annual report 2008-09 - IRDA

annual report 2008-09 - IRDA

annual report 2008-09 - IRDA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

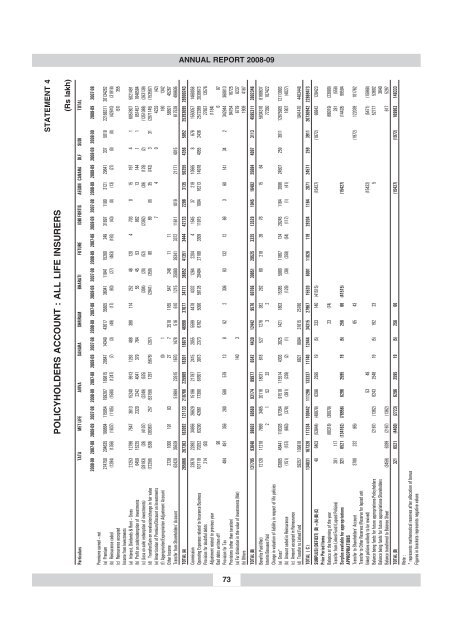

ANNUAL REPORT <strong>2008</strong>-<strong>09</strong><br />

POLICYHOLDERS ACCOUNT : ALL LIFE INSURERS<br />

STATEMENT 4<br />

(Rs lakh)<br />

Particulars TATA MET LIFE AVIVA SAHARA SHRIRAM BHARATI FUTURE IDBI FORTIS AEGON CANARA DLF SUDI TOTAL<br />

<strong>2008</strong>-<strong>09</strong> 2007-08 <strong>2008</strong>-<strong>09</strong> 2007-08 <strong>2008</strong>-<strong>09</strong> 2007-08 <strong>2008</strong>-<strong>09</strong> 2007-08 <strong>2008</strong>-<strong>09</strong> 2007-08 <strong>2008</strong>-<strong>09</strong> 2007-08 <strong>2008</strong>-<strong>09</strong> 2007-08 <strong>2008</strong>-<strong>09</strong> 2007-08 <strong>2008</strong>-<strong>09</strong> <strong>2008</strong>-<strong>09</strong> <strong>2008</strong>-<strong>09</strong> <strong>2008</strong>-<strong>09</strong> <strong>2008</strong>-<strong>09</strong> 2007-08<br />

Premiums earned – net<br />

(a) Premium 274750 204635 199664 115954 199287 189815 20647 14349 43617 35805 36041 11841 15260 249 31897 1190 3121 29641 337 5019 22168311 20134262<br />

(b) Reinsurance ceded (1294) (1356) (1837) (1105) (1580) (1247) (7) (3) (49) (17) (93) (27) (463) (192) (43) (0) (13) (27) (0) (0) (42610) (31918)<br />

(c) Reinsurance accepted (57) 355<br />

Income from Investments<br />

(a) Interest, Dividends & Rent – Gross 21253 12796 7547 3613 15240 9913 1263 488 388 114 252 46 120 4 703 0 15 197 4 1 6057807 5021491<br />

(b) Profit on sale/redemption of investments 6459 15225 2320 2242 4041 379 764 55 45 53 862 13 144 1 1 851457 1646584<br />

(c) (Loss on sale/ redemption of investments) (28193) (28) (4107) (3249) (525) (304) (20) (52) (2392) (39) (129) (2) (1351088) (263139)<br />

(d) Transfer/Gain on revaluation/change in fair value (72256) (538) (39367) 257 (53158) 1297 (5678) (207) (2941) (359) 80 89 (0) 35 (742) 3 31 (2971145) (153567)<br />

(e) Amortization of Premium/Discount on Investments 7 4 0 4233 (42)<br />

(f) Appropriation/Expropriation Adjustment Account (0) 1 160 1342<br />

Other Income 2728 1000 191 93 27 7 2518 1165 547 246 11 11 58501 45267<br />

Transfer from Shareholders’ Account 62420 35629 51984 22615 1670 1478 516 610 1215 25080 26341 3372 11611 1019 21171 4015 617528 499606<br />

