3912 reportcomplete final web:layout 1

3912 reportcomplete final web:layout 1

3912 reportcomplete final web:layout 1

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Currency allocation:<br />

Olympic Foundation investments can be made in every<br />

convertible currency. Nevertheless, the following ranges<br />

should be maintained and respected:<br />

35–45% of the total of investments in USD<br />

35–45% of the total of investments in EUR<br />

10–20% of the total of investments in CHF<br />

Custodian banks:<br />

The Olympic Foundation assets should be held in several<br />

banks for diversification purposes. None of them should<br />

have more than 70% of the global portfolio.<br />

e) Olympic Solidarity Portfolio<br />

Types of investments permitted include US dollardenominated<br />

money market instruments, notes and bonds<br />

issued by supranational entities as well as G-10 countries,<br />

including their governments and corporations, whereby the<br />

following limits apply:<br />

Ratings: corporate obligations shall have a rating of “A”<br />

or above; the applicable limit for single “A” is 20% of the<br />

market value of the portfolio.<br />

The duration of the fixed-income portfolio shall not exceed<br />

five years, and the 90-day value-at-risk must remain below<br />

6% of the market value at inception of the funding<br />

allocation.<br />

Total exposure to any one corporate issuer should not<br />

exceed 6% of the market value of the total portfolio at<br />

inception of the funding allocation.<br />

f) Top Programme and OBS Portfolios<br />

These two portfolios only consist of money market<br />

investments and focus on managing liquidity.<br />

g) Benchmarks<br />

Each category of investment allocated to the IOC portfolios<br />

have a benchmark index identified. These will be used to<br />

compare the actual total return of the components of the<br />

International Olympic Committee, the Olympic Foundation,<br />

the Top programme and the OBS portfolio with a<br />

corresponding passive index.<br />

h) Reporting<br />

Reports on the investment portfolios must be presented<br />

to the IOC Finance Commission on a semi-annual basis<br />

and quarterly to the Finance Management Committee.<br />

In addition, a dashboard report is issued every month and<br />

sent to the management. This report assesses the full<br />

compliance of investments with risk policies. Any deviation<br />

is underlined and the follow-up and the <strong>final</strong> decision are<br />

taken by management.<br />

The monthly dashboard is distributed to the Finance<br />

Management Committee which is composed of the<br />

following members: IOC President, Chairman of the Finance<br />

Commission, General Director, Chief Financial Officer and<br />

the Treasurer.<br />

As at 31 December 2008 and 2007, the dashboard did not<br />

reveal any significant discrepancy with risk management<br />

policies.<br />

i) Policy Exceptions<br />

Policy exceptions may be approved in the event that<br />

unusual market conditions require immediate action, and it<br />

is not feasible to convene the Finance Commission. In the<br />

case of any proposed actions that could result in exceeding<br />

a policy limit, approval must be obtained from at least two<br />

members of the Finance Management Committee, one of<br />

whom must be either the IOC President or the Chairman<br />

of the Finance Commission, before proceeding. At the<br />

following Finance Management Committee meeting, the<br />

transaction(s) must be presented for ratification.<br />

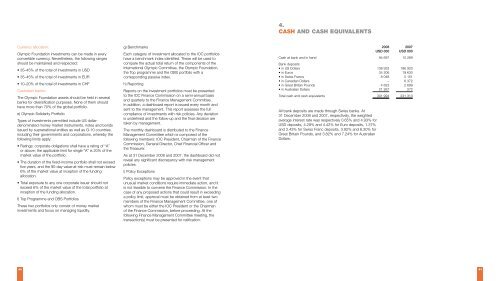

4.<br />

CASH AND CASH EQUIVALENTS<br />

2008 2007<br />

USD 000 USD 000<br />

Cash at bank and in hand 94 697 10 269<br />

Bank deposits<br />

in US Dollars 138 933 186 920<br />

in Euros 34 206 19 630<br />

in Swiss Francs 8 048 5 151<br />

in Canadian Dollars – 6 372<br />

in Great Britain Pounds 4 823 2 699<br />

in Australian Dollars 21 287 272<br />

Total cash and cash equivalents 301 994 231 313<br />

All bank deposits are made through Swiss banks. At<br />

31 December 2008 and 2007, respectively, the weighted<br />

average interest rate was respectively 0.65% and 4.93% for<br />

USD deposits, 4.29% and 4.42% for Euro deposits, 1.37%<br />

and 2.43% for Swiss Franc deposits, 3.92% and 6.30% for<br />

Great Britain Pounds, and 3.82% and 7.24% for Australian<br />

Dollars.<br />

80 81