One - Lippo Malls Indonesia Retail Trust - Investor Relations

One - Lippo Malls Indonesia Retail Trust - Investor Relations

One - Lippo Malls Indonesia Retail Trust - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

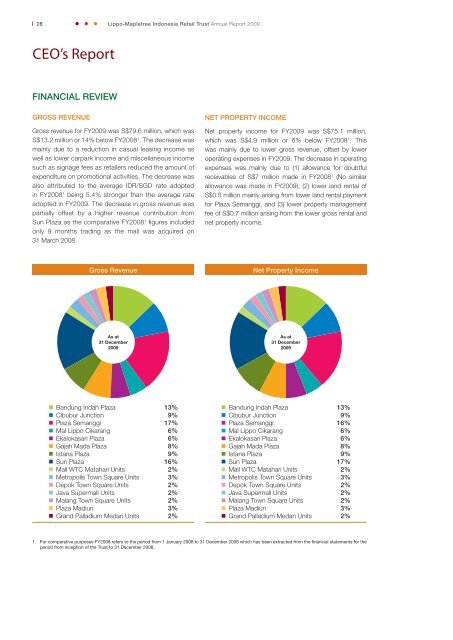

28<strong>Lippo</strong>-Mapletree <strong>Indonesia</strong> <strong>Retail</strong> <strong>Trust</strong> Annual Report 2009CEO’s ReportFINANCIAL REVIEWGROSS REVENUEGross revenue for FY2009 was S$79.6 million, which wasS$13.2 million or 14% below FY2008 1 . The decrease wasmainly due to a reduction in casual leasing income aswell as lower carpark income and miscellaneous incomesuch as signage fees as retailers reduced the amount ofexpenditure on promotional activities. The decrease wasalso attributed to the average IDR/SGD rate adoptedin FY2008 1 being 5.4% stronger than the average rateadopted in FY2009. The decrease in gross revenue waspartially offset by a higher revenue contribution fromSun Plaza as the comparative FY2008 1 fi gures includedonly 9 months trading as the mall was acquired on31 March 2008.NET PROPERTY INCOMENet property income for FY2009 was S$75.1 million,which was S$4.9 million or 6% below FY2008 1 . Thiswas mainly due to lower gross revenue, offset by loweroperating expenses in FY2009. The decrease in operatingexpenses was mainly due to (1) allowance for doubtfulreceivables of S$7 million made in FY2008 1 (No similarallowance was made in FY2009), (2) lower land rental ofS$0.5 million mainly arising from lower land rental paymentfor Plaza Semanggi, and (3) lower property managementfee of S$0.7 million arising from the lower gross rental andnet property income.Gross RevenueNet Property IncomeAs at31 December2009As at31 December2009• Bandung Indah Plaza 13%• Cibubur Junction 9%• Plaza Semanggi 17%• Mal <strong>Lippo</strong> Cikarang 6%• Ekalokasari Plaza 6%• Gajah Mada Plaza 8%• Istana Plaza 9%• Sun Plaza 16%• Mall WTC Matahari Units 2%• Metropolis Town Square Units 3%• Depok Town Square Units 2%• Java Supermall Units 2%• Malang Town Square Units 2%• Plaza Madiun 3%• Grand Palladium Medan Units 2%• Bandung Indah Plaza 13%• Cibubur Junction 9%• Plaza Semanggi 16%• Mal <strong>Lippo</strong> Cikarang 6%• Ekalokasari Plaza 6%• Gajah Mada Plaza 8%• Istana Plaza 9%• Sun Plaza 17%• Mall WTC Matahari Units 2%• Metropolis Town Square Units 3%• Depok Town Square Units 2%• Java Supermall Units 2%• Malang Town Square Units 2%• Plaza Madiun 3%• Grand Palladium Medan Units 2%1 For comparative purposes FY2008 refers to the period from 1 January 2008 to 31 December 2008 which has been extracted from the financial statements for theperiod from inception of the <strong>Trust</strong> to 31 December 2008.