Annual Report 2012

Annual Report 2012

Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

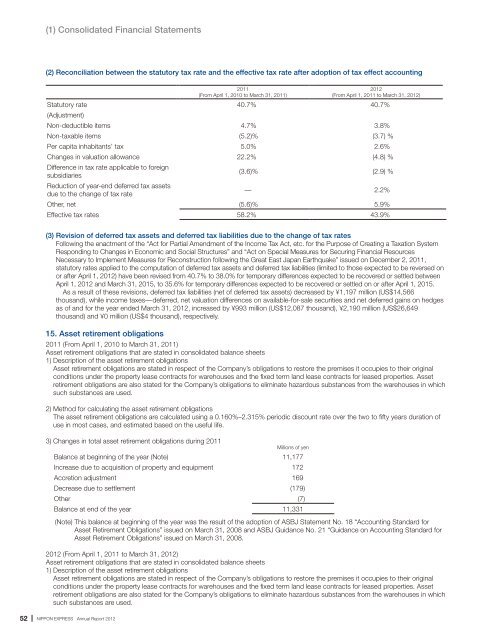

(1) Consolidated Financial Statements(2) Reconciliation between the statutory tax rate and the effective tax rate after adoption of tax effect accounting2011(From April 1, 2010 to March 31, 2011)<strong>2012</strong>(From April 1, 2011 to March 31, <strong>2012</strong>)Statutory rate 40.7% 40.7%(Adjustment)Non-deductible items 4.7% 3.8%Non-taxable items (5.2)% (3.7) %Per capita inhabitants’ tax 5.0% 2.6%Changes in valuation allowance 22.2% (4.8) %Difference in tax rate applicable to foreignsubsidiaries(3.6)% (2.9) %Reduction of year-end deferred tax assetsdue to the change of tax rate— 2.2%Other, net (5.6)% 5.9%Effective tax rates 58.2% 43.9%(3) Revision of deferred tax assets and deferred tax liabilities due to the change of tax ratesFollowing the enactment of the “Act for Partial Amendment of the Income Tax Act, etc. for the Purpose of Creating a Taxation SystemResponding to Changes in Economic and Social Structures” and “Act on Special Measures for Securing Financial ResourcesNecessary to Implement Measures for Reconstruction following the Great East Japan Earthquake” issued on December 2, 2011,statutory rates applied to the computation of deferred tax assets and deferred tax liabilities (limited to those expected to be reversed onor after April 1, <strong>2012</strong>) have been revised from 40.7% to 38.0% for temporary differences expected to be recovered or settled betweenApril 1, <strong>2012</strong> and March 31, 2015, to 35.6% for temporary differences expected to be recovered or settled on or after April 1, 2015.As a result of these revisions, deferred tax liabilities (net of deferred tax assets) decreased by ¥1,197 million (US$14,566thousand), while income taxes—deferred, net valuation differences on available-for-sale securities and net deferred gains on hedgesas of and for the year ended March 31, <strong>2012</strong>, increased by ¥993 million (US$12,087 thousand), ¥2,190 million (US$26,649thousand) and ¥0 million (US$4 thousand), respectively.15. Asset retirement obligations2011 (From April 1, 2010 to March 31, 2011)Asset retirement obligations that are stated in consolidated balance sheets1) Description of the asset retirement obligationsAsset retirement obligations are stated in respect of the Company’s obligations to restore the premises it occupies to their originalconditions under the property lease contracts for warehouses and the fixed term land lease contracts for leased properties. Assetretirement obligations are also stated for the Company’s obligations to eliminate hazardous substances from the warehouses in whichsuch substances are used.2) Method for calculating the asset retirement obligationsThe asset retirement obligations are calculated using a 0.160%–2.315% periodic discount rate over the two to fifty years duration ofuse in most cases, and estimated based on the useful life.3) Changes in total asset retirement obligations during 2011Millions of yenBalance at beginning of the year (Note) 11,177Increase due to acquisition of property and equipment 172Accretion adjustment 169Decrease due to settlement (179)Other (7)Balance at end of the year 11,331(Note) This balance at beginning of the year was the result of the adoption of ASBJ Statement No. 18 “Accounting Standard forAsset Retirement Obligations” issued on March 31, 2008 and ASBJ Guidance No. 21 “Guidance on Accounting Standard forAsset Retirement Obligations” issued on March 31, 2008.<strong>2012</strong> (From April 1, 2011 to March 31, <strong>2012</strong>)Asset retirement obligations that are stated in consolidated balance sheets1) Description of the asset retirement obligationsAsset retirement obligations are stated in respect of the Company’s obligations to restore the premises it occupies to their originalconditions under the property lease contracts for warehouses and the fixed term land lease contracts for leased properties. Assetretirement obligations are also stated for the Company’s obligations to eliminate hazardous substances from the warehouses in whichsuch substances are used.52 NIPPON EXPRESS <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>

![Business Report for the 102nd Term [PDF 718KB] - Nippon Express](https://img.yumpu.com/46285896/1/184x260/business-report-for-the-102nd-term-pdf-718kb-nippon-express.jpg?quality=85)

![CSR Report 2010 [PDF 5764KB] - Nippon Express](https://img.yumpu.com/45662405/1/184x260/csr-report-2010-pdf-5764kb-nippon-express.jpg?quality=85)