Jpmorgan Funds - Fundsupermart.com

Jpmorgan Funds - Fundsupermart.com

Jpmorgan Funds - Fundsupermart.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

JPMorgan <strong>Funds</strong><br />

Notes to the Financial Statements (continued)<br />

As at 30 June 2008<br />

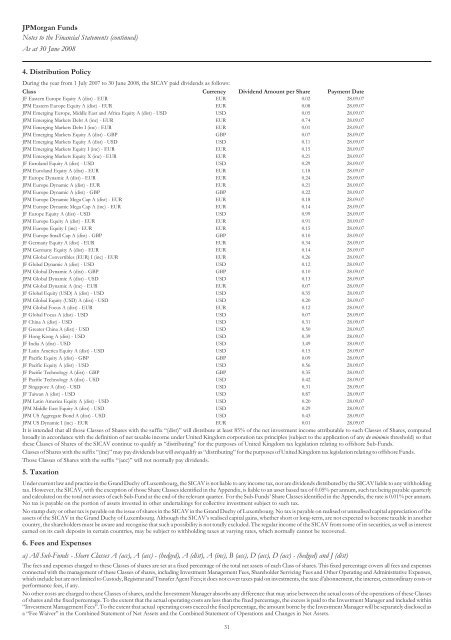

4. Distribution Policy<br />

During the year from 1 July 2007 to 30 June 2008, the SICAV paid dividends as follows:<br />

Class Currency Dividend Amount per Share Payment Date<br />

JF Eastern Europe Equity A(dist) - EUR EUR 0.02 28.09.07<br />

JPM Eastern Europe Equity A(dist) - EUR EUR 0.08 28.09.07<br />

JPM Emerging Europe, Middle East and Africa Equity A (dist) - USD USD 0.05 28.09.07<br />

