Jpmorgan Funds - Fundsupermart.com

Jpmorgan Funds - Fundsupermart.com

Jpmorgan Funds - Fundsupermart.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

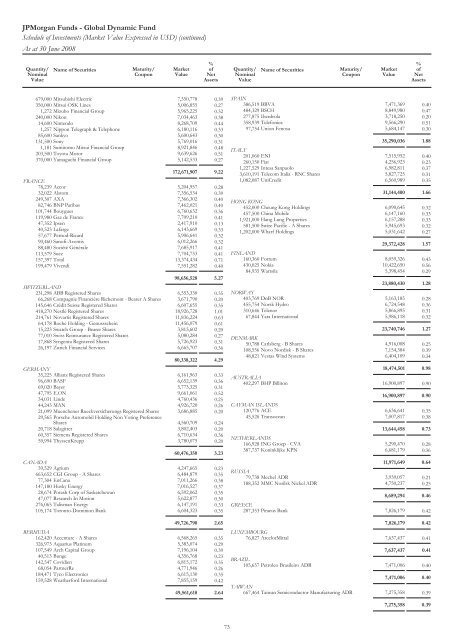

JPMorgan <strong>Funds</strong> - Global Dynamic Fund<br />

Schedule of Investments (Market Value Expressed in USD) (continued)<br />

As at 30 June 2008<br />

Quantity/<br />

Nominal<br />

Value<br />

Name of Securities<br />

Maturity/<br />

Coupon<br />

Market<br />

Value<br />

% of<br />

Net<br />

Assets<br />

679,000 Mitsubishi Electric 7,350,778 0.39<br />

350,000 Mitsui OSK Lines 5,006,855 0.27<br />

1,272 Mizuho Financial Group 5,965,225 0.32<br />

240,000 Nikon 7,034,463 0.38<br />

14,600 Nintendo 8,268,709 0.44<br />

1,257 Nippon Telegraph & Telephone 6,180,116 0.33<br />

85,600 Sankyo 5,600,643 0.30<br />

131,500 Sony 5,769,016 0.31<br />

1,181 Sumitomo Mitsui Financial Group 8,921,846 0.48<br />

203,500 Toyota Motor 9,639,626 0.51<br />

370,000 Yamaguchi Financial Group 5,142,533 0.27<br />

172,671,907 9.22<br />

FRANCE<br />

78,239 Accor 5,204,957 0.28<br />

32,022 Alstom 7,356,534 0.39<br />

249,307 AXA 7,366,302 0.40<br />

82,746 BNP Paribas 7,462,021 0.40<br />

101,744 Bouygues 6,760,632 0.36<br />

119,980 Gaz de France 7,709,210 0.41<br />

47,352 Ipsen 2,417,910 0.13<br />

40,523 Lafarge 6,143,669 0.33<br />

57,677 Pernod-Ricard 5,906,641 0.32<br />

90,460 Sanofi-Aventis 6,012,266 0.32<br />

88,480 Société Générale 7,685,917 0.41<br />

113,579 Suez 7,704,753 0.41<br />

157,397 Total 13,374,434 0.71<br />

199,479 Vivendi 7,551,282 0.40<br />

98,656,528 5.27<br />

SWITZERLAND<br />

231,298 ABB Registered Shares 6,553,330 0.35<br />

66,268 Compagnie Financière Richemont - Bearer AShares 3,671,790 0.20<br />

145,646 Crédit Suisse Registered Shares 6,607,655 0.35<br />

418,270 Nestlé Registered Shares 18,926,728 1.01<br />

214,761 Novartis Registered Shares 11,836,224 0.63<br />

64,178 Roche Holding - Genussschein 11,456,079 0.61<br />

15,223 Swatch Group - Bearer Shares 3,813,602 0.20<br />

77,010 Swiss Reinsurance Registered Shares 5,080,284 0.27<br />

17,868 Syngenta Registered Shares 5,726,923 0.31<br />

26,197 Zurich Financial Services 6,665,707 0.36<br />

80,338,322 4.29<br />

GERMANY<br />

35,225 Allianz Registered Shares 6,161,963 0.33<br />

96,690 BASF 6,652,139 0.36<br />

69,020 Bayer 5,773,325 0.31<br />

47,795 E.ON 9,661,061 0.52<br />

34,031 Linde 4,760,436 0.25<br />

44,243 MAN 4,926,720 0.26<br />

21,099 Muenchener Rueckversicherungs Registered Shares 3,686,885 0.20<br />

29,565 Porsche Automobil Holding Non Voting Preference<br />

Shares 4,560,709 0.24<br />

20,718 Salzgitter 3,802,403 0.20<br />

60,357 Siemens Registered Shares 6,710,634 0.36<br />

59,994 ThyssenKrupp 3,780,075 0.20<br />

60,476,350 3.23<br />

CANADA<br />

39,529 Agrium 4,247,665 0.23<br />

663,652 CGI Group - AShares 6,484,879 0.35<br />

77,304 EnCana 7,011,266 0.38<br />

