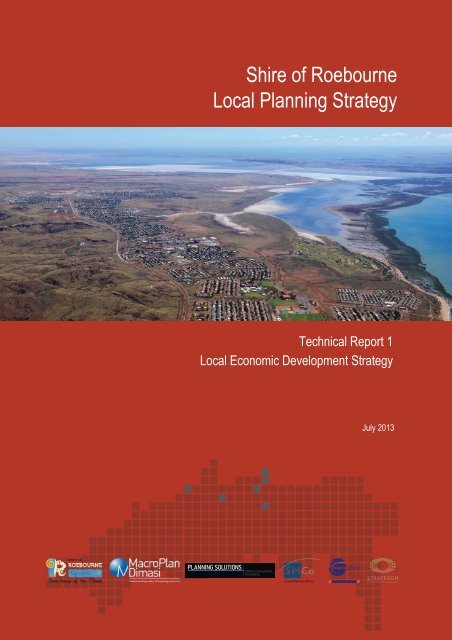

Shire of Roebourne Local Planning Strategy

Shire of Roebourne Local Planning Strategy

Shire of Roebourne Local Planning Strategy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>1 Introduction1.1 This paperThis Technical report 1: Economic Development <strong>Strategy</strong> is a preliminary paper in a suite <strong>of</strong> five reportsto inform the preparation <strong>of</strong> the <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong> (LPS) for the <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong>. There isplanned to be a series <strong>of</strong> consultations and further information gathering through the course <strong>of</strong> theformulation <strong>of</strong> the LPS.The Economic Development <strong>Strategy</strong>, as a component <strong>of</strong> the LPS and as a <strong>Strategy</strong> in its own right, willbe refined and finalised in the course <strong>of</strong> this process.The scope for the five technical reports was identified through an Information Gap Analysis prepared byMike Allen <strong>Planning</strong> in June 2012. This means that the Technical Reports do not comprehensivelyaddress all <strong>of</strong> the issues that will affect the <strong>Shire</strong>’s future; instead they are designed to complement thewide body <strong>of</strong> research and planning that has already been undertaken.1.2 History and overviewThe <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> is located in the Pilbara region <strong>of</strong> northern Western Australia, about 1,200kilometres north <strong>of</strong> Perth. The <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> is bounded by the Indian Ocean in the north and west,the Town <strong>of</strong> Port Hedland in the east, and the <strong>Shire</strong> <strong>of</strong> Ashburton in the south.The original inhabitants <strong>of</strong> the <strong>Roebourne</strong> area were the Ngaluma and Yindibarndi Aboriginal people.European settlement dates from the 1860s, with land used mainly for pastoral purposes (sheep grazing).Some growth took place in the late 1800s and early 1900s, particularly in Cossack and Point Samson.The population then declined. Significant development did not occur until the late 1960s when iron oredeposits and <strong>of</strong>fshore natural gas fields were discovered. The townships <strong>of</strong> Dampier, Karratha andWickham were established to house mining and transport workers, with Dampier established as a port.Growth took place from the 1970s, with the population <strong>of</strong> the <strong>Shire</strong> increasing from about 10,000 in 1971to 17,000 in 1991. This growth was driven by the North-West Shelf Gas joint venture, with Karrathafunctioning as a service centre for on and <strong>of</strong>f-shore oil and gas facilities. The population declined slightlyduring the early 1990s, falling to about 15,000 in 1996. From the late 1990s the population increasedsubstantially, rising to about 19,000 in 2006. By 2011 the resident population <strong>of</strong> the <strong>Shire</strong> had grown to23,900. Population growth is expected to continue, particularly in and around Karratha, largely a result<strong>of</strong> investment in new mining operations and continued global demand for iron ore and natural gas.The <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> encompasses a total land area <strong>of</strong> over 15,000 square kilometres. The <strong>Shire</strong> ispredominantly rural, with growing population centres in the township <strong>of</strong> Karratha and the smallertownships <strong>of</strong> Dampier, <strong>Roebourne</strong> and Wickham/Point Samson. The main industries in the <strong>Shire</strong> aremining (iron ore and gas extraction), salt production, and cattle and sheep grazing, with some fishing andtourism. The key employment sectors are currently mining and construction, and to a lesser extent, retail,transport, education, tourism and property and business services. The major industrial areas are theDampier and Cape Lambert Ports, with an industrial estate to the south <strong>of</strong> Karratha. The <strong>Shire</strong>'s mainretail area is the Karratha CBD, with a smaller centre at Wickham. <strong>Roebourne</strong> features one tertiaryinstitution (Pilbara Institute) and a number <strong>of</strong> primary and secondary schools.6

