EY-africa-attractiveness-survey-june-2015-final

EY-africa-attractiveness-survey-june-2015-final

EY-africa-attractiveness-survey-june-2015-final

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

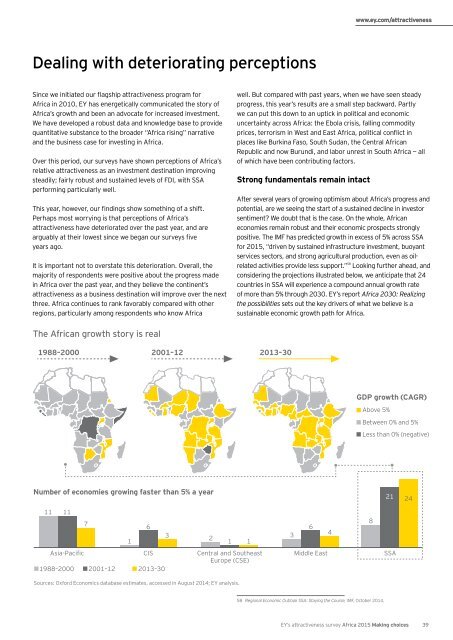

www.ey.com/<strong>attractiveness</strong>Dealing with deteriorating perceptionsSince we initiated our flagship <strong>attractiveness</strong> program forAfrica in 2010, <strong>EY</strong> has energetically communicated the story ofAfrica’s growth and been an advocate for increased investment.We have developed a robust data and knowledge base to providequantitative substance to the broader “Africa rising” narrativeand the business case for investing in Africa.Over this period, our <strong>survey</strong>s have shown perceptions of Africa’srelative <strong>attractiveness</strong> as an investment destination improvingsteadily; fairly robust and sustained levels of FDI, with SSAperforming particularly well.This year, however, our findings show something of a shift.Perhaps most worrying is that perceptions of Africa’s<strong>attractiveness</strong> have deteriorated over the past year, and arearguably at their lowest since we began our <strong>survey</strong>s fiveyears ago.It is important not to overstate this deterioration. Overall, themajority of respondents were positive about the progress madein Africa over the past year, and they believe the continent’s<strong>attractiveness</strong> as a business destination will improve over the nextthree. Africa continues to rank favorably compared with otherregions, particularly among respondents who know Africawell. But compared with past years, when we have seen steadyprogress, this year’s results are a small step backward. Partlywe can put this down to an uptick in political and economicuncertainty across Africa: the Ebola crisis, falling commodityprices, terrorism in West and East Africa, political conflict inplaces like Burkina Faso, South Sudan, the Central AfricanRepublic and now Burundi, and labor unrest in South Africa — allof which have been contributing factors.Strong fundamentals remain intactAfter several years of growing optimism about Africa’s progress andpotential, are we seeing the start of a sustained decline in investorsentiment? We doubt that is the case. On the whole, Africaneconomies remain robust and their economic prospects stronglypositive. The IMF has predicted growth in excess of 5% across SSAfor <strong>2015</strong>, “driven by sustained infrastructure investment, buoyantservices sectors, and strong agricultural production, even as oilrelatedactivities provide less support.” 58 Looking further ahead, andconsidering the projections illustrated below, we anticipate that 24countries in SSA will experience a compound annual growth rateof more than 5% through 2030. <strong>EY</strong>’s report Africa 2030: Realizingthe possibilities sets out the key drivers of what we believe is asustainable economic growth path for Africa.The African growth story is real1988–2000 2001–12 2013–30GDP growth (CAGR)Above 5%Between 0% and 5%Less than 0% (negative)Number of economies growing faster than 5% a year2124634811 117631Asia-Pacific1988–2000 2001–12CIS2013–3021 1Central and SoutheastEurope (CSE)Middle EastSSASources: Oxford Economics database estimates, accessed in August 2014; <strong>EY</strong> analysis.58 Regional Economic Outlook SSA: Staying the Course, IMF, October 2014.<strong>EY</strong>’s <strong>attractiveness</strong> <strong>survey</strong> Africa <strong>2015</strong> Making choices39