Annual Report 2012

Annual Report 2012

Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

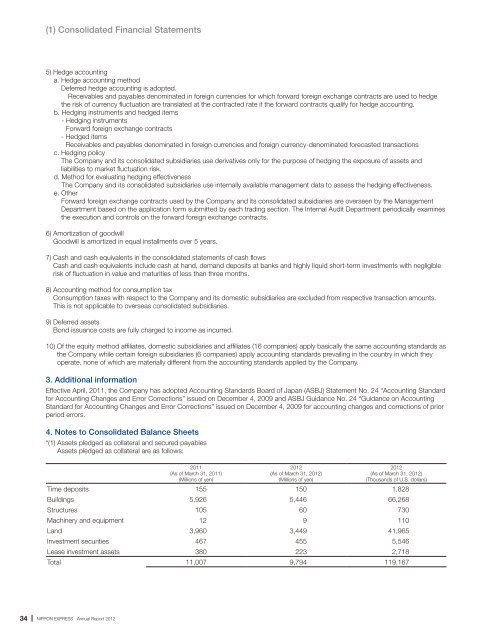

(1) Consolidated Financial Statements5) Hedge accountinga. Hedge accounting methodDeferred hedge accounting is adopted.Receivables and payables denominated in foreign currencies for which forward foreign exchange contracts are used to hedgethe risk of currency fluctuation are translated at the contracted rate if the forward contracts qualify for hedge accounting.b. Hedging instruments and hedged items- Hedging instrumentsForward foreign exchange contracts- Hedged itemsReceivables and payables denominated in foreign currencies and foreign currency-denominated forecasted transactionsc. Hedging policyThe Company and its consolidated subsidiaries use derivatives only for the purpose of hedging the exposure of assets andliabilities to market fluctuation risk.d. Method for evaluating hedging effectivenessThe Company and its consolidated subsidiaries use internally available management data to assess the hedging effectiveness.e. OtherForward foreign exchange contracts used by the Company and its consolidated subsidiaries are overseen by the ManagementDepartment based on the application form submitted by each trading section. The Internal Audit Department periodically examinesthe execution and controls on the forward foreign exchange contracts.6) Amortization of goodwillGoodwill is amortized in equal installments over 5 years.7) Cash and cash equivalents in the consolidated statements of cash flowsCash and cash equivalents include cash at hand, demand deposits at banks and highly liquid short-term investments with negligiblerisk of fluctuation in value and maturities of less than three months.8) Accounting method for consumption taxConsumption taxes with respect to the Company and its domestic subsidiaries are excluded from respective transaction amounts.This is not applicable to overseas consolidated subsidiaries.9) Deferred assetsBond issuance costs are fully charged to income as incurred.10) Of the equity method affiliates, domestic subsidiaries and affiliates (16 companies) apply basically the same accounting standards asthe Company while certain foreign subsidiaries (6 companies) apply accounting standards prevailing in the country in which theyoperate, none of which are materially different from the accounting standards applied by the Company.3. Additional informationEffective April, 2011, the Company has adopted Accounting Standards Board of Japan (ASBJ) Statement No. 24 “Accounting Standardfor Accounting Changes and Error Corrections” issued on December 4, 2009 and ASBJ Guidance No. 24 “Guidance on AccountingStandard for Accounting Changes and Error Corrections” issued on December 4, 2009 for accounting changes and corrections of priorperiod errors.4. Notes to Consolidated Balance Sheets*(1) Assets pledged as collateral and secured payablesAssets pledged as collateral are as follows:2011(As of March 31, 2011)(Millions of yen)<strong>2012</strong>(As of March 31, <strong>2012</strong>)(Millions of yen)<strong>2012</strong>(As of March 31, <strong>2012</strong>)(Thousands of U.S. dollars)Time deposits 155 150 1,828Buildings 5,926 5,446 66,268Structures 105 60 730Machinery and equipment 12 9 110Land 3,960 3,449 41,965Investment securities 467 455 5,546Lease investment assets 380 223 2,718Total 11,007 9,794 119,16734 NIPPON EXPRESS <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>

![Business Report for the 102nd Term [PDF 718KB] - Nippon Express](https://img.yumpu.com/46285896/1/184x260/business-report-for-the-102nd-term-pdf-718kb-nippon-express.jpg?quality=85)

![CSR Report 2010 [PDF 5764KB] - Nippon Express](https://img.yumpu.com/45662405/1/184x260/csr-report-2010-pdf-5764kb-nippon-express.jpg?quality=85)