annual report 2008-09 - IRDA

annual report 2008-09 - IRDA

annual report 2008-09 - IRDA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REPORT <strong>2008</strong>-<strong>09</strong><br />

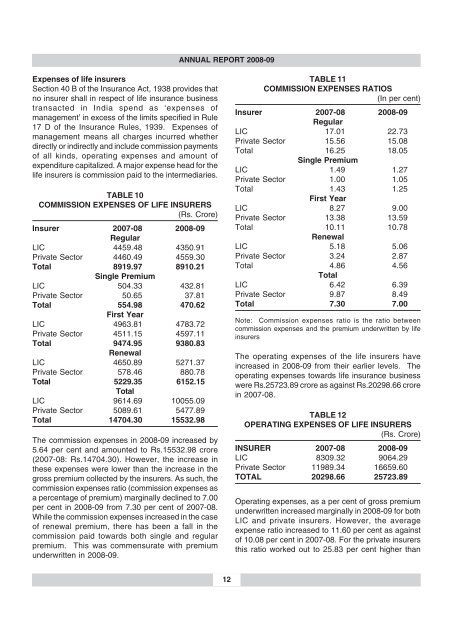

Expenses of life insurers<br />

Section 40 B of the Insurance Act, 1938 provides that<br />

no insurer shall in respect of life insurance business<br />

transacted in India spend as ‘expenses of<br />

management’ in excess of the limits specified in Rule<br />

17 D of the Insurance Rules, 1939. Expenses of<br />

management means all charges incurred whether<br />

directly or indirectly and include commission payments<br />

of all kinds, operating expenses and amount of<br />

expenditure capitalized. A major expense head for the<br />

life insurers is commission paid to the intermediaries.<br />

TABLE 10<br />

COMMISSION EXPENSES OF LIFE INSURERS<br />

(Rs. Crore)<br />

Insurer 2007-08 <strong>2008</strong>-<strong>09</strong><br />

Regular<br />

LIC 4459.48 4350.91<br />

Private Sector 4460.49 4559.30<br />

Total 8919.97 8910.21<br />

Single Premium<br />

LIC 504.33 432.81<br />

Private Sector 50.65 37.81<br />

Total 554.98 470.62<br />

First Year<br />

LIC 4963.81 4783.72<br />

Private Sector 4511.15 4597.11<br />

Total 9474.95 9380.83<br />

Renewal<br />

LIC 4650.89 5271.37<br />

Private Sector 578.46 880.78<br />

Total 5229.35 6152.15<br />

Total<br />

LIC 9614.69 10055.<strong>09</strong><br />

Private Sector 5089.61 5477.89<br />

Total 14704.30 15532.98<br />

The commission expenses in <strong>2008</strong>-<strong>09</strong> increased by<br />

5.64 per cent and amounted to Rs.15532.98 crore<br />

(2007-08: Rs.14704.30). However, the increase in<br />

these expenses were lower than the increase in the<br />

gross premium collected by the insurers. As such, the<br />

commission expenses ratio (commission expenses as<br />

a percentage of premium) marginally declined to 7.00<br />

per cent in <strong>2008</strong>-<strong>09</strong> from 7.30 per cent of 2007-08.<br />

While the commission expenses increased in the case<br />

of renewal premium, there has been a fall in the<br />

commission paid towards both single and regular<br />

premium. This was commensurate with premium<br />

underwritten in <strong>2008</strong>-<strong>09</strong>.<br />

TABLE 11<br />

COMMISSION EXPENSES RATIOS<br />

(In per cent)<br />

Insurer 2007-08 <strong>2008</strong>-<strong>09</strong><br />

Regular<br />

LIC 17.01 22.73<br />

Private Sector 15.56 15.08<br />

Total 16.25 18.05<br />

Single Premium<br />

LIC 1.49 1.27<br />

Private Sector 1.00 1.05<br />

Total 1.43 1.25<br />

First Year<br />

LIC 8.27 9.00<br />

Private Sector 13.38 13.59<br />

Total 10.11 10.78<br />

Renewal<br />

LIC 5.18 5.06<br />

Private Sector 3.24 2.87<br />

Total 4.86 4.56<br />

Total<br />

LIC 6.42 6.39<br />

Private Sector 9.87 8.49<br />

Total 7.30 7.00<br />

Note: Commission expenses ratio is the ratio between<br />

commission expenses and the premium underwritten by life<br />

insurers<br />

The operating expenses of the life insurers have<br />

increased in <strong>2008</strong>-<strong>09</strong> from their earlier levels. The<br />

operating expenses towards life insurance business<br />

were Rs.25723.89 crore as against Rs.20298.66 crore<br />

in 2007-08.<br />

TABLE 12<br />

OPERATING EXPENSES OF LIFE INSURERS<br />

(Rs. Crore)<br />

INSURER 2007-08 <strong>2008</strong>-<strong>09</strong><br />

LIC 83<strong>09</strong>.32 9064.29<br />

Private Sector 11989.34 16659.60<br />

TOTAL 20298.66 25723.89<br />

Operating expenses, as a per cent of gross premium<br />

underwritten increased marginally in <strong>2008</strong>-<strong>09</strong> for both<br />

LIC and private insurers. However, the average<br />

expense ratio increased to 11.60 per cent as against<br />

of 10.08 per cent in 2007-08. For the private insurers<br />

this ratio worked out to 25.83 per cent higher than<br />

12