Annual Report 2012

Annual Report 2012

Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

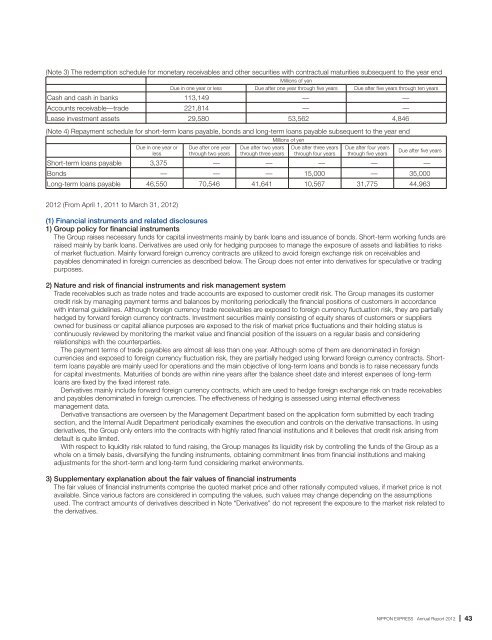

(Note 3) The redemption schedule for monetary receivables and other securities with contractual maturities subsequent to the year endMillions of yenDue in one year or less Due after one year through five years Due after five years through ten yearsCash and cash in banks 113,149 — —Accounts receivable—trade 221,814 — —Lease investment assets 29,580 53,562 4,846(Note 4) Repayment schedule for short-term loans payable, bonds and long-term loans payable subsequent to the year endMillions of yenDue in one year orlessDue after one yearthrough two yearsDue after two yearsthrough three yearsDue after three yearsthrough four yearsDue after four yearsthrough five yearsDue after five yearsShort-term loans payable 3,375 — — — — —Bonds — — — 15,000 — 35,000Long-term loans payable 46,550 70,546 41,641 10,567 31,775 44,963<strong>2012</strong> (From April 1, 2011 to March 31, <strong>2012</strong>)(1) Financial instruments and related disclosures1) Group policy for financial instrumentsThe Group raises necessary funds for capital investments mainly by bank loans and issuance of bonds. Short-term working funds areraised mainly by bank loans. Derivatives are used only for hedging purposes to manage the exposure of assets and liabilities to risksof market fluctuation. Mainly forward foreign currency contracts are utilized to avoid foreign exchange risk on receivables andpayables denominated in foreign currencies as described below. The Group does not enter into derivatives for speculative or tradingpurposes.2) Nature and risk of financial instruments and risk management systemTrade receivables such as trade notes and trade accounts are exposed to customer credit risk. The Group manages its customercredit risk by managing payment terms and balances by monitoring periodically the financial positions of customers in accordancewith internal guidelines. Although foreign currency trade receivables are exposed to foreign currency fluctuation risk, they are partiallyhedged by forward foreign currency contracts. Investment securities mainly consisting of equity shares of customers or suppliersowned for business or capital alliance purposes are exposed to the risk of market price fluctuations and their holding status iscontinuously reviewed by monitoring the market value and financial position of the issuers on a regular basis and consideringrelationships with the counterparties.The payment terms of trade payables are almost all less than one year. Although some of them are denominated in foreigncurrencies and exposed to foreign currency fluctuation risk, they are partially hedged using forward foreign currency contracts. Shorttermloans payable are mainly used for operations and the main objective of long-term loans and bonds is to raise necessary fundsfor capital investments. Maturities of bonds are within nine years after the balance sheet date and interest expenses of long-termloans are fixed by the fixed interest rate.Derivatives mainly include forward foreign currency contracts, which are used to hedge foreign exchange risk on trade receivablesand payables denominated in foreign currencies. The effectiveness of hedging is assessed using internal effectivenessmanagement data.Derivative transactions are overseen by the Management Department based on the application form submitted by each tradingsection, and the Internal Audit Department periodically examines the execution and controls on the derivative transactions. In usingderivatives, the Group only enters into the contracts with highly rated financial institutions and it believes that credit risk arising fromdefault is quite limited.With respect to liquidity risk related to fund raising, the Group manages its liquidity risk by controlling the funds of the Group as awhole on a timely basis, diversifying the funding instruments, obtaining commitment lines from financial institutions and makingadjustments for the short-term and long-term fund considering market environments.3) Supplementary explanation about the fair values of financial instrumentsThe fair values of financial instruments comprise the quoted market price and other rationally computed values, if market price is notavailable. Since various factors are considered in computing the values, such values may change depending on the assumptionsused. The contract amounts of derivatives described in Note “Derivatives” do not represent the exposure to the market risk related tothe derivatives.NIPPON EXPRESS <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>43

![Business Report for the 102nd Term [PDF 718KB] - Nippon Express](https://img.yumpu.com/46285896/1/184x260/business-report-for-the-102nd-term-pdf-718kb-nippon-express.jpg?quality=85)

![CSR Report 2010 [PDF 5764KB] - Nippon Express](https://img.yumpu.com/45662405/1/184x260/csr-report-2010-pdf-5764kb-nippon-express.jpg?quality=85)