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>1.3 Economic development & the role <strong>of</strong> the governmentThe purpose <strong>of</strong> economic development is to build up the economic capacity <strong>of</strong> the <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> toimprove its economic future and the quality <strong>of</strong> life for all. It is a process by which the <strong>Shire</strong> will liaise withthe public, business, government and not-for-pr<strong>of</strong>it sector partners collectively, to create better conditionsfor economic growth and employment generation.The <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> City <strong>of</strong> the North Plan identifies the need to explore options for the creation <strong>of</strong>an economic development model for the <strong>Shire</strong>. Delivery <strong>of</strong> the plan cannot be achieved by any oneorganisation. All stakeholders and partners, both big and small, need to work together to help achievethe visionThe <strong>Roebourne</strong> <strong>Shire</strong> is in an influential position to implement economic development and currentstrategic planning aims to be inclusive and expansionary. The <strong>Shire</strong> and its residents recognise thevalues and special characteristics which are the foundation <strong>of</strong> long term planning. The <strong>Shire</strong> can play thefollowing economic development governance role: Shape the qualities <strong>of</strong> the community; Provide assistance and support to business; Determine how land use and facilities are developed; Support the development <strong>of</strong> a local workforce; Communicate the district’s assets, advantages and aspirations; Establish policies to align business and community goals; Allocate funds to key projects and services 1 ;Provide leadership for long term economic success; andForm strategic partnerships with the public and private sector to maximise the value <strong>of</strong> thestrategy and share implementation responsibility.Underpinning the aspirational target <strong>of</strong> 50,000 residents for Karratha: City <strong>of</strong> the North is the need tocreate over 22,000 jobs and with it substantial economic diversity. Proactive engagement anddevelopment <strong>of</strong> initiatives is needed to facilitate job creation and business expansion. The <strong>Shire</strong>’seconomic development services provide a range <strong>of</strong> initiatives to enhance economic diversity andbusiness development. This creates a more normalised market and improves the delivery <strong>of</strong> services tothe community.1These include community facilities and programs which improve liveability in the <strong>Shire</strong> and thus have aneconomic dimension.7

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>1.4 Policy frameworkStrategic Community Plan 2012-2022Some guidance for the economic strategy is contained in the <strong>Shire</strong>’s Strategic Community Plan 2012-2022.Aspiration:The primary aspiration for the <strong>Shire</strong> over the next ten years is to grow into a collection<strong>of</strong> diverse and sustainable cities supporting a regional population <strong>of</strong> 40,000 residents,realising the State Government’s ‘Pilbara Cities’ initiative <strong>of</strong> transforming Karratha intoa ‘world class City <strong>of</strong> the North’Themes involve a quadruple bottom line approach (QBL) to achieving the primary communityaspiration. These themes include ‘Our community – Diverse and Balanced’, ‘Our Economy – Well Managed and Diversified’, ‘Our Natural and Built Environment – Thriving and Sustainable’; and ‘Our Leadership – Responsive and Accountable’ in line with community expectations.The Goal for the Economy Strategic Theme is: To develop infrastructure and facilities in a sustainable way to support the communities’needs. To manage and maximise the benefits <strong>of</strong> growth in the region while diversifying theeconomic base.<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> Strategic Community Plan: Outcomes and ResponsesOutcomesResponseCreate opportunities for growth and diversification <strong>of</strong> thelocal economyMore industrial, commercial and residential land supply andcreation <strong>of</strong> readily developable land banks that can bequickly released to the market.Develop initiatives, build partnerships and deliver projects toattract and support Small to Medium Enterprises in theregion.Develop Initiatives, build partnerships and initiate projectswhich identify and develop land and accommodationopportunities including facilities for key service workersEncourage diversification <strong>of</strong> the local economy through thesupport <strong>of</strong> tourism and visitation.Create opportunities for growth and diversification for localbusiness.Facilitate the release <strong>of</strong> land to cater for growingdevelopment opportunities.8

