One - Lippo Malls Indonesia Retail Trust - Investor Relations

One - Lippo Malls Indonesia Retail Trust - Investor Relations

One - Lippo Malls Indonesia Retail Trust - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

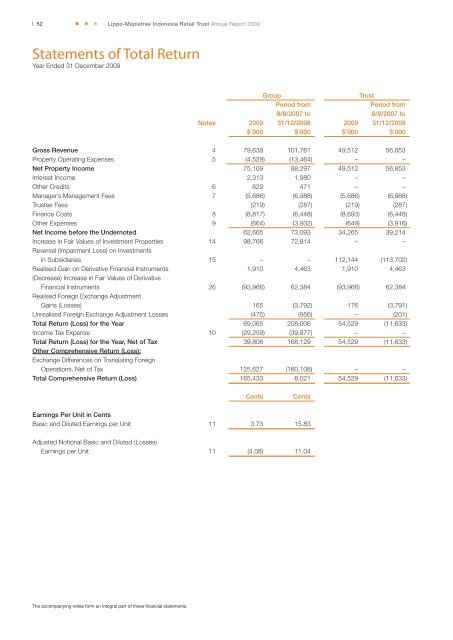

52<strong>Lippo</strong>-Mapletree <strong>Indonesia</strong> <strong>Retail</strong> <strong>Trust</strong> Annual Report 2009Statements of Total ReturnYear Ended 31 December 2009Group<strong>Trust</strong>Period fromPeriod from8/8/2007 to 8/8/2007 toNotes 2009 31/12/2008 2009 31/12/2008$’000 $’000 $’000 $’000Gross Revenue 4 79,638 101,761 49,512 56,853Property Operating Expenses 5 (4,529) (13,464) – –Net Property Income 75,109 88,297 49,512 56,853Interest Income 2,313 1,980 – –Other Credits 6 629 471 – –Manager’s Management Fees 7 (5,686) (6,988) (5,686) (6,988)<strong>Trust</strong>ee Fees (219) (287) (219) (287)Finance Costs 8 (8,817) (6,448) (8,693) (6,448)Other Expenses 9 (664) (3,932) (649) (3,916)Net Income before the Undernoted 62,665 73,093 34,265 39,214Increase in Fair Values of Investment Properties 14 98,766 72,814 – –Reversal (Impairment Loss) on Investmentsin Subsidiaries 15 – – 112,144 (113,702)Realised Gain on Derivative Financial Instruments 1,910 4,463 1,910 4,463(Decrease) Increase in Fair Values of DerivativeFinancial Instruments 26 (93,966) 62,384 (93,966) 62,384Realised Foreign Exchange AdjustmentGains (Losses) 165 (3,792) 176 (3,791)Unrealised Foreign Exchange Adjustment Losses (475) (956) – (201)Total Return (Loss) for the Year 69,065 208,006 54,529 (11,633)Income Tax Expense 10 (29,259) (39,877) – –Total Return (Loss) for the Year, Net of Tax 39,806 168,129 54,529 (11,633)Other Comprehensive Return (Loss):Exchange Differences on Translating ForeignOperations, Net of Tax 125,627 (160,108) – –Total Comprehensive Return (Loss) 165,433 8,021 54,529 (11,633)CentsCentsEarnings Per Unit in CentsBasic and Diluted Earnings per Unit 11 3.73 15.83Adjusted Notional Basic and Diluted (Losses)Earnings per Unit 11 (4.08) 11.04The accompanying notes form an integral part of these financial statements.