annual report 2008-09 - IRDA

annual report 2008-09 - IRDA

annual report 2008-09 - IRDA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL REPORT <strong>2008</strong>-<strong>09</strong><br />

PART II<br />

REVIEW OF WORKING AND OPERATIONS<br />

(i) Regulation of Insurance and re-insurance<br />

companies<br />

a. Collection of information pertaining to premium,<br />

claims offices of general insurance companies<br />

In order to undertake meaningful analysis of the<br />

functioning of the general insurance companies and<br />

improve off-site monitoring, the <strong>IRDA</strong> prescribed the<br />

following formats for submission by the companies:<br />

quarterly submission of a) state-wise gross direct<br />

premium, b) claims <strong>report</strong>ed, c) channel-wise gross<br />

direct premium, d) segment wise Incurred claims, e)<br />

claims performance f) ageing of claims, and g) office<br />

details.<br />

b. One Page Motor Policy<br />

As part of the steps taken by the Authority to improve<br />

efficiency in the general insurance business and to<br />

reduce administrative costs, the Authority permitted<br />

insurers to issue a one page Motor policy without<br />

attaching detailed terms and condition subject to the<br />

following conditions:<br />

1. motor certificate of insurance/ cover note shall<br />

continue to be used in physical form as stipulated<br />

in the Motor Vehicles Act<br />

2. A one page motor policy in physical form can be<br />

issued to a policyholder who explicitly agrees to<br />

receive such a policy<br />

3. every insurer shall have a robust web-site<br />

enabling access to policyholders who wish to<br />

know the terms and conditions.<br />

4. as and when standard terms and conditions<br />

placed on the web-site are allowed to be<br />

modified, the earlier version(s) shall also be made<br />

available on the web-site for access.<br />

5. where an insured requires a complete set of<br />

policy in physical form, he shall be issued a<br />

complete set with all the clauses and conditions<br />

attached, free of cost.<br />

6. where the coverage terms are in any manner<br />

different from the standard terms and conditions<br />

placed on the web-site, the policy shall be issued<br />

in full physical form only.<br />

7. notwithstanding the standard conditions placed<br />

on their web-site, insurer shall abide by the<br />

provisions of Indian Stamp Act.<br />

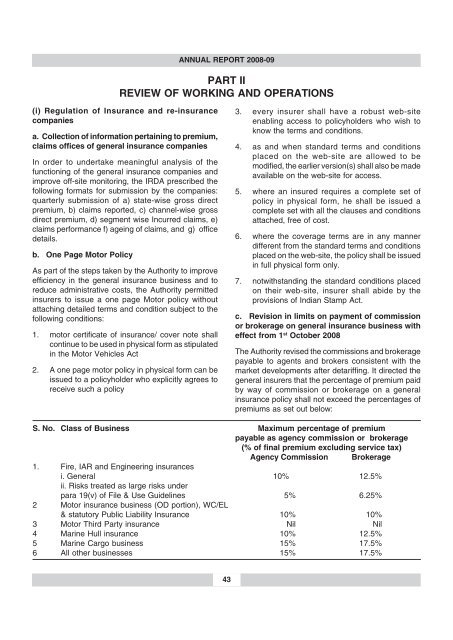

c. Revision in limits on payment of commission<br />

or brokerage on general insurance business with<br />

effect from 1 st October <strong>2008</strong><br />

The Authority revised the commissions and brokerage<br />

payable to agents and brokers consistent with the<br />

market developments after detariffing. It directed the<br />

general insurers that the percentage of premium paid<br />

by way of commission or brokerage on a general<br />

insurance policy shall not exceed the percentages of<br />

premiums as set out below:<br />

S. No. Class of Business Maximum percentage of premium<br />

payable as agency commission or brokerage<br />

(% of final premium excluding service tax)<br />

Agency Commission Brokerage<br />

1. Fire, IAR and Engineering insurances<br />

i. General 10% 12.5%<br />

ii. Risks treated as large risks under<br />

para 19(v) of File & Use Guidelines 5% 6.25%<br />

2 Motor insurance business (OD portion), WC/EL<br />

& statutory Public Liability Insurance 10% 10%<br />

3 Motor Third Party insurance Nil Nil<br />

4 Marine Hull insurance 10% 12.5%<br />

5 Marine Cargo business 15% 17.5%<br />

6 All other businesses 15% 17.5%<br />

43