2 The economy <strong>of</strong> the <strong>Shire</strong><strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>2.1 Factors <strong>of</strong> economic growth in the <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong>The economy <strong>of</strong> the <strong>Shire</strong> is heavily dependent on the minerals and energy sector. The mining sectoraccounts for $4,041 million <strong>of</strong> the $6,894 million total value added (59% <strong>of</strong> total) in the <strong>Shire</strong> (2011estimates) and the oil and gas and iron ore mining make up 57% and 38% respectively <strong>of</strong> value addedin the <strong>Shire</strong> from the mining sector. 2 Construction, the next largest sector measured by value added, isoverwhelmingly directly related to mining and resources projects.Table 2: Value added by industry sector, <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> Modelled dataIndustry sector (2006 ANZSIC) 2011 $ millions (2008/092011 % <strong>of</strong> totalconstant prices)Agriculture, Forestry and Fishing 63 0.9Mining 4,041 58.6Manufacturing 84 1.2Electricity, Gas, Water and Waste Services 75 1.1Construction 1,940 28.1Wholesale Trade 54 0.8Retail Trade 49 0.7Accommodation and Food Services 25 0.4Transport, Postal and Warehousing 148 2.1Information Media and Telecommunications 16 0.2Financial and Insurance Services 23 0.3Rental, Hiring and Real Estate Services 60 0.9Pr<strong>of</strong>essional, Scientific and Technical Services 48 0.7Administrative and Support Services 61 0.9Public Administration and Safety 84 1.2Education and Training 56 0.8Health Care and Social Assistance 43 0.6Arts and Recreation Services 2 0Other Services 23 0.3Total industries 6,894 100Source: National Institute <strong>of</strong> Economic and Industry Research (NIEIR) modelling and .id consultantsThe resources sector is the only one in the <strong>Shire</strong> selling outside <strong>of</strong> the Pilbara region in significant volume.It is this which drives wealth into the region.However, the resources sector is highly capital intensive, not labour intensive, and this is likely to becomemore marked over time. Major companies with capital intensive operations will seek to continually reduceon-site labour costs – remote mining technology is one <strong>of</strong> the main areas <strong>of</strong> research for the mining2Pilbara Development Commission, Pilbara Regional Economy Version 2, March 201210

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>majors. Much research and technical development is directed towards improving on-site labourproductivity and increasing the ability to undertake parts <strong>of</strong> operations remotely. This technology is underdevelopment and is being steadily implemented by the major resource companies. This will serve todampen regional population growth generally. Some <strong>of</strong> this is already in place: a current example is theremote control (from Perth) <strong>of</strong> haul trains.Extensions <strong>of</strong> technological applications over time will serve to subdue or even reduce regional labourdemand from resources projects, even as the volume and value-added measures increase. This willserve to dampen regional population growth generally.Australia is currently positioned at the point <strong>of</strong> a major transformation in the world’s economic weight fromwest to east. The rapid industrialisation <strong>of</strong> structurally large Asian economies, predominantly China, hasdriven world economic growth over recent times and changed the dynamics <strong>of</strong> key international resource,product and capital markets.For Australia, this has translated to strong demand and elevated prices for energy and mineral resources,and is underpinning massive investments by the minerals and oil and gas industry in new capacity. Theeconomic advancement in Australia’s region is overwhelmingly positive for Australia, playing tocomparative advantages as a secure and reliable energy exporter.The oil and gas industry currently represents around 2.0% <strong>of</strong> gross domestic product, with direct andflow-on value added <strong>of</strong> approximately $28.3 billion in 2010-11 (based on total sales <strong>of</strong> $29.7 billion).Moreover, the industry’s systemic significance is continuing to grow on the back <strong>of</strong> large LNG exportinvestments, mainly in Western Australia, Queensland and the Northern Territory. Separately, these represent some <strong>of</strong> the biggest projects ever undertaken in Australia; andcollectively, they account for around 35.4% <strong>of</strong> all business investment. Further, if all oil andgas investments are realised, they will comprise over 64% <strong>of</strong> all committed investment. LNG output is expected to grow by around 250% over the next seven years, with a projectedvalue <strong>of</strong> over $35 billion in 2017-18.Importantly, the industry’s economic linkages are broad and deep. Of total industry value added, about$4.3 billion is generated by supplying industries across the economy — including the resource supportservices, maintenance and construction and pr<strong>of</strong>essional services sectors. These linkages areparticularly visible in the thriving resource service hubs which have emerged in Brisbane and Perth, butalso in the supply sectors <strong>of</strong> resource communities such as in the <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong>.Building on these linkages, robust export performance by Australia’s oil and gas industry, and otherresource producers more broadly, has provided important income and employment support over thecourse <strong>of</strong> the global downturn. This has played a key role in Australia withstanding the more dramaticeconomic declines which confronted other developed economies.11

