annual report 2008-09 - IRDA

annual report 2008-09 - IRDA

annual report 2008-09 - IRDA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Committee, supported by their working parties. The<br />

day-to-day business and affairs of the IAIS are taken<br />

care of by its Secretariat, located at the Bank for<br />

International Settlements in Basel, Switzerland.<br />

The IAIS develops principles, standards and guidance<br />

for effective insurance supervisory regimes. In doing<br />

so it helps to establish and maintain fair and efficient<br />

insurance markets for the benefit and protection of<br />

policyholders. The IAIS also prepares ‘issue papers’<br />

that provide background on specific areas of interest<br />

to insurance supervisors.<br />

The IAIS collaborates closely with other international<br />

financial institutions and international associations of<br />

supervisors or regulators and assists in shaping<br />

financial systems globally. In particular, the IAIS is<br />

one of the constituting bodies of the Joint Forum and<br />

participates in all of its working groups. It is also<br />

represented on the Financial Stability Forum. The<br />

IAIS provides input to the International Accounting<br />

Standards Board (IASB) for its work on the<br />

international financial <strong>report</strong>ing standards most<br />

relevant to insurers, and is a member of the IASB’s<br />

Standards Advisory Council as well as an official<br />

observer of its Insurance Working Group and Financial<br />

Instruments Working Group. It also has observer<br />

status on the Financial Action Task Force, which<br />

combats money laundering and terrorist financing.<br />

The Authority is represented by its Chairman on its<br />

Executive Committee and by Members on the various<br />

Committees of IAIS looking into insurance contracts,<br />

accounting aspects, insurance laws, reinsurance,<br />

financial conglomerates, solvency, frauds, etc.<br />

(v) Public grievances<br />

The Grievance Cell of <strong>IRDA</strong> receives complaints from<br />

policyholders, insurance intermediaries and from other<br />

sources against different insurance companies. On<br />

receipt of the complaints the cell functions in two ways:<br />

ANNUAL REPORT <strong>2008</strong>-<strong>09</strong><br />

(a)<br />

(b)<br />

Facilitates —- early resolution of the complaint<br />

by the insurer through direct interaction with the<br />

policyholder and<br />

Analyses the complaints based on:<br />

(i) duration of disposal<br />

(ii) functional area<br />

The insurer wise analysis for duration of complaints<br />

evaluates the effectiveness and simplicity of the<br />

process adopted by the insurer in handling the<br />

complaints. It also evaluates how insurer is complying<br />

with the provisions of Regulation 5 of <strong>IRDA</strong><br />

(Policyholders’ Interests) Regulations, 2002. The<br />

Regulation requires speedy and efficient handling of<br />

the complaints by the insurer.<br />

The analysis of the complaints based on functional<br />

area indicates:<br />

(a)<br />

The weakness in market practices<br />

(b) The inadequacies of the insurance companies -<br />

which may require regulatory intervention for<br />

necessary corrective action.<br />

The Grievance cell plays a facilitative role by<br />

registering the complaint and tracking down the same<br />

with the insurer for its early resolution. In case of<br />

dispute on any issue between the insurer and the<br />

complainant, the cell informs the complainant to take<br />

up the matter with quasi judiciary (insurance<br />

ombudsman / consumer forums) or judiciary bodies,<br />

since <strong>IRDA</strong> does not have the power of adjudication.<br />

Life Insurers<br />

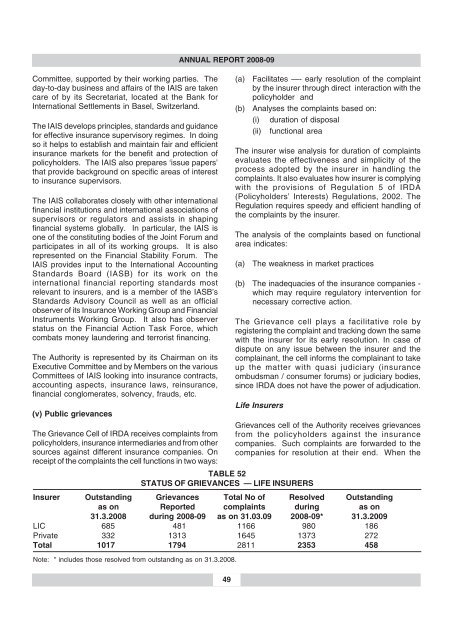

TABLE 52<br />

STATUS OF GRIEVANCES — LIFE INSURERS<br />

Grievances cell of the Authority receives grievances<br />

from the policyholders against the insurance<br />

companies. Such complaints are forwarded to the<br />

companies for resolution at their end. When the<br />

Insurer Outstanding Grievances Total No of Resolved Outstanding<br />

as on Reported complaints during as on<br />

31.3.<strong>2008</strong> during <strong>2008</strong>-<strong>09</strong> as on 31.03.<strong>09</strong> <strong>2008</strong>-<strong>09</strong>* 31.3.20<strong>09</strong><br />

LIC 685 481 1166 980 186<br />

Private 332 1313 1645 1373 272<br />

Total 1017 1794 2811 2353 458<br />

Note: * includes those resolved from outstanding as on 31.3.<strong>2008</strong>.<br />

49