Volume 3, ISSUE1/2012 - Review of Applied Socio-Economic ...

Volume 3, ISSUE1/2012 - Review of Applied Socio-Economic ...

Volume 3, ISSUE1/2012 - Review of Applied Socio-Economic ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

assets<br />

revenue<br />

assets<br />

revenue<br />

assets<br />

revenue<br />

assets<br />

revenue<br />

Average market<br />

share <strong>of</strong> assets<br />

Average market<br />

share <strong>of</strong> revenue<br />

ISSN: 2247-6172<br />

ISSN-L: 2247-6172<br />

<strong>Review</strong> <strong>of</strong> <strong>Applied</strong> <strong>Socio</strong>- <strong>Economic</strong> Research<br />

(<strong>Volume</strong> 3, Issue 1/ <strong>2012</strong>), pp.89<br />

URL: http://www.reaser.eu<br />

e-mail: editors@reaser.eu<br />

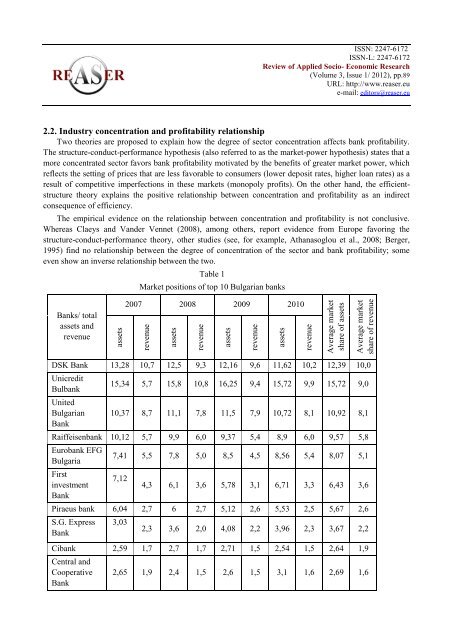

2.2. Industry concentration and pr<strong>of</strong>itability relationship<br />

Two theories are proposed to explain how the degree <strong>of</strong> sector concentration affects bank pr<strong>of</strong>itability.<br />

The structure-conduct-performance hypothesis (also referred to as the market-power hypothesis) states that a<br />

more concentrated sector favors bank pr<strong>of</strong>itability motivated by the benefits <strong>of</strong> greater market power, which<br />

reflects the setting <strong>of</strong> prices that are less favorable to consumers (lower deposit rates, higher loan rates) as a<br />

result <strong>of</strong> competitive imperfections in these markets (monopoly pr<strong>of</strong>its). On the other hand, the efficientstructure<br />

theory explains the positive relationship between concentration and pr<strong>of</strong>itability as an indirect<br />

consequence <strong>of</strong> efficiency.<br />

The empirical evidence on the relationship between concentration and pr<strong>of</strong>itability is not conclusive.<br />

Whereas Claeys and Vander Vennet (2008), among others, report evidence from Europe favoring the<br />

structure-conduct-performance theory, other studies (see, for example, Athanasoglou et al., 2008; Berger,<br />

1995) find no relationship between the degree <strong>of</strong> concentration <strong>of</strong> the sector and bank pr<strong>of</strong>itability; some<br />

even show an inverse relationship between the two.<br />

Table 1<br />

Market positions <strong>of</strong> top 10 Bulgarian banks<br />

Banks/ total<br />

assets and<br />

revenue<br />

2007 2008 2009 2010<br />

DSK Bank 13,28 10,7 12,5 9,3 12,16 9,6 11,62 10,2 12,39 10,0<br />

Unicredit<br />

Bulbank<br />

United<br />

Bulgarian<br />

Bank<br />

15,34 5,7 15,8 10,8 16,25 9,4 15,72 9,9 15,72 9,0<br />

10,37 8,7 11,1 7,8 11,5 7,9 10,72 8,1 10,92 8,1<br />

Raiffeisenbank 10,12 5,7 9,9 6,0 9,37 5,4 8,9 6,0 9,57 5,8<br />

Eurobank EFG<br />

Bulgaria<br />

First<br />

investment<br />

Bank<br />

7,41 5,5 7,8 5,0 8,5 4,5 8,56 5,4 8,07 5,1<br />

7,12<br />

4,3 6,1 3,6 5,78 3,1 6,71 3,3 6,43 3,6<br />

Piraeus bank 6,04 2,7 6 2,7 5,12 2,6 5,53 2,5 5,67 2,6<br />

S.G. Express<br />

Bank<br />

3,03<br />

2,3 3,6 2,0 4,08 2,2 3,96 2,3 3,67 2,2<br />

Cibank 2,59 1,7 2,7 1,7 2,71 1,5 2,54 1,5 2,64 1,9<br />

Central and<br />

Cooperative<br />

Bank<br />

2,65 1,9 2,4 1,5 2,6 1,5 3,1 1,6 2,69 1,6