3912 reportcomplete final web:layout 1

3912 reportcomplete final web:layout 1

3912 reportcomplete final web:layout 1

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

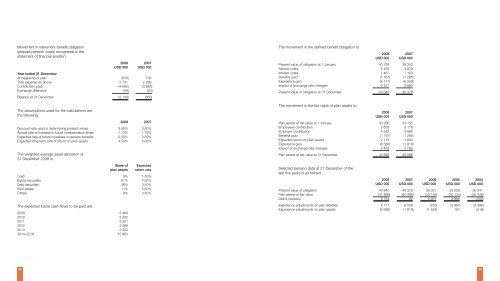

Movement in retirement benefit obligation<br />

(prepaid pension costs) recognised in the<br />

statement of financial position:<br />

2008 2007<br />

USD 000 USD 000<br />

Year ended 31 December<br />

At beginning of year (650) 736<br />

Total expense as above 2 131 2 299<br />

Contribution paid (4 562) (3 665)<br />

Exchange difference (59) (20)<br />

Balance at 31 December (3 140) (650)<br />

The assumptions used for the calculations are<br />

the following:<br />

2008 2007<br />

Discount rate used in determining present values 3.50% 3.50%<br />

Annual rate of increase in future compensation levels 1.75% 1.75%<br />

Expected rate of future increases in pension benefits 0.50% 0.50%<br />

Expected long-term rate of return on plan assets 4.50% 5.00%<br />

The weighted average asset allocation at<br />

31 December 2008 is:<br />

Share of Expected<br />

plan assets return rate<br />

Cash 8% 1.50%<br />

Equity securities 27% 7.00%<br />

Debt securities 46% 3.50%<br />

Real estate 11% 5.00%<br />

Others 8% 3.50%<br />

The expected future cash flows to be paid are:<br />

2009 3 464<br />

2010 3 432<br />

2011 3 341<br />

2012 3 366<br />

2013 3 302<br />

2014–2018 15 863<br />

92<br />

The movement in the defined benefit obligation is:<br />

2008 2007<br />

USD 000 USD 000<br />

Present value of obligation at 1 January 40 378 39 350<br />

Service costs 5 402 4 879<br />

Interest costs 1 487 1 103<br />

Benefits paid (1 767) (1 285)<br />

Experience gain (4 117) (6 559)<br />

Impact of exchange rate changes 2 457 2 890<br />

Present value of obligation at 31 December 43 840 40 378<br />

The movement in the fair value of plan assets is:<br />

2008 2007<br />

USD 000 USD 000<br />

Plan assets at fair value at 1 January 40 286 33 150<br />

Employees contribution 2 639 2 118<br />

Employer contribution 4 562 3 665<br />

Benefits paid (1 767) (1 285)<br />

Expected return on plan assets 2 119 1 690<br />

Experience gain (8 588) (1 818)<br />

Impact of exchange rate changes 2 435 2 766<br />

Plan assets at fair value at 31 December 41 686 40 286<br />

Selected pension data at 31 December of the<br />

last five years is as follows:<br />

2008 2007 2006 2005 2004<br />

USD 000 USD 000 USD 000 USD 000 USD 000<br />

Present value of obligation 43 840 40 378 39 351 33 028 30 241<br />

Plan assets at fair value (41 686) (40 286) (33 150) (30 134) (30 446)<br />

Deficit (surplus) 2 154 92 6 201 2 894 (205)<br />

Experience adjustments on plan liabilities 4 117 6 559 (253) (3 997) (2 495)<br />

Experience adjustments on plan assets (8 588) (1 818) (1 552) 157 (518)<br />

93