Tullow Oil plc 2011/2012 Corporate Responsibility Report - The Group

Tullow Oil plc 2011/2012 Corporate Responsibility Report - The Group

Tullow Oil plc 2011/2012 Corporate Responsibility Report - The Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

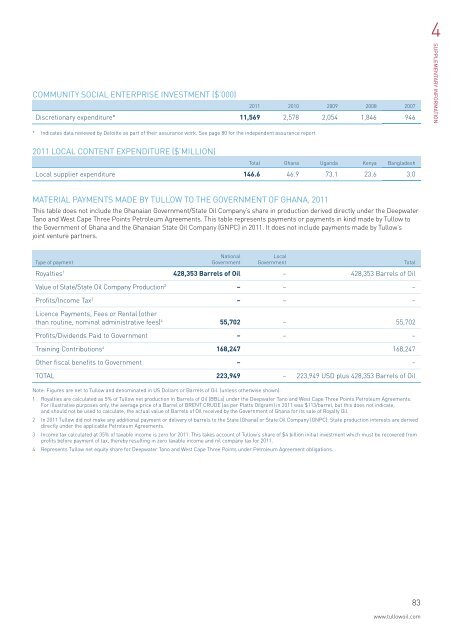

4COMMUNITY SOCIAL ENTERPRISE INVESTMENT ($’000)<strong>2011</strong> 2010 2009 2008 2007Discretionary expenditure* 11,569 2,578 2,054 1,846 946SUPPLEMENTARY INFORMATION* Indicates data reviewed by Deloitte as part of their assurance work. See page 80 for the independent assurance report.<strong>2011</strong> LOCAL CONTENT EXPENDITURE ($’MILLION)Total Ghana Uganda Kenya BangladeshLocal supplier expenditure 146.6 46.9 73.1 23.6 3.0MATERIAL PAYMENTS MADE BY TULLOW TO THE GOVERNMENT OF GHANA, <strong>2011</strong>This table does not include the Ghanaian Government/State <strong>Oil</strong> Company’s share in production derived directly under the DeepwaterTano and West Cape Three Points Petroleum Agreements. This table represents payments or payments in kind made by <strong>Tullow</strong> tothe Government of Ghana and the Ghanaian State <strong>Oil</strong> Company (GNPC) in <strong>2011</strong>. It does not include payments made by <strong>Tullow</strong>’sjoint venture partners.NationalLocalType of paymentGovernment GovernmentTotalRoyalties 1 428,353 Barrels of <strong>Oil</strong> – 428,353 Barrels of <strong>Oil</strong>Value of State/State <strong>Oil</strong> Company Production 2 – – –Profits/Income Tax 3 – – –Licence Payments, Fees or Rental (otherthan routine, nominal administrative fees) 4 55,702 – 55,702Profits/Dividends Paid to Government – – –Training Contributions 4 168,247 168,247Other fiscal benefits to Government – –TOTAL 223,949 – 223,949 USD plus 428,353 Barrels of <strong>Oil</strong>Note: Figures are net to <strong>Tullow</strong> and denominated in US Dollars or Barrels of <strong>Oil</strong>. (unless otherwise shown).1 Royalties are calculated as 5% of <strong>Tullow</strong> net production in Barrels of <strong>Oil</strong> (BBLs) under the Deepwater Tano and West Cape Three Points Petroleum Agreements.For illustrative purposes only, the average price of a Barrel of BRENT CRUDE (as per Platts <strong>Oil</strong>gram) in <strong>2011</strong> was $113/barrel, but this does not indicate,and should not be used to calculate, the actual value of Barrels of <strong>Oil</strong> received by the Government of Ghana for its sale of Royalty <strong>Oil</strong>.2 In <strong>2011</strong> <strong>Tullow</strong> did not make any additional payment or delivery of barrels to the State (Ghana) or State <strong>Oil</strong> Company (GNPC). State production interests are deriveddirectly under the applicable Petroleum Agreements.3 Income tax calculated at 35% of taxable income is zero for <strong>2011</strong>. This takes account of <strong>Tullow</strong>’s share of $4 billion initial investment which must be recovered fromprofits before payment of tax, thereby resulting in zero taxable income and nil company tax for <strong>2011</strong>.4 Represents <strong>Tullow</strong> net equity share for Deepwater Tano and West Cape Three Points under Petroleum Agreement obligations.83www.tullowoil.com