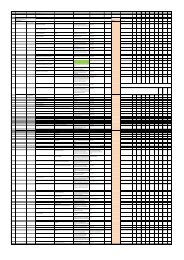

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>2.2 EmploymentThus while the mining sector is an important employer, it is not currently the main one. The dominance<strong>of</strong> the construction sector as an employer in the <strong>Shire</strong> is illustrated in the following table and graph:Employment by Industry <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> 2006, 2011 and 2012 (Persons Employed)Industry sector (2006 ANZSIC) 2012 2011 2006Agriculture, Forestry, Fishing 137 100 82Mining 5,040 4,837 2,367Manufacturing 950 743 515Electricity, Water, Waste Services 423 505 252Construction 5,246 5,017 2,332Wholesale Trade 434 343 405Retail Trade 1,209 906 790Accommodation & Food Services 822 829 559Transport, Postal, Warehousing 1,286 1,289 865Information Media & Telecommunications 116 71 94Financial and Insurance Services 107 65 109Rental, Hiring and Real Estate Services 426 402 197Pr<strong>of</strong>essional, Scientific & Technical Services 1,019 911 506Administrative and Support Services 743 694 397Public Administration and Safety 1,431 1,196 609Education and Training 931 845 634Health Care and Social Assistance 994 751 422Arts and Recreation Services 59 53 101Other Services 610 544 293Total industries 21,983 20,101 11,529Source: National Institute <strong>of</strong> Economic and Industry Research (NIEIR) modelling and .id consultants12

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>Figure 2: <strong>Roebourne</strong> <strong>Shire</strong> Employment 2006, 2011 and 2012<strong>Roebourne</strong> <strong>Shire</strong> Employment 2006, 2011, 20126000500040002006201120123000200010000Source: National Institute <strong>of</strong> Economic and Industry Research (NIEIR) modelling and .id consultantsIt shows a very substantial increase in construction-related employment over the period 2006 to 2011,increasing by almost 2,700 over the period, while employment in the mining sector rose substantially, butby 2,470 workers. It is also worth noting the relatively large increases in proportionate terms <strong>of</strong>administrative categories and <strong>of</strong> pr<strong>of</strong>essional, scientific and technical services.The nature <strong>of</strong> economic activity in the <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> is different to many mining communities: it hasfew iron ore mines and none within commuting distance <strong>of</strong> the main settlement areas. In addition toconstruction, economic activities driving employment around the main settlement areas are regionalservices and administration, LNG production, port and port-related transport operations and salt mining.While major centres in the <strong>Shire</strong> are not close to operational mines – some FIFO workers may useKarratha, <strong>Roebourne</strong> and other settlements as a FIFO / DIDO residential base to work elsewhere in thePilbara. This may partly be the result <strong>of</strong> the indigenous employment program <strong>of</strong> Fortescue and Rio.There is some evidence <strong>of</strong> this – the 2006 census shows in the two big employment sectors <strong>of</strong> miningand manufacturing, employment self-containment <strong>of</strong> 85% and 81% respectively, with almost 500 workersin those two industries and almost 1,200 overall with their main residence in the <strong>Shire</strong> but their place <strong>of</strong>employment elsewhere. These will have the reverse effect on demand for community facilities to theincoming FIFO workers.However information provided by Rio shows that the numbers <strong>of</strong> workers using Karratha as a residentialbase is far eclipsed by other locations: amongst regional WA, Rio FIFO workers are far more likely tohave Busselton, Geraldton and Broome as a home base than Karratha. This is an area <strong>of</strong> opportunityfor the <strong>Shire</strong>.13

