3912 reportcomplete final web:layout 1

3912 reportcomplete final web:layout 1

3912 reportcomplete final web:layout 1

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

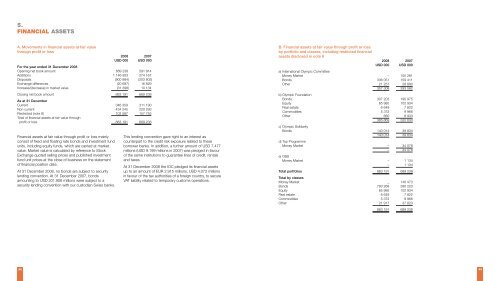

5.<br />

FINANCIAL ASSETS<br />

A. Movements in financial assets at fair value<br />

through profit or loss<br />

2008 2007<br />

USD 000 USD 000<br />

For the year ended 31 December 2008<br />

Opening net book amount 689 238 591 914<br />

Additions 1 146 923 274 167<br />

Disposals (900 884) (203 805)<br />

Exchange differences (20 687) 16 829<br />

Increase/(decrease) in market value (31 398) 10 134<br />

Closing net book amount 883 191 689 238<br />

As at 31 December<br />

Current 346 359 311 190<br />

Non current 434 245 220 293<br />

Restricted (note 8) 102 587 157 755<br />

Total of financial assets at fair value through<br />

profit or loss 883 191 689 238<br />

Financial assets at fair value through profit or loss mainly<br />

consist of fixed and floating rate bonds and investment fund<br />

units, including equity funds, which are carried at market<br />

value. Market value is calculated by reference to Stock<br />

Exchange quoted selling prices and published investment<br />

fund unit prices at the close of business on the statement<br />

of financial position date.<br />

At 31 December 2008, no bonds are subject to security<br />

lending convention. At 31 December 2007, bonds<br />

amounting to USD 201.906 millions were subject to a<br />

security lending convention with our custodian Swiss banks.<br />

82<br />

This lending convention gave right to an interest as<br />

counterpart to the credit risk exposure related to these<br />

borrower banks. In addition, a further amount of USD 7.477<br />

millions (USD 9.199 millions in 2007) was pledged in favour<br />

of the same institutions to guarantee lines of credit, rentals<br />

and taxes.<br />

At 31 December 2008 the IOC pledged its financial assets<br />

up to an amount of EUR 2.915 millions, USD 4.072 millions<br />

in favour of the tax authorities of a foreign country, to secure<br />

VAT liability related to temporary customs operations.<br />

B. Financial assets at fair value through profit or loss<br />

by portfolio and classes, including restricted financial<br />

assets disclosed in note 8<br />

2008 2007<br />

USD 000 USD 000<br />

a) International Olympic Committee<br />

Money Market – 105 261<br />

Bonds 336 051 159 411<br />

Other 21 257 28 890<br />

357 308 293 562<br />

b) Olympic Foundation<br />

Bonds 307 203 190 975<br />

Equity 65 985 102 934<br />

Real estate 6 649 7 822<br />

Commodities 5 372 9 966<br />

Other 660 8 933<br />

385 869 320 630<br />

c) Olympic Solidarity<br />

Bonds 140 014 39 834<br />

140 014 39 834<br />

d) Top Programme<br />

Money Market – 34 078<br />

– 34 078<br />

e) OBS<br />

Money Market – 1 134<br />

– 1 134<br />

Total portfolios 883 191 689 238<br />

Total by classes<br />

Money Market _ 140 473<br />

Bonds 783 268 390 220<br />

Equity 65 985 102 934<br />

Real estate 6 649 7 822<br />

Commodities 5 372 9 966<br />

Other 21 917 37 823<br />

883 191 689 238<br />

83