annual report 2008-09 - IRDA

annual report 2008-09 - IRDA

annual report 2008-09 - IRDA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REPORT <strong>2008</strong>-<strong>09</strong><br />

On the other hand, all private insurers have <strong>report</strong>ed<br />

increases in their investment income and their total<br />

investment income has gone up to Rs.1<strong>09</strong>1.20 crore<br />

during <strong>2008</strong>-<strong>09</strong> from Rs.742.05 crore in 2007-08; an<br />

increase of 47.05 per cent. (Statement 31 & 32)<br />

Incurred Claims Ratio<br />

The net incurred claims of the non-life insurers stood<br />

at Rs.19702.57 crore in <strong>2008</strong>-<strong>09</strong> (2007-08:<br />

Rs.16371.12 crore), registering a slower growth of<br />

20.34 per cent, as against 25.41 per cent in 2007-08.<br />

However, the industry level incurred claims ratio rose<br />

marginally in <strong>2008</strong>-<strong>09</strong>, as the net incurred claims grew<br />

at a higher rate than the rate of growth in net premium.<br />

The incurred claims of public and private sector<br />

insurers rose by 12.48 per cent and 42.82 per cent<br />

respectively in <strong>2008</strong>-<strong>09</strong>. (Statement 33, 34)<br />

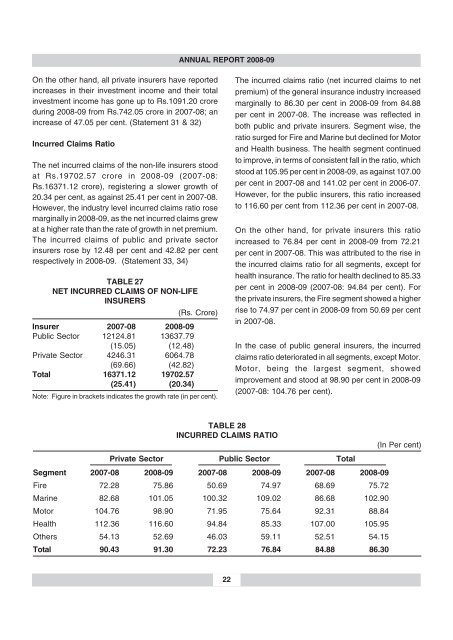

TABLE 27<br />

NET INCURRED CLAIMS OF NON-LIFE<br />

INSURERS<br />

(Rs. Crore)<br />

Insurer 2007-08 <strong>2008</strong>-<strong>09</strong><br />

Public Sector 12124.81 13637.79<br />

(15.05) (12.48)<br />

Private Sector 4246.31 6064.78<br />

(69.66) (42.82)<br />

Total 16371.12 19702.57<br />

(25.41) (20.34)<br />

Note: Figure in brackets indicates the growth rate (in per cent).<br />

The incurred claims ratio (net incurred claims to net<br />

premium) of the general insurance industry increased<br />

marginally to 86.30 per cent in <strong>2008</strong>-<strong>09</strong> from 84.88<br />

per cent in 2007-08. The increase was reflected in<br />

both public and private insurers. Segment wise, the<br />

ratio surged for Fire and Marine but declined for Motor<br />

and Health business. The health segment continued<br />

to improve, in terms of consistent fall in the ratio, which<br />

stood at 105.95 per cent in <strong>2008</strong>-<strong>09</strong>, as against 107.00<br />

per cent in 2007-08 and 141.02 per cent in 2006-07.<br />

However, for the public insurers, this ratio increased<br />

to 116.60 per cent from 112.36 per cent in 2007-08.<br />

On the other hand, for private insurers this ratio<br />

increased to 76.84 per cent in <strong>2008</strong>-<strong>09</strong> from 72.21<br />

per cent in 2007-08. This was attributed to the rise in<br />

the incurred claims ratio for all segments, except for<br />

health insurance. The ratio for health declined to 85.33<br />

per cent in <strong>2008</strong>-<strong>09</strong> (2007-08: 94.84 per cent). For<br />

the private insurers, the Fire segment showed a higher<br />

rise to 74.97 per cent in <strong>2008</strong>-<strong>09</strong> from 50.69 per cent<br />

in 2007-08.<br />

In the case of public general insurers, the incurred<br />

claims ratio deteriorated in all segments, except Motor.<br />

Motor, being the largest segment, showed<br />

improvement and stood at 98.90 per cent in <strong>2008</strong>-<strong>09</strong><br />

(2007-08: 104.76 per cent).<br />

TABLE 28<br />

INCURRED CLAIMS RATIO<br />

(In Per cent)<br />

Private Sector Public Sector Total<br />

Segment 2007-08 <strong>2008</strong>-<strong>09</strong> 2007-08 <strong>2008</strong>-<strong>09</strong> 2007-08 <strong>2008</strong>-<strong>09</strong><br />

Fire 72.28 75.86 50.69 74.97 68.69 75.72<br />

Marine 82.68 101.05 100.32 1<strong>09</strong>.02 86.68 102.90<br />

Motor 104.76 98.90 71.95 75.64 92.31 88.84<br />

Health 112.36 116.60 94.84 85.33 107.00 105.95<br />

Others 54.13 52.69 46.03 59.11 52.51 54.15<br />

Total 90.43 91.30 72.23 76.84 84.88 86.30<br />

22