One - Lippo Malls Indonesia Retail Trust - Investor Relations

One - Lippo Malls Indonesia Retail Trust - Investor Relations

One - Lippo Malls Indonesia Retail Trust - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

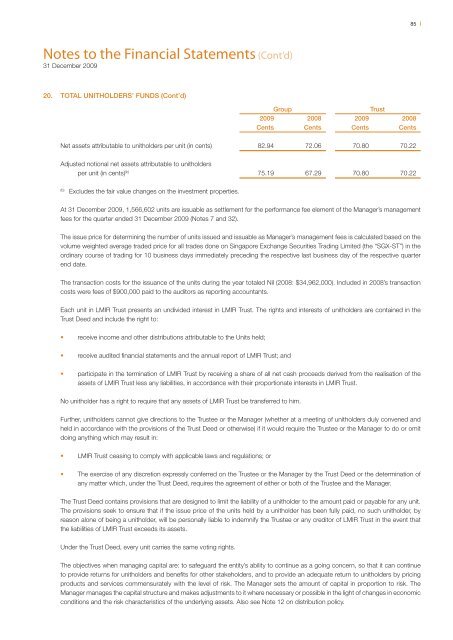

85Notes to the Financial Statements (Cont’d)31 December 200920. TOTAL UNITHOLDERS’ FUNDS (Cont’d)Group<strong>Trust</strong>2009 2008 2009 2008Cents Cents Cents CentsNet assets attributable to unitholders per unit (in cents) 82.94 72.06 70.80 70.22Adjusted notional net assets attributable to unitholdersper unit (in cents) (b) 75.19 67.29 70.80 70.22(b)Excludes the fair value changes on the investment properties.At 31 December 2009, 1,566,602 units are issuable as settlement for the performance fee element of the Manager’s managementfees for the quarter ended 31 December 2009 (Notes 7 and 32).The issue price for determining the number of units issued and issuable as Manager’s management fees is calculated based on thevolume weighted average traded price for all trades done on Singapore Exchange Securities Trading Limited (the “SGX-ST”) in theordinary course of trading for 10 business days immediately preceding the respective last business day of the respective quarterend date.The transaction costs for the issuance of the units during the year totaled Nil (2008: $34,962,000). Included in 2008’s transactioncosts were fees of $900,000 paid to the auditors as reporting accountants.Each unit in LMIR <strong>Trust</strong> presents an undivided interest in LMIR <strong>Trust</strong>. The rights and interests of unitholders are contained in the<strong>Trust</strong> Deed and include the right to:• receive income and other distributions attributable to the Units held;• receive audited fi nancial statements and the annual report of LMIR <strong>Trust</strong>; and• participate in the termination of LMIR <strong>Trust</strong> by receiving a share of all net cash proceeds derived from the realisation of theassets of LMIR <strong>Trust</strong> less any liabilities, in accordance with their proportionate interests in LMIR <strong>Trust</strong>.No unitholder has a right to require that any assets of LMIR <strong>Trust</strong> be transferred to him.Further, unitholders cannot give directions to the <strong>Trust</strong>ee or the Manager (whether at a meeting of unitholders duly convened andheld in accordance with the provisions of the <strong>Trust</strong> Deed or otherwise) if it would require the <strong>Trust</strong>ee or the Manager to do or omitdoing anything which may result in:• LMIR <strong>Trust</strong> ceasing to comply with applicable laws and regulations; or• The exercise of any discretion expressly conferred on the <strong>Trust</strong>ee or the Manager by the <strong>Trust</strong> Deed or the determination ofany matter which, under the <strong>Trust</strong> Deed, requires the agreement of either or both of the <strong>Trust</strong>ee and the Manager.The <strong>Trust</strong> Deed contains provisions that are designed to limit the liability of a unitholder to the amount paid or payable for any unit.The provisions seek to ensure that if the issue price of the units held by a unitholder has been fully paid, no such unitholder, byreason alone of being a unitholder, will be personally liable to indemnify the <strong>Trust</strong>ee or any creditor of LMIR <strong>Trust</strong> in the event thatthe liabilities of LMIR <strong>Trust</strong> exceeds its assets.Under the <strong>Trust</strong> Deed, every unit carries the same voting rights.The objectives when managing capital are: to safeguard the entity’s ability to continue as a going concern, so that it can continueto provide returns for unitholders and benefi ts for other stakeholders, and to provide an adequate return to unitholders by pricingproducts and services commensurately with the level of risk. The Manager sets the amount of capital in proportion to risk. TheManager manages the capital structure and makes adjustments to it where necessary or possible in the light of changes in economicconditions and the risk characteristics of the underlying assets. Also see Note 12 on distribution policy.