One - Lippo Malls Indonesia Retail Trust - Investor Relations

One - Lippo Malls Indonesia Retail Trust - Investor Relations

One - Lippo Malls Indonesia Retail Trust - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

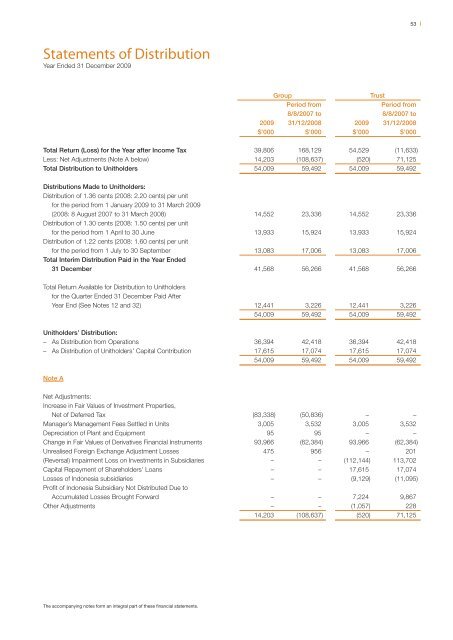

53Statements of DistributionYear Ended 31 December 2009Group<strong>Trust</strong>Period fromPeriod from8/8/2007 to 8/8/2007 to2009 31/12/2008 2009 31/12/2008$’000 $’000 $’000 $’000Total Return (Loss) for the Year after Income Tax 39,806 168,129 54,529 (11,633)Less: Net Adjustments (Note A below) 14,203 (108,637) (520) 71,125Total Distribution to Unitholders 54,009 59,492 54,009 59,492Distributions Made to Unitholders:Distribution of 1.36 cents (2008: 2.20 cents) per unitfor the period from 1 January 2009 to 31 March 2009(2008: 8 August 2007 to 31 March 2008) 14,552 23,336 14,552 23,336Distribution of 1.30 cents (2008: 1.50 cents) per unitfor the period from 1 April to 30 June 13,933 15,924 13,933 15,924Distribution of 1.22 cents (2008: 1.60 cents) per unitfor the period from 1 July to 30 September 13,083 17,006 13,083 17,006Total Interim Distribution Paid in the Year Ended31 December 41,568 56,266 41,568 56,266Total Return Available for Distribution to Unitholdersfor the Quarter Ended 31 December Paid AfterYear End (See Notes 12 and 32) 12,441 3,226 12,441 3,22654,009 59,492 54,009 59,492Unitholders’ Distribution:– As Distribution from Operations 36,394 42,418 36,394 42,418– As Distribution of Unitholders’ Capital Contribution 17,615 17,074 17,615 17,07454,009 59,492 54,009 59,492Note ANet Adjustments:Increase in Fair Values of Investment Properties,Net of Deferred Tax (83,338) (50,836) – –Manager’s Management Fees Settled in Units 3,005 3,532 3,005 3,532Depreciation of Plant and Equipment 95 95 – –Change in Fair Values of Derivatives Financial Instruments 93,966 (62,384) 93,966 (62,384)Unrealised Foreign Exchange Adjustment Losses 475 956 – 201(Reversal) Impairment Loss on Investments in Subsidiaries – – (112,144) 113,702Capital Repayment of Shareholders’ Loans – – 17,615 17,074Losses of <strong>Indonesia</strong> subsidiaries – – (9,129) (11,095)Profi t of <strong>Indonesia</strong> Subsidiary Not Distributed Due toAccumulated Losses Brought Forward – – 7,224 9,867Other Adjustments – – (1,057) 22814,203 (108,637) (520) 71,125The accompanying notes form an integral part of these financial statements.