You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

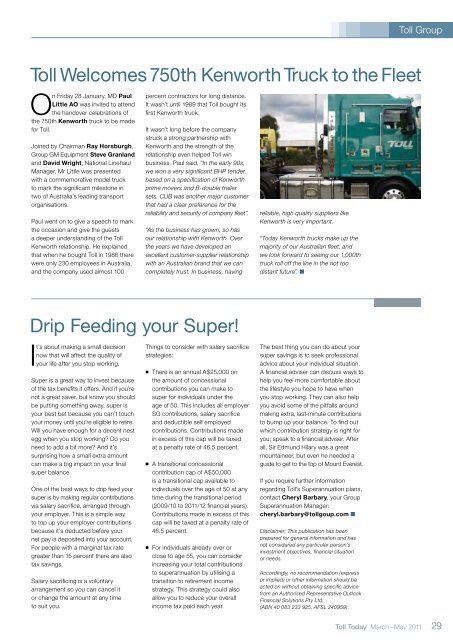

<strong>Toll</strong> Welcomes 750th Kenworth Truck to the Fleet<br />

On Friday 28 January, MD Paul<br />

Little ao was invited to attend<br />

the handover celebrations of<br />

the 750th Kenworth truck to be made<br />

for <strong>Toll</strong>.<br />

Joined by Chairman Ray Horsburgh,<br />

<strong>Group</strong> GM Equipment Steve Granland<br />

and David wright, National Linehaul<br />

Manager, Mr Little was presented<br />

with a commemorative model truck<br />

to mark the significant milestone in<br />

two of Australia’s leading transport<br />

organisations.<br />

Paul went on to give a speech to mark<br />

the occasion and give the guests<br />

a deeper understanding of the <strong>Toll</strong><br />

Kenworth relationship. He explained<br />

that when he bought <strong>Toll</strong> in 1986 there<br />

were only 230 employees in Australia,<br />

and the company used almost 100<br />

Drip Feeding your Super!<br />

It’s about making a small decision<br />

now that will affect the quality of<br />

your life after you stop working.<br />

Super is a great way to invest because<br />

of the tax benefits it offers. And if you’re<br />

not a great saver, but know you should<br />

be putting something away, super is<br />

your best bet because you can’t touch<br />

your money until you’re eligible to retire.<br />

Will you have enough for a decent nest<br />

egg when you stop working? Do you<br />

need to add a bit more? And it’s<br />

surprising how a small extra amount<br />

can make a big impact on your final<br />

super balance.<br />

One of the best ways to drip feed your<br />

super is by making regular contributions<br />

via salary sacrifice, arranged through<br />

your employer. This is a simple way<br />

to top up your employer contributions<br />

because it’s deducted before your<br />

net pay is deposited into your account.<br />

For people with a marginal tax rate<br />

greater than 15 percent there are also<br />

tax savings.<br />

Salary sacrificing is a voluntary<br />

arrangement so you can cancel it<br />

or change the amount at any time<br />

to suit you.<br />

percent contractors for long distance.<br />

It wasn’t until 1989 that <strong>Toll</strong> bought its<br />

first Kenworth truck.<br />

It wasn’t long before the company<br />

struck a strong partnership with<br />

Kenworth and the strength of the<br />

relationship even helped <strong>Toll</strong> win<br />

business. Paul said, “In the early 90s,<br />

we won a very significant BHP tender,<br />

based on a specification of Kenworth<br />

prime movers and B-double trailer<br />

sets. CUB was another major customer<br />

that had a clear preference for the<br />

reliability and security of company fleet”.<br />

“As the business has grown, so has<br />

our relationship with Kenworth. Over<br />

the years we have developed an<br />

excellent customer-supplier relationship<br />

with an Australian brand that we can<br />

completely trust. In business, having<br />

Things to consider with salary sacrifice<br />

strategies:<br />

n There is an annual A$25,000 on<br />

the amount of concessional<br />

contributions you can make to<br />

super for individuals under the<br />

age of 50. This includes all employer<br />

SG contributions, salary sacrifice<br />

and deductible self employed<br />

contributions. Contributions made<br />

in excess of this cap will be taxed<br />

at a penalty rate of 46.5 percent.<br />

n A transitional concessional<br />

contribution cap of A$50,000<br />

is a transitional cap available to<br />

individuals over the age of 50 at any<br />

time during the transitional period<br />

(2009/10 to <strong>2011</strong>/12 financial years).<br />

Contributions made in excess of this<br />

cap will be taxed at a penalty rate of<br />

46.5 percent.<br />

n For individuals already over or<br />

close to age 55, you can consider<br />

increasing your total contributions<br />

to superannuation by utilising a<br />

transition to retirement income<br />

strategy. This strategy could also<br />

allow you to reduce your overall<br />

income tax paid each year.<br />

reliable, high quality suppliers like<br />

Kenworth is very important.<br />

“<strong>Today</strong> Kenworth trucks make up the<br />

majority of our Australian fleet, and<br />

we look forward to seeing our 1,000th<br />

truck roll off the line in the not too<br />

distant future”. n<br />

The best thing you can do about your<br />

super savings is to seek professional<br />

advice about your individual situation.<br />

A financial adviser can discuss ways to<br />

help you feel more comfortable about<br />

the lifestyle you hope to have when<br />

you stop working. They can also help<br />

you avoid some of the pitfalls around<br />

making extra, last-minute contributions<br />

to bump up your balance. To find out<br />

which contribution strategy is right for<br />

you; speak to a financial adviser. After<br />

all, Sir Edmund Hilary was a great<br />

mountaineer, but even he needed a<br />

guide to get to the top of Mount Everest.<br />

If you require further information<br />

regarding <strong>Toll</strong>’s Superannuation plans,<br />

contact Cheryl Barbary, your <strong>Group</strong><br />

Superannuation Manager:<br />

cheryl.barbary@tollgoup.com n<br />

Disclaimer: This publication has been<br />

prepared for general information and has<br />

not considered any particular person’s<br />

investment objectives, financial situation<br />

or needs.<br />

Accordingly, no recommendation (express<br />

or implied) or other information should be<br />

acted on without obtaining specific advice<br />

from an Authorised Representative Outlook<br />

Financial Solutions Pty Ltd.<br />

(ABN 40 083 233 925, AFSL 240959).<br />

<strong>Toll</strong> <strong>Group</strong><br />

<strong>Toll</strong> <strong>Today</strong> <strong>March</strong> – May <strong>2011</strong> 29