Interactive 2009 Annual Report (PDF 7.56 MB) - Denbury Resources ...

Interactive 2009 Annual Report (PDF 7.56 MB) - Denbury Resources ...

Interactive 2009 Annual Report (PDF 7.56 MB) - Denbury Resources ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

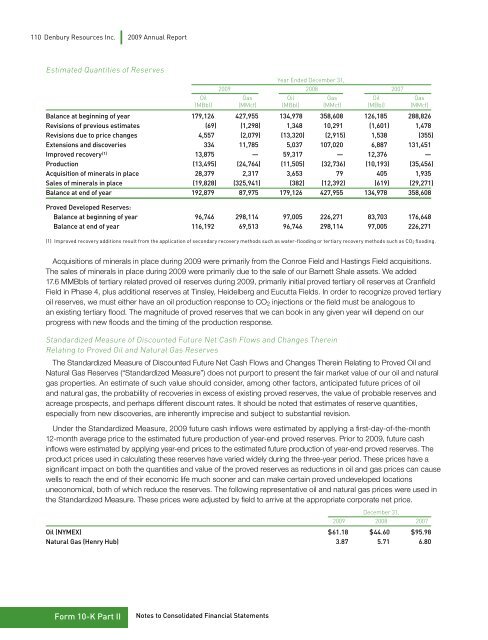

110 <strong>Denbury</strong> <strong>Resources</strong> Inc. <strong>2009</strong> <strong>Annual</strong> <strong>Report</strong>Estimated Quantities of ReservesYear Ended December 31,<strong>2009</strong> 2008 2007Oil Gas Oil Gas Oil Gas(<strong>MB</strong>bl) (MMcf) (<strong>MB</strong>bl) (MMcf) (<strong>MB</strong>bl) (MMcf)Balance at beginning of year 179,126 427,955 134,978 358,608 126,185 288,826Revisions of previous estimates (69) (1,298) 1,348 10,291 (1,601) 1,478Revisions due to price changes 4,557 (2,079) (13,320) (2,915) 1,538 (355)Extensions and discoveries 334 11,785 5,037 107,020 6,887 131,451Improved recovery (1) 13,875 — 59,317 — 12,376 —Production (13,495) (24,764) (11,505) (32,736) (10,193) (35,456)Acquisition of minerals in place 28,379 2,317 3,653 79 405 1,935Sales of minerals in place (19,828) (325,941) (382) (12,392) (619) (29,271)Balance at end of year 192,879 87,975 179,126 427,955 134,978 358,608Proved Developed Reserves:Balance at beginning of year 96,746 298,114 97,005 226,271 83,703 176,648Balance at end of year 116,192 69,513 96,746 298,114 97,005 226,271(1) Improved recovery additions result from the application of secondary recovery methods such as water-flooding or tertiary recovery methods such as CO 2 flooding.Acquisitions of minerals in place during <strong>2009</strong> were primarily from the Conroe Field and Hastings Field acquisitions.The sales of minerals in place during <strong>2009</strong> were primarily due to the sale of our Barnett Shale assets. We added17.6 M<strong>MB</strong>bls of tertiary related proved oil reserves during <strong>2009</strong>, primarily initial proved tertiary oil reserves at CranfieldField in Phase 4, plus additional reserves at Tinsley, Heidelberg and Eucutta Fields. In order to recognize proved tertiaryoil reserves, we must either have an oil production response to CO 2 injections or the field must be analogous toan existing tertiary flood. The magnitude of proved reserves that we can book in any given year will depend on ourprogress with new floods and the timing of the production response.Standardized Measure of Discounted Future Net Cash Flows and Changes ThereinRelating to Proved Oil and Natural Gas ReservesThe Standardized Measure of Discounted Future Net Cash Flows and Changes Therein Relating to Proved Oil andNatural Gas Reserves (“Standardized Measure”) does not purport to present the fair market value of our oil and naturalgas properties. An estimate of such value should consider, among other factors, anticipated future prices of oiland natural gas, the probability of recoveries in excess of existing proved reserves, the value of probable reserves andacreage prospects, and perhaps different discount rates. It should be noted that estimates of reserve quantities,especially from new discoveries, are inherently imprecise and subject to substantial revision.Under the Standardized Measure, <strong>2009</strong> future cash inflows were estimated by applying a first-day-of-the-month12-month average price to the estimated future production of year-end proved reserves. Prior to <strong>2009</strong>, future cashinflows were estimated by applying year-end prices to the estimated future production of year-end proved reserves. Theproduct prices used in calculating these reserves have varied widely during the three-year period. These prices have asignificant impact on both the quantities and value of the proved reserves as reductions in oil and gas prices can causewells to reach the end of their economic life much sooner and can make certain proved undeveloped locationsuneconomical, both of which reduce the reserves. The following representative oil and natural gas prices were used inthe Standardized Measure. These prices were adjusted by field to arrive at the appropriate corporate net price.December 31,<strong>2009</strong> 2008 2007Oil (NYMEX) $ 61.18 $ 44.60 $ 95.98Natural Gas (Henry Hub) 3.87 5.71 6.80Form 10-K Part IINotes to Consolidated Financial Statements