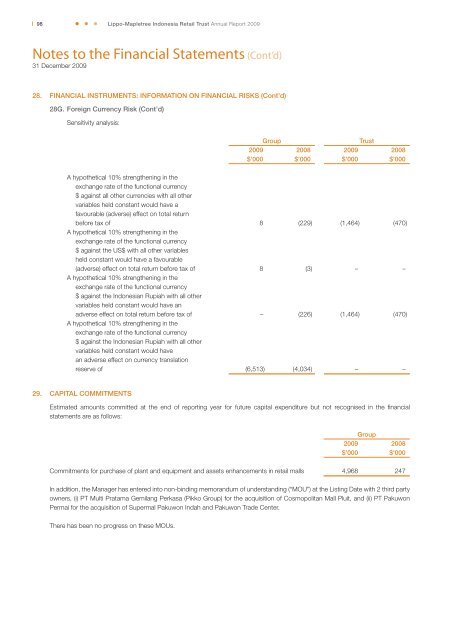

98<strong>Lippo</strong>-Mapletree <strong>Indonesia</strong> <strong>Retail</strong> <strong>Trust</strong> Annual Report 2009Notes to the Financial Statements (Cont’d)31 December 200928. FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (Cont’d)28G. Foreign Currency Risk (Cont’d)Sensitivity analysis:Group<strong>Trust</strong>2009 2008 2009 2008$’000 $’000 $’000 $’000A hypothetical 10% strengthening in theexchange rate of the functional currency$ against all other currencies with all othervariables held constant would have afavourable (adverse) effect on total returnbefore tax of 8 (229) (1,464) (470)A hypothetical 10% strengthening in theexchange rate of the functional currency$ against the US$ with all other variablesheld constant would have a favourable(adverse) effect on total return before tax of 8 (3) – –A hypothetical 10% strengthening in theexchange rate of the functional currency$ against the <strong>Indonesia</strong>n Rupiah with all othervariables held constant would have anadverse effect on total return before tax of – (226) (1,464) (470)A hypothetical 10% strengthening in theexchange rate of the functional currency$ against the <strong>Indonesia</strong>n Rupiah with all othervariables held constant would havean adverse effect on currency translationreserve of (6,513) (4,034) – –29. CAPITAL COMMITMENTSEstimated amounts committed at the end of reporting year for future capital expenditure but not recognised in the fi nancialstatements are as follows:Group2009 2008$’000 $’000Commitments for purchase of plant and equipment and assets enhancements in retail malls 4,968 247In addition, the Manager has entered into non-binding memorandum of understanding (“MOU”) at the Listing Date with 2 third partyowners, (i) PT Multi Pratama Gemilang Perkasa (Pikko Group) for the acquisition of Cosmopolitan Mall Pluit, and (ii) PT PakuwonPermai for the acquisition of Supermal Pakuwon Indah and Pakuwon Trade Center.There has been no progress on these MOUs.

99Notes to the Financial Statements (Cont’d)31 December 200930. OPERATING LEASE INCOME COMMITMENTSAt the end of the reporting year the total of future minimum lease receivables committed under non-cancellable operating leasesare as follows:Group2009 2008$’000 $’000Not later than one year 40,278 39,516Later than one year and not later than fi ve years 136,934 116,468More than fi ve years 34,849 40,219Rental income for the year 68,461 84,411The <strong>Trust</strong> has no operating lease income commitments at the end of the reporting year.The Group has entered into commercial property leases for retail malls and spaces. The lease rental income terms are negotiatedfor an average term of fi ve to ten years for anchor tenants and an average of three to fi ve years for speciality tenants. These leasesare cancellable with conditions and rentals are subject to an escalation clause but the amount of the rent increase is not to exceedto a certain percentage.On 18 October 2007, each of the <strong>Indonesia</strong>n subsidiaries that are owners of retail spaces (“<strong>Retail</strong> Spaces Property Companies”)(as landlord) and the Master Lessee (as tenant) entered into a Master Lease Agreement, pursuant to which the retail spaces wereleased to the master lessee in accordance with the terms and conditions of the Master Lease Agreements. The term of each ofthe Master Lease Agreements is for 10 years with an option for the Master Lessee to renew for a further term of 10 years basedon substantially the same terms and conditions, except for renewal rent. The renewal rent for the further term shall be at the thenprevailing market rent, as may be agreed by the relevant landlord and the Master Lessee in good faith. If there is no agreement bythe relevant landlord and the Master Lessee on such prevailing market rent, the relevant landlord and the Master Lessee may referthe determination of the prevailing market rent to an independent property valuer or valuers.31. OTHER MATTERS(i)Right of First Refusal (“ROFR”)On 14 August 2007, an agreement was entered into between the <strong>Trust</strong>ee and the Sponsor pursuant to which the Sponsorgranted LMIR <strong>Trust</strong>, for so long as (a) <strong>Lippo</strong>-Mapletree <strong>Indonesia</strong> <strong>Retail</strong> <strong>Trust</strong> Management Ltd remains the Manager of LMIR<strong>Trust</strong>; and (b) the Sponsor and/or any of its related corporations, alone or in aggregate, remains a controlling shareholder ofthe Manager; a ROFR over any retail properties located in <strong>Indonesia</strong> (each such property to be known as a “Relevant Asset”):(i) which the Sponsor or any of its subsidiaries (each a “Sponsor Entity”) proposes to sell or transfer (whether such RelevantAsset is wholly-owned or partly-owned by the Sponsor Entity and excluding any sale of Relevant Asset by a Sponsor Entityto any related corporation of such Sponsor Entity pursuant to a reconstruction, amalgamation, restructuring, merger or anyanalogous event) to an unrelated third party; or (ii) for which a proposed offer for sale or transfer of such Relevant Asset hasbeen made to a Sponsor Entity.At statements of fi nancial position date, the scope of the ROFR encompasses fi ve <strong>Indonesia</strong> properties which are currentlyunder development by the Sponsor and/ or its subsidiaries. These properties are namely Binjai Supermall, Pejaten Mall, KutaBeach Mall, Kemang City Mall and Puri “Paragon City”.(ii)<strong>Retail</strong> <strong>Malls</strong> Operating Costs AgreementsPursuant to each of the Operating Costs Agreements entered into between the relevant <strong>Retail</strong> Mall Property Companies and<strong>Indonesia</strong>n companies which run the operation of retail malls (“Operating Companies”), the relevant Operating Companieshave agreed to unconditionally bear, for a period of three years commencing 1 January 2007, all costs directly related to themaintenance and operating of the relevant retail malls.