96 <strong>Denbury</strong> <strong>Resources</strong> Inc. <strong>2009</strong> <strong>Annual</strong> <strong>Report</strong>Restricted StockAs of December 31, <strong>2009</strong>, we had issued 5,900,134 shares of restricted stock (net of forfeited shares) pursuant tothe 2004 Plan and have recorded deferred compensation expense of $50.0 million, the fair market value of the shareson the grant dates, net of estimated forfeitures of $6.7 million. This expense is amortized over the applicable five-year,four-year, or retirement date vesting periods. As of December 31, <strong>2009</strong>, there was $16.8 million of unrecognizedcompensation expense related to non-vested restricted stock grants. This unrecognized compensation cost isexpected to be recognized over a weighted-average period of 3.57 years.A summary of the status of our non-vested restricted stock grants and the changes during the year endedDecember 31, <strong>2009</strong>, is presented below:WeightedAverageGrant-DateNon-Vested Restricted Stock Grants Shares Fair ValueNon-vested at January 1, <strong>2009</strong> 2,210,683 $ 10.52Granted 1,032,896 13.34Vested (672,732) 7.12Forfeited (63,849) 22.42Non-vested at December 31, <strong>2009</strong> 2,506,998 12.29The total vesting date fair value of restricted stock vested during the years ended December 31, <strong>2009</strong>, 2008 and2007 was $10.0 million, $12.3 million and $10.7 million, respectively.Performance Equity AwardsBeginning in 2007, the Board of Directors has awarded an annual grant of performance equity awards to the officersof <strong>Denbury</strong>. These performance-based shares vest over a 1.25 to 3.25 year period. The number of performance-basedshares that will be earned (and eligible to vest) during the performance period will depend on the Company’s level ofsuccess in achieving four specifically identified performance targets. Generally, one-half of the shares earnable underthe performance-based shares will be earned for performance at the designated target levels (100% target vestinglevels) or upon any earlier change of control, and twice the number of shares will be earned if the higher maximumtarget levels are met. If performance is below designated minimum levels for all performance targets, no performancebasedshares will be earned. Any portion of the performance shares that are not earned by the end of the three-yearmeasurement period will be forfeited. In certain change of control events, one-half (i.e., the target level amount) of theperformance-based shares would vest.During <strong>2009</strong>, we granted 293,571 shares of performance-based equity awards (at the 100% targeted vesting level) tothe Company’s executive officers with an average grant date fair value of $12.97 per share. The aggregate number ofperformance-based equity awards outstanding at December 31, <strong>2009</strong> was 475,912 (at the 100% targeted vesting level,less actual forfeitures). The actual number of shares to be delivered pursuant to the performance-based awards couldrange from zero to 200% (951,824) of the stated 100% targeted amount. The Company recognizes compensationexpense when it becomes probable that the performance criteria specified in the plan will be achieved. We currentlyestimate a targeted vesting level of 110%, 100% and 120% for the <strong>2009</strong>, 2008 and 2007 performance grants,respectively. During the years ended December 31, <strong>2009</strong>, 2008, 2007, we recorded $4.7 million, $1.2 million and $0.4million, respectively, of expense in “General and administrative expenses” in our Consolidated Statements of Operationsfor these performance-based awards.Note 10. Derivative Instruments and Hedging ActivitiesOil and Natural Gas Derivative ContractsWe do not apply hedge accounting treatment to our oil and natural gas derivative contracts and therefore thechanges in the fair values of these instruments are recognized in income in the period of change. These fair valuechanges, along with the cash settlements of expired contracts are shown under “Commodity derivative expense(income)” in our Consolidated Statements of Operations.Form 10-K Part IINotes to Consolidated Financial Statements

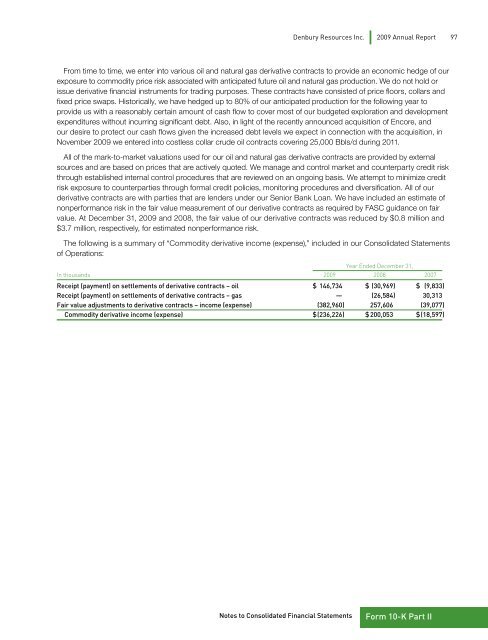

<strong>Denbury</strong> <strong>Resources</strong> Inc. <strong>2009</strong> <strong>Annual</strong> <strong>Report</strong> 97From time to time, we enter into various oil and natural gas derivative contracts to provide an economic hedge of ourexposure to commodity price risk associated with anticipated future oil and natural gas production. We do not hold orissue derivative financial instruments for trading purposes. These contracts have consisted of price floors, collars andfixed price swaps. Historically, we have hedged up to 80% of our anticipated production for the following year toprovide us with a reasonably certain amount of cash flow to cover most of our budgeted exploration and developmentexpenditures without incurring significant debt. Also, in light of the recently announced acquisition of Encore, andour desire to protect our cash flows given the increased debt levels we expect in connection with the acquisition, inNovember <strong>2009</strong> we entered into costless collar crude oil contracts covering 25,000 Bbls/d during 2011.All of the mark-to-market valuations used for our oil and natural gas derivative contracts are provided by externalsources and are based on prices that are actively quoted. We manage and control market and counterparty credit riskthrough established internal control procedures that are reviewed on an ongoing basis. We attempt to minimize creditrisk exposure to counterparties through formal credit policies, monitoring procedures and diversification. All of ourderivative contracts are with parties that are lenders under our Senior Bank Loan. We have included an estimate ofnonperformance risk in the fair value measurement of our derivative contracts as required by FASC guidance on fairvalue. At December 31, <strong>2009</strong> and 2008, the fair value of our derivative contracts was reduced by $0.8 million and$3.7 million, respectively, for estimated nonperformance risk.The following is a summary of “Commodity derivative income (expense),” included in our Consolidated Statementsof Operations:Year Ended December 31,In thousands <strong>2009</strong> 2008 2007Receipt (payment) on settlements of derivative contracts – oil $ 146,734 $ (30,969) $ (9,833)Receipt (payment) on settlements of derivative contracts – gas — (26,584) 30,313Fair value adjustments to derivative contracts – income (expense) (382,960) 257,606 (39,077)Commodity derivative income (expense) $ (236,226) $ 200,053 $ (18,597)Notes to Consolidated Financial StatementsForm 10-K Part II