Jpmorgan Funds - Fundsupermart.com

Jpmorgan Funds - Fundsupermart.com

Jpmorgan Funds - Fundsupermart.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

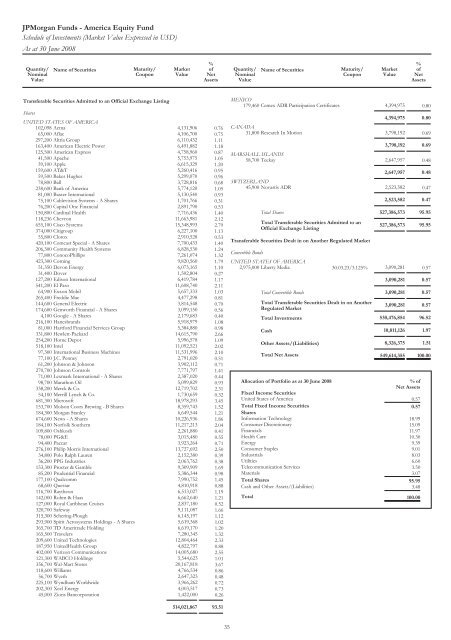

JPMorgan <strong>Funds</strong> - America Equity Fund<br />

Schedule of Investments (Market Value Expressed in USD)<br />

As at 30 June 2008<br />

Quantity/<br />

Nominal<br />

Value<br />

Name of Securities<br />

Maturity/<br />

Coupon<br />

Market<br />

Value<br />

% of<br />

Net<br />

Assets<br />

Transferable Securities Admitted to an Official Exchange Listing<br />

MEXICO<br />

179,460 Cemex ADR Participation Certificates 4,394,975 0.80<br />

Shares<br />

UNITED STATES OFAMERICA<br />

102,098 Aetna<br />

65,000 Aflac<br />

4,131,906<br />

4,106,700<br />

0.76<br />

0.75<br />

CANADA<br />

31,800 Research In Motion<br />

4,394,975<br />

3,798,192<br />

0.80<br />

0.69<br />

297,200 Altria Group<br />

163,400 American Electric Power<br />

6,110,432<br />

6,491,882<br />

1.11<br />

1.18<br />

3,798,192 0.69<br />

125,500 American Express<br />

41,500 Apache<br />

39,100 Apple<br />

4,758,960<br />

5,753,975<br />

6,615,329<br />

0.87<br />

1.05<br />

1.20<br />

MARSHALL ISLANDS<br />

58,700 Teekay 2,647,957 0.48<br />

159,600 AT&T<br />

59,500 Baker Hughes<br />

78,800 Ball<br />

238,600 Bank of America<br />

5,260,416<br />

5,299,070<br />

3,728,816<br />

5,774,120<br />

0.95<br />

0.96<br />

0.68<br />

1.05<br />

SWITZERLAND<br />

45,900 Novartis ADR<br />

2,647,957<br />

2,523,582<br />

0.48<br />

0.47<br />

81,000 Baxter International<br />

75,100 Cablevision Systems - AShares<br />

5,130,540<br />

1,701,766<br />

0.93<br />

0.31<br />

2,523,582 0.47<br />

76,200 Capital One Financial<br />

150,800 Cardinal Health<br />

2,891,790<br />

7,716,436<br />

0.53<br />

1.40<br />

Total Shares 527,386,573 95.95<br />

118,236 Chevron<br />

655,100 Cisco Systems<br />

374,000 Citigroup<br />

11,663,981<br />

15,348,993<br />

6,227,100<br />

2.12<br />

2.79<br />

1.13<br />

Total Transferable Securities Admitted to an<br />

Official Exchange Listing<br />

527,386,573 95.95<br />

55,800 Clorox<br />

420,100 Comcast Special - AShares<br />

2,910,528<br />

7,700,433<br />

0.53<br />

1.40<br />

Transferable Securities Dealt in on Another Regulated Market<br />

206,300 Community Health Systems<br />

77,800 ConocoPhillips<br />

6,828,530<br />

7,261,074<br />

1.24<br />

1.32<br />

Convertible Bonds<br />

423,300 Corning 9,820,560 1.79 UNITED STATES OFAMERICA<br />

51,350 Devon Energy 6,073,165 1.10 2,975,000 Liberty Media 30.03.23/3.125% 3,090,281 0.57<br />

