EY-africa-attractiveness-survey-june-2015-final

EY-africa-attractiveness-survey-june-2015-final

EY-africa-attractiveness-survey-june-2015-final

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

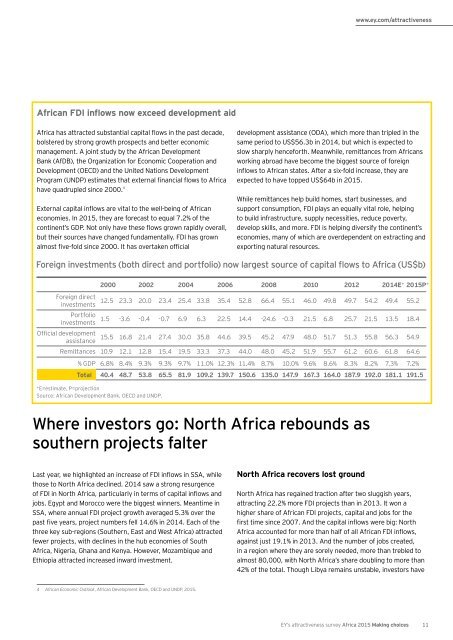

www.ey.com/<strong>attractiveness</strong>African FDI inflows now exceed development aidAfrica has attracted substantial capital flows in the past decade,bolstered by strong growth prospects and better economicmanagement. A joint study by the African DevelopmentBank (AfDB), the Organization for Economic Cooperation andDevelopment (OECD) and the United Nations DevelopmentProgram (UNDP) estimates that external financial flows to Africahave quadrupled since 2000. 4External capital inflows are vital to the well-being of Africaneconomies. In <strong>2015</strong>, they are forecast to equal 7.2% of thecontinent’s GDP. Not only have these flows grown rapidly overall,but their sources have changed fundamentally. FDI has grownalmost five-fold since 2000. It has overtaken officialdevelopment assistance (ODA), which more than tripled in thesame period to US$56.3b in 2014, but which is expected toslow sharply henceforth. Meanwhile, remittances from Africansworking abroad have become the biggest source of foreigninflows to African states. After a six-fold increase, they areexpected to have topped US$64b in <strong>2015</strong>.While remittances help build homes, start businesses, andsupport consumption, FDI plays an equally vital role, helpingto build infrastructure, supply necessities, reduce poverty,develop skills, and more. FDI is helping diversify the continent’seconomies, many of which are overdependent on extracting andexporting natural resources.Foreign investments (both direct and portfolio) now largest source of capital flows to Africa (US$b)20002002200420062008201020122014E* <strong>2015</strong>P*Foreign directinvestments12.523.320.023.425.433.835.452.866.455.146.049.849.754.249.455.2Portfolioinvestments1.5-3.6-0.4-0.76.96.322.514.4-24.6-0.321.56.825.721.513.518.4Official developmentassistance15.516.821.427.430.035.844.639.545.247.948.051.751.355.856.354.9Remittances10.912.112.815.419.533.337.344.048.045.251.955.761.260.661.864.6% GDP6.8%8.4%9.3%9.3%9.7%11.0%12.3%11.4%8.7%10.0%9.6%8.6%8.3%8.2%7.3%7.2%Total40.448.753.865.581.9109.2139.7150.6135.0147.9167.3164.0187.9192.0181.1191.5*E=estimate, P=projectionSource: African Development Bank, OECD and UNDP.Where investors go: North Africa rebounds assouthern projects falterLast year, we highlighted an increase of FDI inflows in SSA, whilethose to North Africa declined. 2014 saw a strong resurgenceof FDI in North Africa, particularly in terms of capital inflows andjobs. Egypt and Morocco were the biggest winners. Meantime inSSA, where annual FDI project growth averaged 5.3% over thepast five years, project numbers fell 14.6% in 2014. Each of thethree key sub-regions (Southern, East and West Africa) attractedfewer projects, with declines in the hub economies of SouthAfrica, Nigeria, Ghana and Kenya. However, Mozambique andEthiopia attracted increased inward investment.North Africa recovers lost groundNorth Africa has regained traction after two sluggish years,attracting 22.2% more FDI projects than in 2013. It won ahigher share of African FDI projects, capital and jobs for thefirst time since 2007. And the capital inflows were big: NorthAfrica accounted for more than half of all African FDI inflows,against just 19.1% in 2013. And the number of jobs created,in a region where they are sorely needed, more than trebled toalmost 80,000, with North Africa’s share doubling to more than42% of the total. Though Libya remains unstable, investors have4 African Economic Outlook, African Development Bank, OECD and UNDP, <strong>2015</strong>.<strong>EY</strong>’s <strong>attractiveness</strong> <strong>survey</strong> Africa <strong>2015</strong> Making choices11