TOTAL (A) 265866 267363 162<strong>09</strong>2 121133 210766 2259<strong>09</strong> 18301 16879 46990 37677 34771 36852 41351 3444 42733 2208 3135 50255 4356 5052 25393<strong>09</strong>5 26900243<br />

Commission 23978 22892 34956 26629 15196 21797 2415 2055 5599 4478 4332 1264 2204 4 1545 37 219 10565 8 676 1550057 1468058<br />

Operating Expenses related to Insurance Business 107119 70252 63290 42661 77390 67601 3973 2373 6782 5<strong>09</strong>0 56128 29494 27188 33<strong>09</strong> 11915 1004 16213 14978 4055 2436 2572389 2030673<br />

Provision for doubtful debts 214 (92) 27657 13576<br />

Adjustment related to previous year (1184)<br />

Bad debts written off 96 6 97<br />

Provision for Tax 484 491 356 280 588 579 13 8 62 2 306 93 132 12 69 3 60 141 34 2 342944 360813<br />

Provisions (other than taxation) 94754 16725<br />

(a) For diminution in the value of investments (Net) 140 3 6779 8237<br />

(b) Others 19<strong>09</strong> 4167<br />

TOTAL (B) 131795 93640 98602 69569 93174 89977 6542 4439 12442 9570 60766 30851 29525 3325 13529 1045 16492 25684 4<strong>09</strong>7 3113 4595311 3902346<br />

Benefits Paid (Net) 12120 11218 7669 3465 20116 18031 618 527 1276 382 262 60 218 39 76 15 64 5834310 6168637<br />

Interim Bonuses Paid 2 1 52 32 3 2 77350 107422<br />

Change in valuation of liability in respect of life policies<br />

(a) Gross* 62805 46441 110326 97354 91519 115514 4303 3025 1421 1803 15385 5980 11867 134 29245 1164 2<strong>09</strong>6 24507 259 3911 12875905 12113993<br />

(b) Amount ceded in Reinsurance (151) (157) (663) (378) (391) (239) (2) (1) (126) (39) (258) (54) (117) (1) (41) 1907 (4027)<br />

(c) Amount accepted in Reinsurance<br />

(d) Transfer to Linked Fund 59257 1<strong>09</strong>818 6821 8894 31615 25780 1941470 4483448<br />

TOTAL ( C ) 134031 167320 117334 100442 111296 133337 11740 12444 34315 27967 15520 6001 11826 119 29204 1164 2071 24571 259 3911 2073<strong>09</strong>42 22869473<br />

SURPLUS/ (DEFICIT) (D) =(A)-(B)-(C) 40 6403 (53844) (48878) 6296 2595 19 (5) 233 140 (41515) (15427) (1972) 66842 128423<br />

Prior Period Items<br />

Balance at the beginning of the year (80318) (30079) 23 (74) (66019) (23080)<br />

Transfer from Linked Fund (Lapsed Policies) 281 117 281 (558)<br />

Surplus available for appropriations 321 6521 (134162) (78956) 6296 2595 19 (5) 256 66 (41515) (15427) (14428) 99594<br />

APPROPRIATIONS<br />

Transfer to Shareholders’ Account 3780 232 (65) 65 43 (1972) 122039 101762<br />

Transfer to Other Reserves (Reserve for lapsed unit<br />

linked policies unlikely to be revived) 53 48 (15432) (5471) (15968)<br />

Balance being funds for future appropriations-Policyholders (2167) (1362) 6243 2548 19 (5) 192 23 5 52777 53602<br />

Balance being funds for future appropriations-Shareholders 3640<br />

Balance transferred to Balance Sheet (3459) 6289 (2167) (1362) 617 5297<br />

TOTAL (D) 321 6521 (4400) (2723) 6296 2595 19 (5) 256 66 (15427) (1972) 169963 148333<br />

Note :<br />

* represents mathematical reserves after allocation of bonus<br />

Figures in brackets represents negative values<br />

73