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>Employment Self-Containment <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> 2006ResidentemployeesEmployedin <strong>Shire</strong>Employedoutside<strong>Shire</strong>Selfcontainment %Agriculture, Forestry and Fishing 31 13 18 41.9Mining 1,889 1,602 287 84.8Manufacturing 408 332 76 81.4Electricity, Gas, Water and Waste Services 134 121 13 90.3Construction 1,057 848 209 80.2Wholesale Trade 218 201 17 92.2Retail Trade 665 621 44 93.4Accommodation and Food Services 376 334 42 88.8Transport, Postal and Warehousing 464 392 72 84.5Information Media & Telecommunications 48 39 9 81.3Financial and Insurance Services 67 67 0 100Rental, Hiring and Real Estate Services 206 190 16 92.2Pr<strong>of</strong>essional, Scientific & Technical Services 200 163 37 81.5Administrative and Support Services 295 252 43 85.4Public Administration and Safety 528 480 48 90.9Education and Training 589 561 28 95.2Health Care and Social Assistance 424 394 30 92.9Arts and Recreation Services 30 30 0 100Other Services 229 202 27 88.2Inadequately described 278 109 169 39.2Total industries 8,136 6,951 1185 85.4Ref: id consultants and ABS2.3 FIFO in the <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong>A significant challenge faced together by Pilbara towns and the resources sector is a rapid increase inemployees and their families choosing fly-in-fly-out (FIFO) employment in preference to residentiallybased employment. ‘Long distance commuting’ for work can be traced back to the first half <strong>of</strong> the 20thcentury when shearing teams, recruited in Perth, travelled from sheep stations in the Kimberley throughto pastoral areas. In the resources sector, long distance commuting has manifested into FIFO and hadits beginnings during construction <strong>of</strong> the iron ore mining and shipping facilities in the Pilbara in the 1960sand 70s. Groups <strong>of</strong> specialist labour recruited from outside the region were housed in temporary campswhile they completed their work. When they were done, some <strong>of</strong> these workers took permanent jobs inthe region, but most returned home.It remains a significant proportion <strong>of</strong> the workforce employed in the Pilbara and there is no indication thatthis will change markedly. It is an entrenched practice for workers and their employers. According to theChamber <strong>of</strong> Minerals and Energy:14

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>“At the most basic level, FIFO is about providing choice for workers. In a competitive labourmarket, employee choice is paramount. Choice <strong>of</strong> what job they do, who they work for and,importantly, <strong>of</strong> where they choose to live.” 3In the next few years, the majority <strong>of</strong> FIFO workers in WA will be involved in construction <strong>of</strong> new resourcesprojects and maintaining existing ones. Construction workforces are typically much larger and transientthan operational workforces, as many individual employees or contractors may only be required for ashort time. For example, ground surveyors may only be utilised at the start <strong>of</strong> a construction project,whereas fit-out specialists such as painters will generally be engaged near the completion <strong>of</strong> the project.Once their specialist task is complete, they then demobilise from the site.Large maintenance workforces are also <strong>of</strong>ten employed over short periods to undertake routinemaintenance tasks once a project is operational. These workers typically move from one worksite toanother across the state and the nation, utilising their specialist skills for a defined period <strong>of</strong> time.Operational workforces tend to be smaller, and their employment is generally for the longer-term andmore stable.In accommodating construction and maintenance staff, facilities typically are less permanent and <strong>of</strong>varying standards compared with those provided to operational employees, who have ongoingemployment, though the facilities may be used for multiple projects. Some facilities are not permanent,as companies, as well as local governments, naturally avoid the provision <strong>of</strong> accommodation forconstruction workers that is not suitable for long-term operational employees. This is not only importantfrom an economic point <strong>of</strong> view, but can also be important for communities, as it avoids the provision <strong>of</strong>un-needed accommodation that could adversely affect the local market, particularly in times <strong>of</strong> economicchange.It may also be the preference <strong>of</strong> communities to have construction camps located at site, or outside town,due to the potential disruption that could be created by having a large workforce in the community for ashort period <strong>of</strong> time.Limited research has been undertaken to qualify the impact <strong>of</strong> a non-resident population on importanthard infrastructure that sustains and builds communities i.e. roads, water, sewer, waste and socialinfrastructure that supports strong local communities i.e. community sport and recreation facilities,libraries, community events.Resource sectors expand and contract rapidly, <strong>of</strong>ten with little warning due to volatile commodity prices,which makes it difficult for councils to plan for and supply key community and emergency services.Community services such as general practitioners, emergency rooms, ambulances, hospitals,pharmacies, nursing services, dentists and police confront significantly increased levels <strong>of</strong> demand asFIFO workers are as likely to use these as local residents. The public benefit nature <strong>of</strong> many <strong>of</strong> theseservices, that is they are available to all participants in the community, results in the perception <strong>of</strong> theFIFO workforce is acting as “free-loaders”, utilising the services and facilities without being required tocontribute to the provision <strong>of</strong> the services and infrastructure. A resulting situation where these essentialservices are only provided to the level <strong>of</strong> “permanent” population benchmarks is that local residentsperceive under delivery <strong>of</strong> service in the local community and may be forced to travel to other larger townsto access these services.3The Chamber <strong>of</strong> Minerals and Energy Of WA, A Matter <strong>of</strong> Choice: Capturing the FIFO Opportunity in Pilbara Communities,April 201215

