One - Lippo Malls Indonesia Retail Trust - Investor Relations

One - Lippo Malls Indonesia Retail Trust - Investor Relations

One - Lippo Malls Indonesia Retail Trust - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

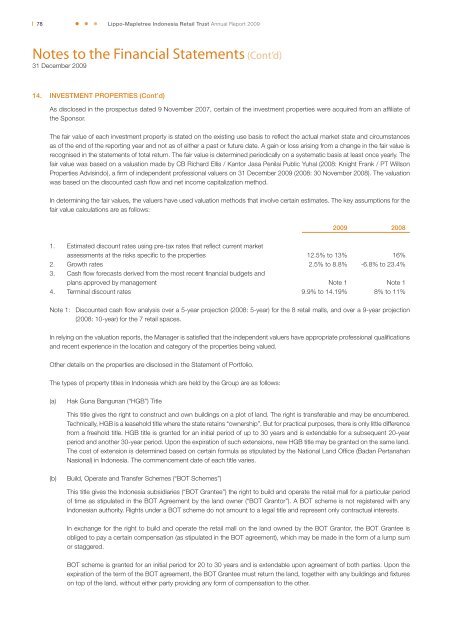

78<strong>Lippo</strong>-Mapletree <strong>Indonesia</strong> <strong>Retail</strong> <strong>Trust</strong> Annual Report 2009Notes to the Financial Statements (Cont’d)31 December 200914. INVESTMENT PROPERTIES (Cont’d)As disclosed in the prospectus dated 9 November 2007, certain of the investment properties were acquired from an affi liate ofthe Sponsor.The fair value of each investment property is stated on the existing use basis to refl ect the actual market state and circumstancesas of the end of the reporting year and not as of either a past or future date. A gain or loss arising from a change in the fair value isrecognised in the statements of total return. The fair value is determined periodically on a systematic basis at least once yearly. Thefair value was based on a valuation made by CB Richard Ellis / Kantor Jasa Penilai Public Yuhal (2008: Knight Frank / PT WillsonProperties Advisindo), a fi rm of independent professional valuers on 31 December 2009 (2008: 30 November 2008). The valuationwas based on the discounted cash fl ow and net income capitalization method.In determining the fair values, the valuers have used valuation methods that involve certain estimates. The key assumptions for thefair value calculations are as follows:2009 20081. Estimated discount rates using pre-tax rates that refl ect current marketassessments at the risks specifi c to the properties 12.5% to 13% 16%2. Growth rates 2.5% to 8.8% -6.8% to 23.4%3. Cash fl ow forecasts derived from the most recent fi nancial budgets andplans approved by management Note 1 Note 14. Terminal discount rates 9.9% to 14.19% 8% to 11%Note 1: Discounted cash fl ow analysis over a 5-year projection (2008: 5-year) for the 8 retail malls, and over a 9-year projection(2008: 10-year) for the 7 retail spaces.In relying on the valuation reports, the Manager is satisfi ed that the independent valuers have appropriate professional qualifi cationsand recent experience in the location and category of the properties being valued.Other details on the properties are disclosed in the Statement of Portfolio.The types of property titles in <strong>Indonesia</strong> which are held by the Group are as follows:(a)Hak Guna Bangunan (“HGB”) TitleThis title gives the right to construct and own buildings on a plot of land. The right is transferable and may be encumbered.Technically, HGB is a leasehold title where the state retains “ownership”. But for practical purposes, there is only little differencefrom a freehold title. HGB title is granted for an initial period of up to 30 years and is extendable for a subsequent 20-yearperiod and another 30-year period. Upon the expiration of such extensions, new HGB title may be granted on the same land.The cost of extension is determined based on certain formula as stipulated by the National Land Offi ce (Badan PertanahanNasional) in <strong>Indonesia</strong>. The commencement date of each title varies.(b)Build, Operate and Transfer Schemes (“BOT Schemes”)This title gives the <strong>Indonesia</strong> subsidiaries (“BOT Grantee”) the right to build and operate the retail mall for a particular periodof time as stipulated in the BOT Agreement by the land owner (“BOT Grantor”). A BOT scheme is not registered with any<strong>Indonesia</strong>n authority. Rights under a BOT scheme do not amount to a legal title and represent only contractual interests.In exchange for the right to build and operate the retail mall on the land owned by the BOT Grantor, the BOT Grantee isobliged to pay a certain compensation (as stipulated in the BOT agreement), which may be made in the form of a lump sumor staggered.BOT scheme is granted for an initial period for 20 to 30 years and is extendable upon agreement of both parties. Upon theexpiration of the term of the BOT agreement, the BOT Grantee must return the land, together with any buildings and fi xtureson top of the land, without either party providing any form of compensation to the other.