annual report 2008-09 - IRDA

annual report 2008-09 - IRDA

annual report 2008-09 - IRDA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL REPORT <strong>2008</strong>-<strong>09</strong><br />

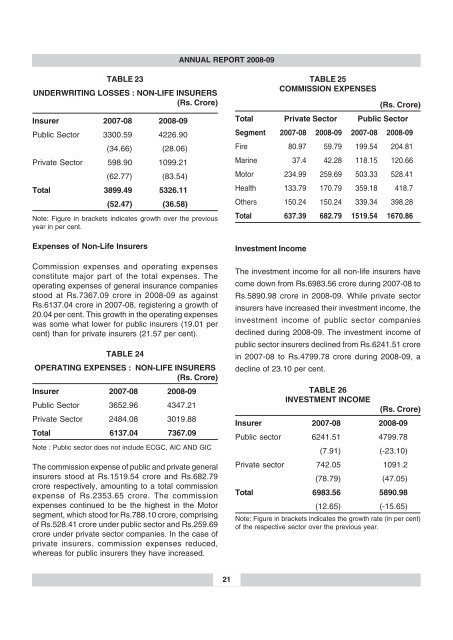

TABLE 23<br />

UNDERWRITING LOSSES : NON-LIFE INSURERS<br />

(Rs. Crore)<br />

Insurer 2007-08 <strong>2008</strong>-<strong>09</strong><br />

Public Sector 3300.59 4226.90<br />

(34.66) (28.06)<br />

Private Sector 598.90 1<strong>09</strong>9.21<br />

(62.77) (83.54)<br />

Total 3899.49 5326.11<br />

(52.47) (36.58)<br />

Note: Figure in brackets indicates growth over the previous<br />

year in per cent.<br />

Expenses of Non-Life Insurers<br />

Commission expenses and operating expenses<br />

constitute major part of the total expenses. The<br />

operating expenses of general insurance companies<br />

stood at Rs.7367.<strong>09</strong> crore in <strong>2008</strong>-<strong>09</strong> as against<br />

Rs.6137.04 crore in 2007-08, registering a growth of<br />

20.04 per cent. This growth in the operating expenses<br />

was some what lower for public insurers (19.01 per<br />

cent) than for private insurers (21.57 per cent).<br />

TABLE 24<br />

OPERATING EXPENSES : NON-LIFE INSURERS<br />

(Rs. Crore)<br />

Insurer 2007-08 <strong>2008</strong>-<strong>09</strong><br />

Public Sector 3652.96 4347.21<br />

Private Sector 2484.08 3019.88<br />

Total 6137.04 7367.<strong>09</strong><br />

Note : Public sector does not include ECGC, AIC AND GIC<br />

The commission expense of public and private general<br />

insurers stood at Rs.1519.54 crore and Rs.682.79<br />

crore respectively, amounting to a total commission<br />

expense of Rs.2353.65 crore. The commission<br />

expenses continued to be the highest in the Motor<br />

segment, which stood for Rs.788.10 crore, comprising<br />

of Rs.528.41 crore under public sector and Rs.259.69<br />

crore under private sector companies. In the case of<br />

private insurers, commission expenses reduced,<br />

whereas for public insurers they have increased.<br />

TABLE 25<br />

COMMISSION EXPENSES<br />

(Rs. Crore)<br />

Total Private Sector Public Sector<br />

Segment 2007-08 <strong>2008</strong>-<strong>09</strong> 2007-08 <strong>2008</strong>-<strong>09</strong><br />

Fire 80.97 59.79 199.54 204.81<br />

Marine 37.4 42.28 118.15 120.66<br />

Motor 234.99 259.69 503.33 528.41<br />

Health 133.79 170.79 359.18 418.7<br />

Others 150.24 150.24 339.34 398.28<br />

Total 637.39 682.79 1519.54 1670.86<br />

Investment Income<br />

The investment income for all non-life insurers have<br />

come down from Rs.6983.56 crore during 2007-08 to<br />

Rs.5890.98 crore in <strong>2008</strong>-<strong>09</strong>. While private sector<br />

insurers have increased their investment income, the<br />

investment income of public sector companies<br />

declined during <strong>2008</strong>-<strong>09</strong>. The investment income of<br />

public sector insurers declined from Rs.6241.51 crore<br />

in 2007-08 to Rs.4799.78 crore during <strong>2008</strong>-<strong>09</strong>, a<br />

decline of 23.10 per cent.<br />

TABLE 26<br />

INVESTMENT INCOME<br />

(Rs. Crore)<br />

Insurer 2007-08 <strong>2008</strong>-<strong>09</strong><br />

Public sector 6241.51 4799.78<br />

(7.91) (-23.10)<br />

Private sector 742.05 1<strong>09</strong>1.2<br />

(78.79) (47.05)<br />

Total 6983.56 5890.98<br />

(12.65) (-15.65)<br />

Note: Figure in brackets indicates the growth rate (in per cent)<br />

of the respective sector over the previous year.<br />

21