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>A survey by the Queensland Department <strong>of</strong> Treasury <strong>of</strong> short term accommodation providers in theBowen Basin (including the Isaac Region) is likely to give results that are broadly similar to the shortterm accommodation situation in the <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> if a similar survey were conducted there.From the survey, the characteristics <strong>of</strong> non-resident workers were found to vary, but generalobservations upon their disposition were: Single Persons Quarters (SPQs) are more likely to contain young single people than otherforms <strong>of</strong> accommodation, but also house unaccompanied non-resident workers whosepartners and dependants live elsewhere. Although the occupants <strong>of</strong> SPQs arepredominantly male, most larger establishments also cater for female workers. A relativelysmall number <strong>of</strong> workers live in SPQs as their permanent place <strong>of</strong> residence; Many motels have a semi-permanent block booking arrangement for companies, cateringlargely to sub-contractors and government agencies. Where permanent housing is in shortsupply, motels may supply medium-term interim accommodation for mining companyemployees and contractors. Motels are the primary providers <strong>of</strong> short-term accommodationfor visiting executive, managerial and consulting staff; The number <strong>of</strong> hotel occupants varies according to location and availability <strong>of</strong> other dwellingtypes. With a few exceptions, hotels are less likely to provide medium-term accommodationfor non-resident workers than motels, caravan parks and SPQs; Of all accommodation types surveyed, caravan parks have the most diverse range <strong>of</strong>occupants, ranging from usual residents to short-term visitors. These parks usually containa mix <strong>of</strong> working age singles, couples and families with children. Compared with the stateoverall, local area caravan parks generally have lower proportions <strong>of</strong> usual residents whoare retirees; and Head-leased private housing is sometimes used as interim accommodation for newly arrivedworkers with families, particularly those awaiting permanent housing in the local area.Private housing is also rented by groups <strong>of</strong> unaccompanied workers, either in the form <strong>of</strong>private group housing arrangements or as overflow rooming to existing hostels. 8The Scale and Constitution <strong>of</strong> the FIFO CommunityA literature review indicates that the data on FIFO workers in the <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> is not definitive andis incomplete. The recently released AEC report 9 provides some information, but does not providesufficient detail to make any definitive conclusions. It provides some estimated breakdown on the size<strong>of</strong> the FIFO workforce and their possible location, based on the PDC report, but this is not in the form ordetail to inform the <strong>Shire</strong>’s particular needs concerning the appropriate level and scale <strong>of</strong> communityfacilities.There is some data available that can give some insights into the FIFO workforce in the <strong>Shire</strong>:8Queensland Treasury, Office <strong>of</strong> Economic and Statistical Research, Bowen Basin population report, 2009, Full-time equivalent (FTE)population estimates, July 20099Fly-In Fly-Out Worker Economic Impact Assessment on Services and Infrastructure Delivered by <strong>Local</strong> Government in thePilbara Region, AEC Group, June 201218

