,800 Clorox<br />

759,700 Comcast Special - A Shares<br />

10,193,580<br />

13,917,704<br />

0.97<br />

1.32<br />

Total Net Assets 1,054,003,414 100.00<br />

224,700 Community Health Systems 8,289,183 0.79<br />

123,200 ConocoPhillips 11,070,752 1.05<br />

727,700 Corning<br />

498,800 Dell<br />

17,639,448<br />

12,481,073<br />

1.67<br />

1.18<br />

Allocation of Portfolio as at 31 December 2007 (Unaudited)<br />

%of<br />

Net Assets<br />

145,850 Devon Energy 13,260,682 1.26<br />

287,700 Dover<br />

220,600 Edison International<br />

789,700 El Paso<br />

78,300 Exxon Mobil<br />

410,500 Freddie Mac<br />

197,400 Genworth Financial - A Shares<br />

294,100 Hanesbrands<br />

112,400 Hartford Financial Services Group<br />

395,800 Hewlett-Packard<br />

419,500 Home Depot<br />

771,800 Intel<br />

151,000 International Business Machines<br />

193,500 J.C. Penney<br />

13,306,125<br />

11,912,400<br />

13,796,059<br />

7,429,104<br />

13,837,955<br />

5,027,778<br />

8,117,160<br />

9,936,160<br />

20,454,944<br />

11,263,575<br />

20,938,934<br />

16,656,810<br />

8,417,250<br />

1.26<br />

1.13<br />

1.31<br />

0.70<br />

1.31<br />

0.48<br />

0.77<br />

0.94<br />

1.94<br />

1.07<br />

1.99<br />

1.58<br />

0.80<br />

Shares<br />

Information Technology<br />

Financials<br />

Consumer Discretionary<br />

Health Care<br />

Industrials<br />

Consumer Staples<br />

Utilities<br />

Energy<br />

Materials<br />

Tele<strong>com</strong>munication Services<br />

Total Shares<br />

Cash and Other Assets/(Liabilities)<br />

19.79<br />

15.42<br />

14.62<br />

11.06<br />

9.28<br />

8.14<br />

6.46<br />

6.18<br />

3.62<br />

2.99<br />

97.56<br />

2.44<br />

385,700 Johnson Controls<br />

121,500 Lexmark International - A Shares<br />

14,182,189<br />

4,263,435<br />

1.35<br />

0.40<br />

Total<br />

100.00<br />

75,540 Liberty Media - Capital - A Shares 8,915,231 0.85<br />

87,700 MBIA 1,741,722 0.17<br />

513,500 Merck & Co. 30,183,530 2.86<br />

1,343,000 Microsoft 48,388,290 4.59<br />

268,400 Molson Coors Brewing - B Shares<br />

185,400 Morgan Stanley<br />

14,085,632<br />

9,802,098<br />

1.34<br />

0.93<br />

Allocation of Portfolio as at 30 June 2007<br />

%of<br />

Net Assets<br />

550,800 News - A Shares<br />

422,600 Norfolk Southern<br />

218,800 Oshkosh Truck<br />

104,600 PNC Financial Services Group<br />

90,000 PPG Industries<br />

255,400 Procter & Gamble<br />

266,500 Qual<strong>com</strong>m<br />

158,700 Questar<br />

260,500 Raytheon<br />

220,600 Rohm & Haas<br />

283,200 Royal Caribbean Cruises<br />

398,000 Safeway<br />

639,600 Schering-Plough<br />

387,200 Spirit Aerosystems Holdings - A Shares<br />

11,522,736<br />

21,556,826<br />

10,432,384<br />

6,865,944<br />

6,397,200<br />

18,978,774<br />

10,537,410<br />

8,665,020<br />

16,054,615<br />

11,954,314<br />

12,058,656<br />

14,049,400<br />

17,269,200<br />

13,385,504<br />

1.09<br />

2.05<br />

0.99<br />

0.65<br />

0.61<br />

1.80<br />

1.00<br />

0.82<br />

1.52<br />

1.13<br />

1.14<br />

1.33<br />

1.64<br />

1.27<br />

Shares<br />

Consumer Discretionary<br />

Financials<br />

Information Technology<br />

Health Care<br />

Industrials<br />

Energy<br />

Utilities<br />

Tele<strong>com</strong>munication Services<br />

Materials<br />

Consumer Staples<br />

Total Shares<br />

Cash and Other Assets/(Liabilities)<br />

19.15<br />

19.08<br />

18.28<br />

12.70<br />

9.93<br />

4.74<br />

4.25<br />

3.22<br />

2.87<br />

2.18<br />

96.40<br />

3.60<br />

368,800 Sprint Nextel<br />

357,600 TD Ameritrade Holding<br />

4,967,736<br />

7,141,272<br />

0.47<br />

0.68<br />

Total<br />

100.00<br />

223,800 Travelers 12,232,908 1.16<br />

332,400 United Technologies 25,657,956 2.43<br />

233,700 UnitedHealth Group 13,771,941 1.31<br />

593,900 Verizon Communications 26,588,903 2.52<br />

217,400 WABCO Holdings 10,865,652 1.03<br />

130,000 Wachovia 5,002,400 0.47<br />

638,700 Wal-Mart Stores 30,753,405 2.92<br />

173,300 Wells Fargo & Co. 5,252,723 0.50<br />

301,000 Williams Companies 10,917,270 1.04<br />

151,200 Wyeth 6,714,792 0.64<br />

400,000 Wyndham Worldwide 9,568,000 0.91<br />

421,600 Xcel Energy 9,595,616 0.91<br />

120,000 Xilinx 2,641,200 0.25<br />

392,200 Yahoo! 9,197,090 0.88<br />

998,427,172 94.73<br />

38<br />

Quantity/<br />

Nominal<br />

Value<br />

Name of Securities Market<br />

Value<br />

% of<br />

Net<br />

Assets