annual report 2008-09 - IRDA

annual report 2008-09 - IRDA

annual report 2008-09 - IRDA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL REPORT <strong>2008</strong>-<strong>09</strong><br />

As intermediaries, the TPAs are expected to play a<br />

crucial role in processing health claims and other allied<br />

activities on behalf of the insurers, as the sector is<br />

witnessing growth.<br />

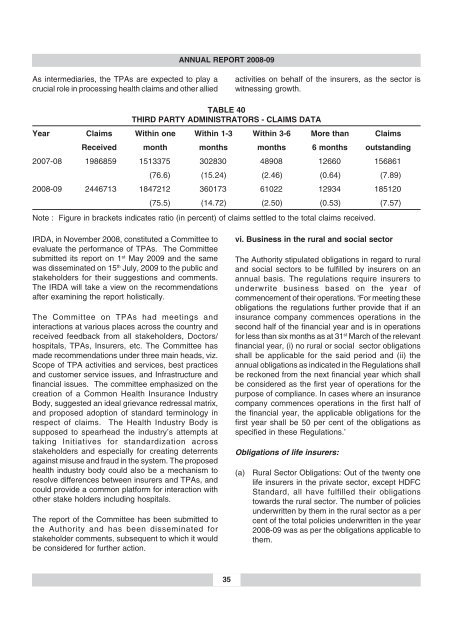

TABLE 40<br />

THIRD PARTY ADMINISTRATORS - CLAIMS DATA<br />

Year Claims Within one Within 1-3 Within 3-6 More than Claims<br />

Received month months months 6 months outstanding<br />

2007-08 1986859 1513375 302830 48908 12660 156861<br />

(76.6) (15.24) (2.46) (0.64) (7.89)<br />

<strong>2008</strong>-<strong>09</strong> 2446713 1847212 360173 61022 12934 185120<br />

(75.5) (14.72) (2.50) (0.53) (7.57)<br />

Note : Figure in brackets indicates ratio (in percent) of claims settled to the total claims received.<br />

<strong>IRDA</strong>, in November <strong>2008</strong>, constituted a Committee to<br />

evaluate the performance of TPAs. The Committee<br />

submitted its <strong>report</strong> on 1 st May 20<strong>09</strong> and the same<br />

was disseminated on 15 th July, 20<strong>09</strong> to the public and<br />

stakeholders for their suggestions and comments.<br />

The <strong>IRDA</strong> will take a view on the recommendations<br />

after examining the <strong>report</strong> holistically.<br />

The Committee on TPAs had meetings and<br />

interactions at various places across the country and<br />

received feedback from all stakeholders, Doctors/<br />

hospitals, TPAs, Insurers, etc. The Committee has<br />

made recommendations under three main heads, viz.<br />

Scope of TPA activities and services, best practices<br />

and customer service issues, and Infrastructure and<br />

financial issues. The committee emphasized on the<br />

creation of a Common Health Insurance Industry<br />

Body, suggested an ideal grievance redressal matrix,<br />

and proposed adoption of standard terminology in<br />

respect of claims. The Health Industry Body is<br />

supposed to spearhead the industry’s attempts at<br />

taking Initiatives for standardization across<br />

stakeholders and especially for creating deterrents<br />

against misuse and fraud in the system. The proposed<br />

health industry body could also be a mechanism to<br />

resolve differences between insurers and TPAs, and<br />

could provide a common platform for interaction with<br />

other stake holders including hospitals.<br />

The <strong>report</strong> of the Committee has been submitted to<br />

the Authority and has been disseminated for<br />

stakeholder comments, subsequent to which it would<br />

be considered for further action.<br />

vi. Business in the rural and social sector<br />

The Authority stipulated obligations in regard to rural<br />

and social sectors to be fulfilled by insurers on an<br />

<strong>annual</strong> basis. The regulations require insurers to<br />

underwrite business based on the year of<br />

commencement of their operations. ‘For meeting these<br />

obligations the regulations further provide that if an<br />

insurance company commences operations in the<br />

second half of the financial year and is in operations<br />

for less than six months as at 31 st March of the relevant<br />

financial year, (i) no rural or social sector obligations<br />

shall be applicable for the said period and (ii) the<br />

<strong>annual</strong> obligations as indicated in the Regulations shall<br />

be reckoned from the next financial year which shall<br />

be considered as the first year of operations for the<br />

purpose of compliance. In cases where an insurance<br />

company commences operations in the first half of<br />

the financial year, the applicable obligations for the<br />

first year shall be 50 per cent of the obligations as<br />

specified in these Regulations.’<br />

Obligations of life insurers:<br />

(a)<br />

Rural Sector Obligations: Out of the twenty one<br />

life insurers in the private sector, except HDFC<br />

Standard, all have fulfilled their obligations<br />

towards the rural sector. The number of policies<br />

underwritten by them in the rural sector as a per<br />

cent of the total policies underwritten in the year<br />

<strong>2008</strong>-<strong>09</strong> was as per the obligations applicable to<br />

them.<br />

35