Comparative Data for <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> from 2011 Census:<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>Place <strong>of</strong> Usual Residence (Includes people who state they were at home in the <strong>Shire</strong> on Census nightplus those who were elsewhere but stated a <strong>Shire</strong> address as usual place <strong>of</strong> residence)Table 5: Population <strong>of</strong> usual residentsRef: ABS Census 2006, 2011, Cat 2001.0 Table B01Note the very large increase in the male population. These data will include people living in FIFOvillages and camps who regard it as their usual residence.Place <strong>of</strong> Enumeration (The Place <strong>of</strong> Enumeration count is a count <strong>of</strong> people based on where theywere located on Census Night. In many cases people are located away from where they usually live.Census counts by place <strong>of</strong> enumeration include overseas visitors.)Table 6: Population by place <strong>of</strong> enumeration on Census night2001 2006 2011Male 8,757 10,922 19,612Female 7,217 8,430 10,356Total 15,974 19,352 29,968Ref: ABS Census 2001, 2006, 2011 Cat 2003.0 Table T012006 2011 ChangeMale 8,865 13,751 4,886Female 7,558 9,149 1,591Total 16,423 22,900 6,477The difference between the two tables (i.e. approximately 2,929 in 2006 and 7,068 in 2011) gives anindication <strong>of</strong> the approximate scale <strong>of</strong> the FIFO workforce in the <strong>Shire</strong>.Note that the very substantial increase between 2006 and 2011 is likely to be predominantly constructionrelated.The Geographia survey gives an indication (based on a very small sample) that in the order <strong>of</strong>73% <strong>of</strong> FIFO workers may be construction–activity related, indicating a longer term FIFO operationalworkforce in the <strong>Shire</strong> <strong>of</strong> around 2,000 – 3,000. To assist in firming up this estimate, the 2011 Censusdata indicates that out <strong>of</strong> a total <strong>of</strong> 7,407 dwellings in the <strong>Shire</strong>, 2,390, or 33% <strong>of</strong> them, were being rentedfrom bodies other than a private landlord or public housing authority. This includes employer-providedhousing and accommodation in caravan parks and residential parks.The Geographia survey also confirms the short term nature <strong>of</strong> the construction non-resident workforce,compared to the workforce involved in operations. This is shown in the table following.19

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>Duration <strong>of</strong> employment – FIFO workersDuration <strong>of</strong> Employment Construction FIFO workers Operations FIFO workersless than 1 yr 32% 30%1 to 2 yrs 36% 18%3 to 5 yrs 27% 16%6 to 9 yrs 0% 6%10+ yrs 5% 21%Total 27.8% 72.2%Source: Geographia SurveyThe Geographia survey also found that while access to health services is very important, the range andquality <strong>of</strong> community services is not high on the factors affecting whether or not to relocate to the <strong>Shire</strong>.The main factors affecting relocation decisions for FIFO workers in the 2012 survey are: Cheaper accommodation & more housing choice; Better hospital & medical services; Lower cost <strong>of</strong> living; More cafes & restaurants; and Better shopping.The figures for overall FIFO workforce size above are <strong>of</strong> the same order <strong>of</strong> magnitude but at a littlevariance from those reported in the 2012 AEC Group report 10 , which estimates a 2012 <strong>Shire</strong> population<strong>of</strong> 20,172 and a FIFO workforce <strong>of</strong> 10,719. This would indicate a current core service population <strong>of</strong>around 30,900. Of this a large proportion is involved in the construction phase <strong>of</strong> minerals resourcesprojects. It size and nature will change as the resources projects now under construction move towardsan operational phase and if the economy diversifies away from its current resources base.There are good indications that a very high proportion <strong>of</strong> the current FIFO workforce is in the constructionsector and that the current high rate <strong>of</strong> short-term accommodation demand is driven by constructionactivity for major projects. At some stage in the medium term this activity will decrease substantially andthe construction sector in the <strong>Shire</strong> will then resemble that found in a relatively stable community.10Fly-In Fly-Out Worker Economic Impact Assessment on Services and Infrastructure Delivered by <strong>Local</strong> Government in thePilbara Region, AEC Group, June 201220

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>2.4 Imports and exportsRegional Exports data represents the value ($) <strong>of</strong> goods and services exported outside <strong>of</strong> the definedregion that have been generated by businesses / organisations in each <strong>of</strong> the industry sectors within theregion. Another way <strong>of</strong> defining exports is as an inflow <strong>of</strong> money into the region, i.e. Motels have an inflow<strong>of</strong> money from people who live outside the region’s boundaries thus they are earning export dollars. Nodistinction is made between domestic and international exports. For instance, so exports <strong>of</strong> goods andservices from Pilbara Region include sales to the rest <strong>of</strong> the region.Regional Imports data represents the value ($) <strong>of</strong> goods and services imported into the defined region bybusinesses / organisations in each <strong>of</strong> the industry sectors. Another way <strong>of</strong> defining imports is as anoutflow <strong>of</strong> money from the region, i.e. a local business outsourcing accountancy services to a firm inanother region which results in an outflow <strong>of</strong> money thus they are importing services. No distinction ismade between domestic and international imports, and so imports into Pilbara Region include goods andservices sourced from the broader region.The value <strong>of</strong> the import and export flow <strong>of</strong> the major industries is shown below, indicating, consistent withthe value add data, a net outflow in mining and construction industries.Figure 3: <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> value <strong>of</strong> imports and exports (major industries) $MMiningConstructionManufacturingTransport, Postal & Warehousing$0.00 $2,000.00 $4,000.00 $6,000.00 $8,000.00 $10,000.00 $12,000.00ExportsImportsData Source: PDC / REMPLANWhen the <strong>Shire</strong> import and export data for other industries an interesting picture emerges <strong>of</strong> high levels<strong>of</strong> import flows compares with export flows from the <strong>Shire</strong> across a wide range <strong>of</strong> services. This is shownin the table following:21