147,180 Husky Energy 7,016,527 0.37<br />

28,674 Potash Corp of Saskatchewan 6,592,062 0.35<br />

47,077 Research In Motion 5,622,877 0.30<br />

276,065 Talisman Energy 6,147,191 0.33<br />

105,174 Toronto-Dominion Bank 6,604,323 0.35<br />

49,726,790 2.65<br />

BERMUDA<br />

162,420 Accenture - A Shares 6,568,265 0.35<br />

326,973 Aquarius Platinum 5,383,074 0.29<br />

107,549 Arch Capital Group 7,196,104 0.39<br />

40,513 Bunge 4,356,768 0.23<br />

142,547 Covidien 6,815,172 0.35<br />

68,054 PartnerRe 4,771,946 0.26<br />

184,471 Tyco Electronics 6,615,130 0.35<br />

159,528 Weatherford International 7,855,159 0.42<br />

49,561,618 2.64<br />

73<br />

Quantity/<br />

Nominal<br />

Value<br />

Name of Securities<br />

Maturity/<br />

Coupon<br />

Market<br />

Value<br />

% of<br />

Net<br />

Assets<br />

SPAIN<br />

386,519 BBVA7,471,369 0.40<br />

484,329 BSCH 8,849,980 0.47<br />

277,875 Iberdrola 3,718,250 0.20<br />

358,939 Telefonica 9,566,290 0.51<br />

97,754 Union Fenosa 5,684,147 0.30<br />

35,290,036 1.88<br />

ITALY<br />

201,060 ENI 7,515,952 0.40<br />

260,150 Fiat 4,256,923 0.23<br />

1,227,529 Intesa Sanpaolo 6,982,811 0.37<br />

3,610,191 Tele<strong>com</strong> Italia - RNC Shares 5,827,725 0.31<br />

1,082,087 UniCredit 6,560,989 0.35<br />

31,144,400 1.66<br />

HONG KONG<br />

452,000 Cheung Kong Holdings 6,090,645 0.32<br />

457,500 China Mobile 6,147,160 0.33<br />

1,921,000 Hang Lung Properties 6,157,288 0.33<br />

581,500 Swire Pacific - AShares 5,945,693 0.32<br />

1,202,000 Wharf Holdings 5,031,642 0.27<br />

29,372,428 1.57<br />

FINLAND<br />

160,360 Fortum 8,059,326 0.43<br />

430,025 Nokia 10,422,650 0.56<br />

84,935 Wartsila 5,398,454 0.29<br />

23,880,430 1.28<br />

NORWAY<br />

403,769 DnB NOR 5,163,185 0.28<br />

455,754 Norsk Hydro 6,724,548 0.36<br />

310,646 Telenor 5,866,895 0.31<br />

67,844 Yara International 5,986,118 0.32<br />

23,740,746 1.27<br />

DENMARK<br />

50,788 Carlsberg - B Shares 4,916,008 0.25<br />

108,556 Novo Nordisk - B Shares 7,154,384 0.39<br />

48,821 Vestas Wind Systems 6,404,109 0.34<br />

18,474,501 0.98<br />

AUSTRALIA<br />

402,297 BHP Billiton 16,900,897 0.90<br />

16,900,897 0.90<br />

CAYMAN ISLANDS<br />

120,776 ACE 6,636,641 0.35<br />

45,526 Transocean 7,007,817 0.38<br />

13,644,458 0.73<br />

NETHERLANDS<br />

166,928 ING Groep - CVA5,290,470 0.28<br />

387,737 Koninklijke KPN 6,681,179 0.36<br />

11,971,649 0.64<br />

RUSSIA<br />

79,738 Mechel ADR 3,939,057 0.21<br />

188,352 MMC Norilsk Nickel ADR 4,750,237 0.25<br />

8,689,294 0.46<br />

GREECE<br />

287,353 Piraeus Bank 7,826,179 0.42<br />

7,826,179 0.42<br />

LUXEMBOURG<br />

76,827 ArcelorMittal 7,637,437 0.41<br />

7,637,437 0.41<br />

BRAZIL<br />

105,657 Petroleo Brasileiro ADR 7,471,006 0.40<br />

7,471,006 0.40<br />

TAIWAN<br />

667,464 Taiwan Semiconductor Manufacturing ADR 7,275,358 0.39<br />

7,275,358 0.39