31,400 Dover 1,502,804 0.27<br />

127,200 Edison International 6,419,784 1.17<br />

3,090,281 0.57<br />

541,200 El Paso 11,608,740 2.11<br />

64,900 Exxon Mobil<br />

265,400 Freddie Mac<br />

144,600 General Electric<br />

174,600 Genworth Financial - AShares<br />

5,657,333<br />

4,477,298<br />

3,814,548<br />

3,099,150<br />

1.03<br />

0.81<br />

0.70<br />

0.56<br />

Total Convertible Bonds<br />

Total Transferable Securities Dealt in on Another<br />

Regulated Market<br />

3,090,281<br />

3,090,281<br />

0.57<br />

0.57<br />

4,100 Google - AShares<br />

216,100 Hanesbrands<br />

2,179,683<br />

5,918,979<br />

0.40<br />

1.08<br />

Total Investments 530,476,854 96.52<br />

81,000 Hartford Financial Services Group<br />

331,800 Hewlett-Packard<br />

5,384,880<br />

14,615,790<br />

0.98<br />

2.66<br />

Cash 10,811,126 1.97<br />

254,200 Home Depot<br />

518,100 Intel<br />

5,996,578<br />

11,092,521<br />

1.09<br />

2.02<br />

Other Assets/(Liabilities) 8,326,375 1.51<br />

97,300 International Business Machines<br />

77,100 J.C. Penney<br />

11,531,996<br />

2,791,020<br />

2.10<br />

0.51<br />

Total Net Assets 549,614,355 100.00<br />

61,200 Johnson & Johnson 3,902,112 0.71<br />

270,700 Johnson Controls 7,771,797 1.41<br />

71,000 Lexmark International - AShares<br />

98,700 Marathon Oil<br />

338,200 Merck & Co.<br />

54,100 Merrill Lynch & Co.<br />

681,300 Microsoft<br />

153,700 Molson Coors Brewing - B Shares<br />

2,387,020<br />

5,099,829<br />

12,719,702<br />

1,730,659<br />

18,978,293<br />

8,359,743<br />

0.44<br />

0.93<br />

2.31<br />

0.32<br />

3.45<br />

1.52<br />

Allocation of Portfolio as at 30 June 2008<br />

Fixed In<strong>com</strong>e Securities<br />

United States of America<br />

Total Fixed In<strong>com</strong>e Securities<br />

% of<br />

Net Assets<br />

0.57<br />

0.57<br />

184,300 Morgan Stanley<br />

674,600 News - AShares<br />

184,100 Norfolk Southern<br />

109,800 Oshkosh<br />

78,000 PG&E<br />

94,400 Paccar<br />

276,100 Philip Morris International<br />

34,800 Polo Ralph Lauren<br />

36,200 PPG Industries<br />

153,300 Procter & Gamble<br />

85,200 Prudential Financial<br />

6,649,544<br />

10,226,936<br />

11,217,213<br />

2,261,880<br />

3,015,480<br />

3,923,264<br />

13,727,692<br />

2,152,380<br />

2,063,762<br />

9,309,909<br />

5,386,344<br />

1.21<br />

1.86<br />

2.04<br />

0.41<br />

0.55<br />

0.71<br />

2.50<br />

0.39<br />

0.38<br />

1.69<br />

0.98<br />

Shares<br />

Information Technology<br />

Consumer Discretionary<br />

Financials<br />

Health Care<br />

Energy<br />

Consumer Staples<br />

Industrials<br />

Utilities<br />

Tele<strong>com</strong>munication Services<br />

Materials<br />

18.99<br />

15.09<br />

11.97<br />

10.30<br />

9.39<br />

9.01<br />

8.03<br />

6.60<br />

3.50<br />

3.07<br />

177,100 Qual<strong>com</strong>m<br />

68,600 Questar<br />

116,700 Raytheon<br />

142,000 Rohm & Haas<br />

7,990,752<br />

4,810,918<br />

6,513,027<br />

6,662,640<br />

1.45<br />

0.88<br />

1.19<br />

1.21<br />

Total Shares<br />

Cash and Other Assets/(Liabilities)<br />

Total<br />

95.95<br />

3.48<br />

100.00<br />

127,000 Royal Caribbean Cruises 2,837,180 0.52<br />

320,700 Safeway 9,111,087 1.66<br />

315,300 Schering-Plough 6,145,197 1.12<br />

293,900 Spirit Aerosystems Holdings - A Shares 5,619,368 1.02<br />

365,700 TD Ameritrade Holding 6,619,170 1.20<br />

165,500 Travelers 7,280,345 1.32<br />

209,600 United Technologies 12,804,464 2.33<br />

187,950 UnitedHealth Group 4,822,797 0.88<br />

402,000 Verizon Communications 14,005,680 2.55<br />

121,300 WABCO Holdings 5,544,623 1.01<br />

356,700 Wal-Mart Stores 20,167,818 3.67<br />

118,600 Williams 4,766,534 0.86<br />

56,700 Wyeth 2,647,323 0.48<br />

225,100 Wyndham Worldwide 3,966,262 0.72<br />

202,300 Xcel Energy 4,003,517 0.73<br />

45,000 Zions Bancorporation 1,422,000 0.26<br />

514,021,867 93.51<br />

35<br />

Quantity/<br />

Nominal<br />

Value<br />

Name of Securities<br />

Maturity/<br />

Coupon<br />

Market<br />

Value<br />

% of<br />

Net<br />

Assets