JPM Emerging Markets Debt A(inc) - EUR EUR 0.74 28.09.07<br />

JPM Emerging Markets Debt I (inc) - EUR EUR 0.01 28.09.07<br />

JPM Emerging Markets Equity A(dist) - GBP GBP 0.07 28.09.07<br />

JPM Emerging Markets Equity A(dist) - USD USD 0.11 28.09.07<br />

JPM Emerging Markets Equity I (inc) - EUR EUR 0.15 28.09.07<br />

JPM Emerging Markets Equity X (inc) - EUR EUR 0.21 28.09.07<br />

JF Euroland Equity A(dist) - USD USD 0.29 28.09.07<br />

JPM Euroland Equity A(dist) - EUR EUR 1.18 28.09.07<br />

JF Europe Dynamic A(dist) - EUR EUR 0.24 28.09.07<br />

JPM Europe Dynamic A(dist) - EUR EUR 0.21 28.09.07<br />

JPM Europe Dynamic A(dist) - GBP GBP 0.22 28.09.07<br />

JPM Europe Dynamic Mega Cap A(dist) - EUR EUR 0.18 28.09.07<br />

JPM Europe Dynamic Mega Cap A(inc) - EUR EUR 0.14 28.09.07<br />

JF Europe Equity A(dist) - USD USD 0.99 28.09.07<br />

JPM Europe Equity A(dist) - EUR EUR 0.91 28.09.07<br />

JPM Europe Equity I (inc) - EUR EUR 0.15 28.09.07<br />

JPM Europe Small Cap A(dist) - GBP GBP 0.10 28.09.07<br />

JF Germany Equity A(dist) - EUR EUR 0.34 28.09.07<br />

JPM Germany Equity A(dist) - EUR EUR 0.14 28.09.07<br />

JPM Global Convertibles (EUR) I (inc) - EUR EUR 0.26 28.09.07<br />

JF Global Dynamic A(dist) - USD USD 0.12 28.09.07<br />

JPM Global Dynamic A(dist) - GBP GBP 0.10 28.09.07<br />

JPM Global Dynamic A(dist) - USD USD 0.13 28.09.07<br />

JPM Global Dynamic A(inc) - EUR EUR 0.07 28.09.07<br />

JF Global Equity (USD) A(dist) - USD USD 0.35 28.09.07<br />

JPM Global Equity (USD) A(dist) - USD USD 0.20 28.09.07<br />

JPM Global Focus A(dist) - EUR EUR 0.12 28.09.07<br />

JF Global Focus A(dist) - USD USD 0.07 28.09.07<br />

JF China A(dist) - USD USD 0.31 28.09.07<br />

JF Greater China A(dist) - USD USD 0.50 28.09.07<br />

JF Hong Kong A(dist) - USD USD 0.39 28.09.07<br />

JF India A(dist) - USD USD 3.49 28.09.07<br />

JF Latin America Equity A (dist) - USD USD 0.15 28.09.07<br />

JF Pacific Equity A(dist) - GBP GBP 0.09 28.09.07<br />

JF Pacific Equity A(dist) - USD USD 0.56 28.09.07<br />

JF Pacific Technology A(dist) - GBP GBP 0.35 28.09.07<br />

JF Pacific Technology A(dist) - USD USD 0.42 28.09.07<br />

JF Singapore A(dist) - USD USD 0.31 28.09.07<br />

JF Taiwan A(dist) - USD USD 0.87 28.09.07<br />

JPM Latin America Equity A (dist) - USD USD 0.20 28.09.07<br />

JPM Middle East Equity A(dist) - USD USD 0.29 28.09.07<br />

JPM US Aggregate Bond A (dist) - USD USD 0.43 28.09.07<br />

JPM US Dynamic I (inc) - EUR EUR 0.01 28.09.07<br />

It is intended that all those Classes of Shares with the suffix “(dist)” will distribute at least 85% of the net investment in<strong>com</strong>e attributable to such Classes of Shares, <strong>com</strong>puted<br />

broadly in accordance with the definition of net taxable in<strong>com</strong>e under United Kingdom corporation tax principles (subject to the application of any de minimis threshold) so that<br />

these Classes of Shares of the SICAV continue to qualify as “distributing” for the purposes of United Kingdom tax legislation relating to offshore Sub-<strong>Funds</strong>.<br />

Classes of Shares with the suffix “(inc)” may pay dividends but will not qualify as “distributing” for the purposes of United Kingdom tax legislation relating to offshore <strong>Funds</strong>.<br />

Those Classes of Shares with the suffix “(acc)” will not normally pay dividends.<br />

5. Taxation<br />

Under current law and practice in the Grand Duchy of Luxembourg, the SICAV is not liable to any in<strong>com</strong>e tax, nor are dividends distributed by the SICAV liable to any withholding<br />

tax. However, the SICAV, with the exception of those Share Classes identified in the Appendix, is liable to an asset based tax of 0.05% per annum, such tax being payable quarterly<br />

and calculated on the total net assets of each Sub-Fund at the end of the relevant quarter. For the Sub-<strong>Funds</strong>’ Share Classes identified in the Appendix, the rate is 0.01% per annum.<br />

No tax is payable on the portion of assets invested in other undertakings for collective investment subject to such tax.<br />

No stamp duty or other tax is payable on the issue of shares in the SICAV in the Grand Duchy of Luxembourg. No tax is payable on realised or unrealised capital appreciation of the<br />

assets of the SICAV in the Grand Duchy of Luxembourg. Although the SICAV’s realised capital gains, whether short or long-term, are not expected to be<strong>com</strong>e taxable in another<br />

country, the shareholders must be aware and recognise that such a possibility is not totally excluded. The regular in<strong>com</strong>e of the SICAV from some of its securities, as well as interest<br />

earned on its cash deposits in certain countries, may be subject to withholding taxes at varying rates, which normally cannot be recovered.<br />

6. Fees and Expenses<br />

a) All Sub-<strong>Funds</strong> - Share Classes A (acc), A (acc) - (hedged), A (dist), A (inc), B (acc), D (acc), D (acc) - (hedged) and J (dist)<br />

The fees and expenses charged to these Classes of shares are set at a fixed percentage of the total net assets of each Class of shares. This fixed percentage covers all fees and expenses<br />

connected with the management of these Classes of shares, including Investment Management Fees, Shareholder Servicing Fees and Other Operating and Administrative Expenses,<br />

which include but are not limited to Custody, Registrar and Transfer Agent Fees; it does not cover taxes paid on investments, the taxe d’abonnement, the interest, extraordinary costs or<br />

performance fees, if any.<br />

No other costs are charged to these Classes of shares, and the Investment Manager absorbs any difference that may arise between the actual costs of the operations of these Classes<br />

of shares and the fixed percentage. To the extent that the actual operating costs are less than the fixed percentage, the excess is paid to the Investment Manager and included within<br />

“Investment Management Fees”. To the extent that actual operating costs exceed the fixed percentage, the amount borne by the Investment Manager will be separately disclosed as<br />

a “Fee Waiver’’ in the Combined Statement of Net Assets and the Combined Statement of Operations and Changes in Net Assets.<br />

31