annual report 2008-09 - IRDA

annual report 2008-09 - IRDA

annual report 2008-09 - IRDA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REPORT <strong>2008</strong>-<strong>09</strong><br />

Rs.9028.68 crore and the private insurers accounted<br />

for Rs.5427.66 crore. While the premium underwritten<br />

by LIC increased by 19.99 per cent, premium of the<br />

private insurers declined by 20.13 per cent over the<br />

corresponding period of the previous year. The<br />

number of policies written by life insurers grew by<br />

12.06 per cent. While the number of policies written<br />

by LIC increased by 22.59 per cent, there has been a<br />

decline of 6.57 per cent in the case of private insurers.<br />

Of the total premium underwritten, individual premium<br />

accounted for Rs.10308.40 crore and the remaining<br />

Rs.4147.93 crore came from the group business. In<br />

respect of LIC, individual business was Rs.5963.64<br />

crore and group business was Rs.3065.04 crore. The<br />

corresponding figures for private insurers were<br />

Rs.4344.75 crore and Rs.1082.90 crore respectively.<br />

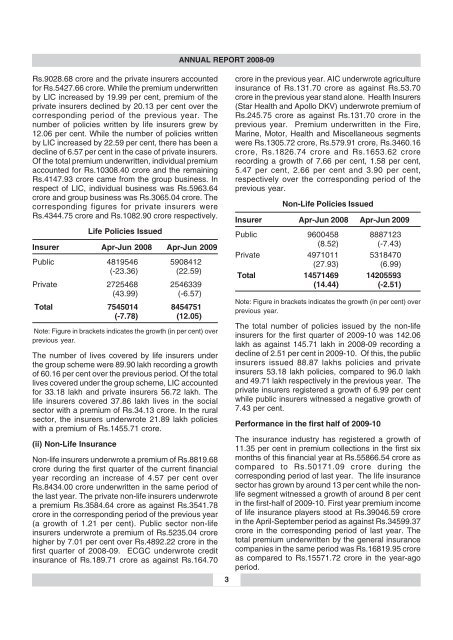

Life Policies Issued<br />

Insurer Apr-Jun <strong>2008</strong> Apr-Jun 20<strong>09</strong><br />

Public 4819546 5908412<br />

(-23.36) (22.59)<br />

Private 2725468 2546339<br />

(43.99) (-6.57)<br />

Total 7545014 8454751<br />

(-7.78) (12.05)<br />

Note: Figure in brackets indicates the growth (in per cent) over<br />

previous year.<br />

The number of lives covered by life insurers under<br />

the group scheme were 89.90 lakh recording a growth<br />

of 60.16 per cent over the previous period. Of the total<br />

lives covered under the group scheme, LIC accounted<br />

for 33.18 lakh and private insurers 56.72 lakh. The<br />

life insurers covered 37.86 lakh lives in the social<br />

sector with a premium of Rs.34.13 crore. In the rural<br />

sector, the insurers underwrote 21.89 lakh policies<br />

with a premium of Rs.1455.71 crore.<br />

(ii) Non-Life Insurance<br />

Non-life insurers underwrote a premium of Rs.8819.68<br />

crore during the first quarter of the current financial<br />

year recording an increase of 4.57 per cent over<br />

Rs.8434.00 crore underwritten in the same period of<br />

the last year. The private non-life insurers underwrote<br />

a premium Rs.3584.64 crore as against Rs.3541.78<br />

crore in the corresponding period of the previous year<br />

(a growth of 1.21 per cent). Public sector non-life<br />

insurers underwrote a premium of Rs.5235.04 crore<br />

higher by 7.01 per cent over Rs.4892.22 crore in the<br />

first quarter of <strong>2008</strong>-<strong>09</strong>. ECGC underwrote credit<br />

insurance of Rs.189.71 crore as against Rs.164.70<br />

3<br />

crore in the previous year. AIC underwrote agriculture<br />

insurance of Rs.131.70 crore as against Rs.53.70<br />

crore in the previous year stand alone. Health Insurers<br />

(Star Health and Apollo DKV) underwrote premium of<br />

Rs.245.75 crore as against Rs.131.70 crore in the<br />

previous year. Premium underwritten in the Fire,<br />

Marine, Motor, Health and Miscellaneous segments<br />

were Rs.1305.72 crore, Rs.579.91 crore, Rs.3460.16<br />

crore, Rs.1826.74 crore and Rs.1653.62 crore<br />

recording a growth of 7.66 per cent, 1.58 per cent,<br />

5.47 per cent, 2.66 per cent and 3.90 per cent,<br />

respectively over the corresponding period of the<br />

previous year.<br />

Non-Life Policies Issued<br />

Insurer Apr-Jun <strong>2008</strong> Apr-Jun 20<strong>09</strong><br />

Public 9600458 8887123<br />

(8.52) (-7.43)<br />

Private 4971011 5318470<br />

(27.93) (6.99)<br />

Total 14571469 14205593<br />

(14.44) (-2.51)<br />

Note: Figure in brackets indicates the growth (in per cent) over<br />

previous year.<br />

The total number of policies issued by the non-life<br />

insurers for the first quarter of 20<strong>09</strong>-10 was 142.06<br />

lakh as against 145.71 lakh in <strong>2008</strong>-<strong>09</strong> recording a<br />

decline of 2.51 per cent in 20<strong>09</strong>-10. Of this, the public<br />

insurers issued 88.87 lakhs policies and private<br />

insurers 53.18 lakh policies, compared to 96.0 lakh<br />

and 49.71 lakh respectively in the previous year. The<br />

private insurers registered a growth of 6.99 per cent<br />

while public insurers witnessed a negative growth of<br />

7.43 per cent.<br />

Performance in the first half of 20<strong>09</strong>-10<br />

The insurance industry has registered a growth of<br />

11.35 per cent in premium collections in the first six<br />

months of this financial year at Rs.55866.54 crore as<br />

compared to Rs.50171.<strong>09</strong> crore during the<br />

corresponding period of last year. The life insurance<br />

sector has grown by around 13 per cent while the nonlife<br />

segment witnessed a growth of around 8 per cent<br />

in the first-half of 20<strong>09</strong>-10. First year premium income<br />

of life insurance players stood at Rs.39046.59 crore<br />

in the April-September period as against Rs.34599.37<br />

crore in the corresponding period of last year. The<br />

total premium underwritten by the general insurance<br />

companies in the same period was Rs.16819.95 crore<br />

as compared to Rs.15571.72 crore in the year-ago<br />

period.