Interactive 2009 Annual Report (PDF 7.56 MB) - Denbury Resources ...

Interactive 2009 Annual Report (PDF 7.56 MB) - Denbury Resources ...

Interactive 2009 Annual Report (PDF 7.56 MB) - Denbury Resources ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

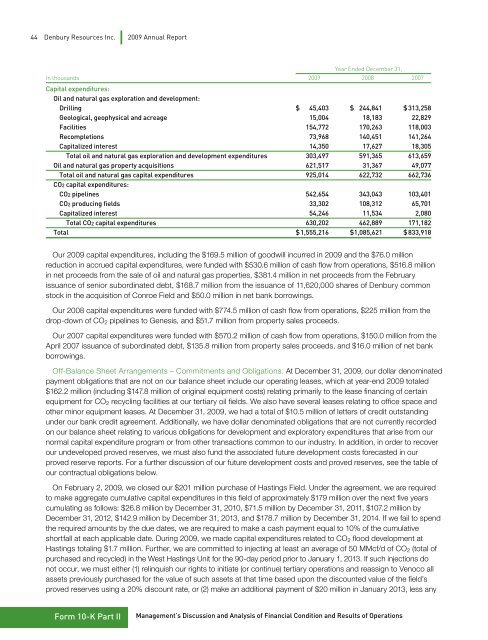

44 <strong>Denbury</strong> <strong>Resources</strong> Inc. <strong>2009</strong> <strong>Annual</strong> <strong>Report</strong>Year Ended December 31,In thousands <strong>2009</strong> 2008 2007Capital expenditures:Oil and natural gas exploration and development:Drilling $ 45,403 $ 244,841 $ 313,258Geological, geophysical and acreage 15,004 18,183 22,829Facilities 154,772 170,263 118,003Recompletions 73,968 140,451 141,264Capitalized interest 14,350 17,627 18,305Total oil and natural gas exploration and development expenditures 303,497 591,365 613,659Oil and natural gas property acquisitions 621,517 31,367 49,077Total oil and natural gas capital expenditures 925,014 622,732 662,736CO2 capital expenditures:CO2 pipelines 542,654 343,043 103,401CO2 producing fields 33,302 108,312 65,701Capitalized interest 54,246 11,534 2,080Total CO2 capital expenditures 630,202 462,889 171,182Total $ 1,555,216 $ 1,085,621 $ 833,918Our <strong>2009</strong> capital expenditures, including the $169.5 million of goodwill incurred in <strong>2009</strong> and the $76.0 millionreduction in accrued capital expenditures, were funded with $530.6 million of cash flow from operations, $516.8 millionin net proceeds from the sale of oil and natural gas properties, $381.4 million in net proceeds from the Februaryissuance of senior subordinated debt, $168.7 million from the issuance of 11,620,000 shares of <strong>Denbury</strong> commonstock in the acquisition of Conroe Field and $50.0 million in net bank borrowings.Our 2008 capital expenditures were funded with $774.5 million of cash flow from operations, $225 million from thedrop-down of CO 2 pipelines to Genesis, and $51.7 million from property sales proceeds.Our 2007 capital expenditures were funded with $570.2 million of cash flow from operations, $150.0 million from theApril 2007 issuance of subordinated debt, $135.8 million from property sales proceeds, and $16.0 million of net bankborrowings.Off-Balance Sheet Arrangements – Commitments and Obligations. At December 31, <strong>2009</strong>, our dollar denominatedpayment obligations that are not on our balance sheet include our operating leases, which at year-end <strong>2009</strong> totaled$162.2 million (including $147.8 million of original equipment costs) relating primarily to the lease financing of certainequipment for CO 2 recycling facilities at our tertiary oil fields. We also have several leases relating to office space andother minor equipment leases. At December 31, <strong>2009</strong>, we had a total of $10.5 million of letters of credit outstandingunder our bank credit agreement. Additionally, we have dollar denominated obligations that are not currently recordedon our balance sheet relating to various obligations for development and exploratory expenditures that arise from ournormal capital expenditure program or from other transactions common to our industry. In addition, in order to recoverour undeveloped proved reserves, we must also fund the associated future development costs forecasted in ourproved reserve reports. For a further discussion of our future development costs and proved reserves, see the table ofour contractual obligations below.On February 2, <strong>2009</strong>, we closed our $201 million purchase of Hastings Field. Under the agreement, we are requiredto make aggregate cumulative capital expenditures in this field of approximately $179 million over the next five yearscumulating as follows: $26.8 million by December 31, 2010, $71.5 million by December 31, 2011, $107.2 million byDecember 31, 2012, $142.9 million by December 31, 2013, and $178.7 million by December 31, 2014. If we fail to spendthe required amounts by the due dates, we are required to make a cash payment equal to 10% of the cumulativeshortfall at each applicable date. During <strong>2009</strong>, we made capital expenditures related to CO 2 flood development atHastings totaling $1.7 million. Further, we are committed to injecting at least an average of 50 MMcf/d of CO 2 (total ofpurchased and recycled) in the West Hastings Unit for the 90-day period prior to January 1, 2013. If such injections donot occur, we must either (1) relinquish our rights to initiate (or continue) tertiary operations and reassign to Venoco allassets previously purchased for the value of such assets at that time based upon the discounted value of the field’sproved reserves using a 20% discount rate, or (2) make an additional payment of $20 million in January 2013, less anyForm 10-K Part IIManagement’s Discussion and Analysis of Financial Condition and Results of Operations