Interactive 2009 Annual Report (PDF 7.56 MB) - Denbury Resources ...

Interactive 2009 Annual Report (PDF 7.56 MB) - Denbury Resources ...

Interactive 2009 Annual Report (PDF 7.56 MB) - Denbury Resources ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

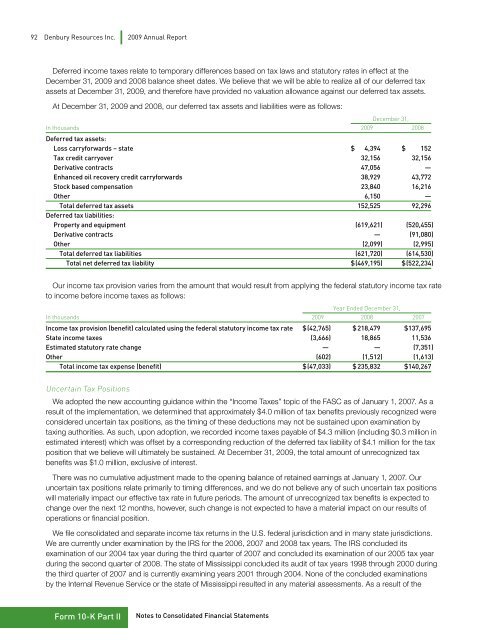

92 <strong>Denbury</strong> <strong>Resources</strong> Inc. <strong>2009</strong> <strong>Annual</strong> <strong>Report</strong>Deferred income taxes relate to temporary differences based on tax laws and statutory rates in effect at theDecember 31, <strong>2009</strong> and 2008 balance sheet dates. We believe that we will be able to realize all of our deferred taxassets at December 31, <strong>2009</strong>, and therefore have provided no valuation allowance against our deferred tax assets.At December 31, <strong>2009</strong> and 2008, our deferred tax assets and liabilities were as follows:December 31,In thousands <strong>2009</strong> 2008Deferred tax assets:Loss carryforwards – state $ 4,394 $ 152Tax credit carryover 32,156 32,156Derivative contracts 47,056 —Enhanced oil recovery credit carryforwards 38,929 43,772Stock based compensation 23,840 16,216Other 6,150 —Total deferred tax assets 152,525 92,296Deferred tax liabilities:Property and equipment (619,621) (520,455)Derivative contracts — (91,080)Other (2,099) (2,995)Total deferred tax liabilities (621,720) (614,530)Total net deferred tax liability $ (469,195) $ (522,234)Our income tax provision varies from the amount that would result from applying the federal statutory income tax rateto income before income taxes as follows:Year Ended December 31,In thousands <strong>2009</strong> 2008 2007Income tax provision (benefit) calculated using the federal statutory income tax rate $ (42,765) $ 218,479 $ 137,695State income taxes (3,666) 18,865 11,536Estimated statutory rate change — — (7,351)Other (602) (1,512) (1,613)Total income tax expense (benefit) $ (47,033) $ 235,832 $ 140,267Uncertain Tax PositionsWe adopted the new accounting guidance within the “Income Taxes” topic of the FASC as of January 1, 2007. As aresult of the implementation, we determined that approximately $4.0 million of tax benefits previously recognized wereconsidered uncertain tax positions, as the timing of these deductions may not be sustained upon examination bytaxing authorities. As such, upon adoption, we recorded income taxes payable of $4.3 million (including $0.3 million inestimated interest) which was offset by a corresponding reduction of the deferred tax liability of $4.1 million for the taxposition that we believe will ultimately be sustained. At December 31, <strong>2009</strong>, the total amount of unrecognized taxbenefits was $1.0 million, exclusive of interest.There was no cumulative adjustment made to the opening balance of retained earnings at January 1, 2007. Ouruncertain tax positions relate primarily to timing differences, and we do not believe any of such uncertain tax positionswill materially impact our effective tax rate in future periods. The amount of unrecognized tax benefits is expected tochange over the next 12 months, however, such change is not expected to have a material impact on our results ofoperations or financial position.We file consolidated and separate income tax returns in the U.S. federal jurisdiction and in many state jurisdictions.We are currently under examination by the IRS for the 2006, 2007 and 2008 tax years. The IRS concluded itsexamination of our 2004 tax year during the third quarter of 2007 and concluded its examination of our 2005 tax yearduring the second quarter of 2008. The state of Mississippi concluded its audit of tax years 1998 through 2000 duringthe third quarter of 2007 and is currently examining years 2001 through 2004. None of the concluded examinationsby the Internal Revenue Service or the state of Mississippi resulted in any material assessments. As a result of theForm 10-K Part IINotes to Consolidated Financial Statements