One - Lippo Malls Indonesia Retail Trust - Investor Relations

One - Lippo Malls Indonesia Retail Trust - Investor Relations

One - Lippo Malls Indonesia Retail Trust - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

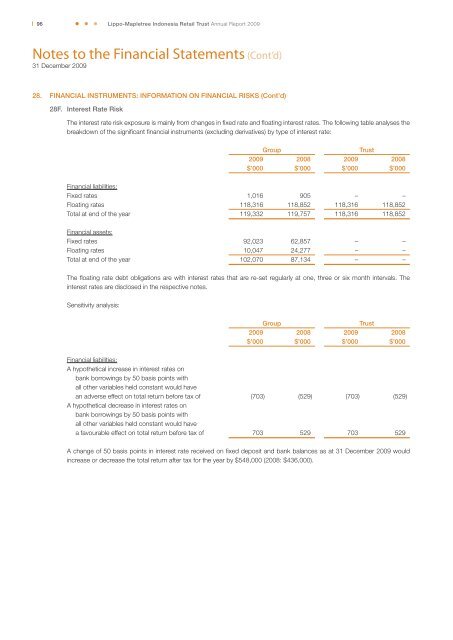

96<strong>Lippo</strong>-Mapletree <strong>Indonesia</strong> <strong>Retail</strong> <strong>Trust</strong> Annual Report 2009Notes to the Financial Statements (Cont’d)31 December 200928. FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (Cont’d)28F. Interest Rate RiskThe interest rate risk exposure is mainly from changes in fi xed rate and fl oating interest rates. The following table analyses thebreakdown of the signifi cant fi nancial instruments (excluding derivatives) by type of interest rate:Group<strong>Trust</strong>2009 2008 2009 2008$’000 $’000 $’000 $’000Financial liabilities:Fixed rates 1,016 905 – –Floating rates 118,316 118,852 118,316 118,852Total at end of the year 119,332 119,757 118,316 118,852Financial assets:Fixed rates 92,023 62,857 – –Floating rates 10,047 24,277 – –Total at end of the year 102,070 87,134 – –The fl oating rate debt obligations are with interest rates that are re-set regularly at one, three or six month intervals. Theinterest rates are disclosed in the respective notes.Sensitivity analysis:Group<strong>Trust</strong>2009 2008 2009 2008$’000 $’000 $’000 $’000Financial liabilities:A hypothetical increase in interest rates onbank borrowings by 50 basis points withall other variables held constant would havean adverse effect on total return before tax of (703) (529) (703) (529)A hypothetical decrease in interest rates onbank borrowings by 50 basis points withall other variables held constant would havea favourable effect on total return before tax of 703 529 703 529A change of 50 basis points in interest rate received on fi xed deposit and bank balances as at 31 December 2009 wouldincrease or decrease the total return after tax for the year by $548,000 (2008: $436,000).