One - Lippo Malls Indonesia Retail Trust - Investor Relations

One - Lippo Malls Indonesia Retail Trust - Investor Relations

One - Lippo Malls Indonesia Retail Trust - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

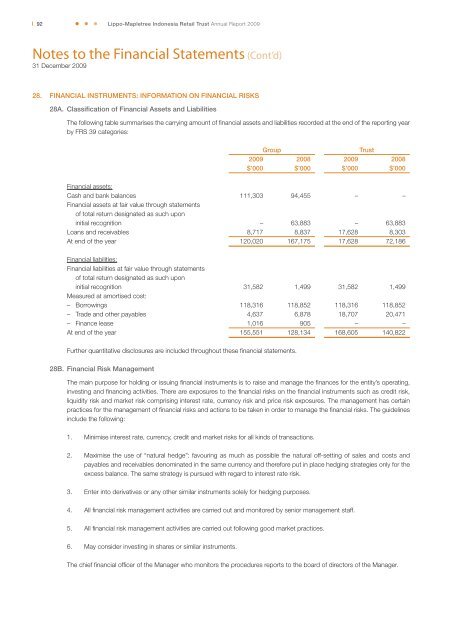

92<strong>Lippo</strong>-Mapletree <strong>Indonesia</strong> <strong>Retail</strong> <strong>Trust</strong> Annual Report 2009Notes to the Financial Statements (Cont’d)31 December 200928. FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS28A. Classification of Financial Assets and LiabilitiesThe following table summarises the carrying amount of fi nancial assets and liabilities recorded at the end of the reporting yearby FRS 39 categories:Group<strong>Trust</strong>2009 2008 2009 2008$’000 $’000 $’000 $’000Financial assets:Cash and bank balances 111,303 94,455 – –Financial assets at fair value through statementsof total return designated as such uponinitial recognition – 63,883 – 63,883Loans and receivables 8,717 8,837 17,628 8,303At end of the year 120,020 167,175 17,628 72,186Financial liabilities:Financial liabilities at fair value through statementsof total return designated as such uponinitial recognition 31,582 1,499 31,582 1,499Measured at amortised cost:– Borrowings 118,316 118,852 118,316 118,852– Trade and other payables 4,637 6,878 18,707 20,471– Finance lease 1,016 905 – –At end of the year 155,551 128,134 168,605 140,822Further quantitative disclosures are included throughout these fi nancial statements.28B. Financial Risk ManagementThe main purpose for holding or issuing fi nancial instruments is to raise and manage the fi nances for the entity’s operating,investing and fi nancing activities. There are exposures to the fi nancial risks on the fi nancial instruments such as credit risk,liquidity risk and market risk comprising interest rate, currency risk and price risk exposures. The management has certainpractices for the management of fi nancial risks and actions to be taken in order to manage the fi nancial risks. The guidelinesinclude the following:1. Minimise interest rate, currency, credit and market risks for all kinds of transactions.2. Maximise the use of “natural hedge”: favouring as much as possible the natural off-setting of sales and costs andpayables and receivables denominated in the same currency and therefore put in place hedging strategies only for theexcess balance. The same strategy is pursued with regard to interest rate risk.3. Enter into derivatives or any other similar instruments solely for hedging purposes.4. All fi nancial risk management activities are carried out and monitored by senior management staff.5. All fi nancial risk management activities are carried out following good market practices.6. May consider investing in shares or similar instruments.The chief fi nancial offi cer of the Manager who monitors the procedures reports to the board of directors of the Manager.