One - Lippo Malls Indonesia Retail Trust - Investor Relations

One - Lippo Malls Indonesia Retail Trust - Investor Relations

One - Lippo Malls Indonesia Retail Trust - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

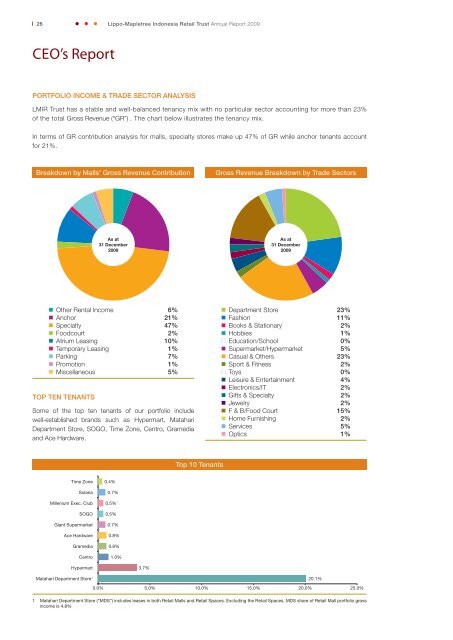

26<strong>Lippo</strong>-Mapletree <strong>Indonesia</strong> <strong>Retail</strong> <strong>Trust</strong> Annual Report 2009CEO’s ReportPORTFOLIO INCOME & TRADE SECTOR ANALYSISLMIR <strong>Trust</strong> has a stable and well-balanced tenancy mix with no particular sector accounting for more than 23%of the total Gross Revenue (“GR”) . The chart below illustrates the tenancy mix.In terms of GR contribution analysis for malls, specialty stores make up 47% of GR while anchor tenants accountfor 21%.Breakdown by <strong>Malls</strong>’ Gross Revenue ContributionGross Revenue Breakdown by Trade SectorsAs at31 December2009As at31 December2009• Other Rental Income 6%• Anchor 21%• Specialty 47%• Foodcourt 2%• Atrium Leasing 10%• Temporary Leasing 1%• Parking 7%• Promotion 1%• Miscellaneous 5%TOP TEN TENANTSSome of the top ten tenants of our portfolio includewell-established brands such as Hypermart, MatahariDepartment Store, SOGO, Time Zone, Centro, Gramediaand Ace Hardware.• Department Store 23%• Fashion 11%• Books & Stationary 2%• Hobbies 1%• Education/School 0%• Supermarket/Hypermarket 5%• Casual & Others 23%• Sport & Fitness 2%• Toys 0%• Leisure & Entertainment 4%• Electronics/IT 2%• Gifts & Specialty 2%• Jewelry 2%• F & B/Food Court 15%• Home Furnishing 2%• Services 5%• Optics 1%Top 10 TenantsTime ZoneSolariaMillenium Exec. ClubSOGOGiant SupermarketAce HardwareGramediaCentro0.4%0.7%0.5%0.5%0.7%0.8%0.8%1.0%Hypermart3.7%Matahari Department Store 10.0% 5.0% 10.0% 15.0% 20.0% 25.0%1 Matahari Department Store (“MDS”) includes leases in both <strong>Retail</strong> <strong>Malls</strong> and <strong>Retail</strong> Spaces. Excluding the <strong>Retail</strong> Spaces, MDS share of <strong>Retail</strong> Mall portfolio grossincome is 4.8%20.1%