Figure 4: <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> value <strong>of</strong> imports and exports (other industries) $MElectricity, Gas, Water & Waste ServicesAccommodation & Food ServicesRental, Hiring & Real Estate ServicesPublic Administration & SafetyWholesale TradeEducation & TrainingPr<strong>of</strong>essional, Scientific & Technical ServicesAdministrative & Support ServicesRetail TradeAgriculture, Forestry & FishingOther ServicesArts & Recreation ServicesInformation Media & TelecommunicationsFinancial & Insurance ServicesHealth Care & Social Assistance<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>$0.00 $20.00 $40.00 $60.00 $80.00 $100.00 $120.00 $140.00ExportsImportsData Source: PDC / REMPLANNote that the <strong>Shire</strong> is net importer <strong>of</strong> many services, including many that service the local economy andlocal community. Most <strong>of</strong> these services would be sourced from major administrative and commercialcentres, principally Perth, but also other Australian major centres (Sydney, Melbourne, Canberra) andoverseas. This points to an area <strong>of</strong> expansion as the community expands and diversifies. It would alsoincrease as the role <strong>of</strong> Karratha as the principal service centre for eh Pilbara region expanded.An objective would be for the <strong>Shire</strong> to be a net exporter <strong>of</strong> services such as health, education, pr<strong>of</strong>essionaland administrative services and knowledge industries in general to the wider Pilbara region.22

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>2.5 Pilbara regional economyThe <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> is a significant component <strong>of</strong> the Pilbara Region. The Pilbara is <strong>of</strong>ten describedas the engine room <strong>of</strong> the nation because <strong>of</strong> its significant contribution to the national wealth. Its immensereserves <strong>of</strong> natural resources provide massive direct export sales and also fuel a thriving economy <strong>of</strong>support services.Resource sectorThe Pilbara's economy is strongly dominated by the mining and petroleum industries and is consideredto be the State's premier mining region. These industries are growing at a considerable rate.The largest export commodity in Australia is iron ore and approximately 95% <strong>of</strong> this is produced in thePilbara. Demand for iron ore principally comes from Japan, China and other rapidly developing Asiannations. In 2010, approximately 400 million tonnes <strong>of</strong> iron ore were exported from the Pilbara, worthAU$46.5b. New projects are continually being proposed and developed in the region as extensivegeological research is uncovering more resources.The region also produces 70% <strong>of</strong> Australia's natural gas. This is sourced from the Carnarvon Basin <strong>of</strong>fshoreand is serviced and processed onshore from the <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> at Dampier.In addition to iron ore and natural gas, 85% <strong>of</strong> Australia's crude oil and condensate comes from thePilbara.The Pilbara also produces a range <strong>of</strong> other minerals having a total 2011 value <strong>of</strong> AU$2.4b. This is led by: gold and silver at $1 billion; copper at $643 million; manganese and salt at $585 million; and other minerals at $131 million.While the <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> is only a small proportion <strong>of</strong> this, it is one <strong>of</strong> the region’s major service andextraction hubs where port, rail, government and industry intersect.Value <strong>of</strong> minerals and energy by LGA region (2012 value)Region Value ($)East Pilbara 29,828,820,725Ashburton 20,002,483,643<strong>Roebourne</strong> 155,782,451Port Hedland 753,742,294Total 50,740,829,113Offshore Petroleum 24,373,312,323Source: Dept <strong>of</strong> Mines and Petroleum, Mineral and Petroleum Statistics Digest 2012Other industriesOther industries include manufacturing, tourism, sheep and cattle, fishing and aquaculture. All figureprominently in the economy <strong>of</strong> the region, providing a diversity <strong>of</strong> activity - and a range <strong>of</strong> business23

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>opportunities. A number <strong>of</strong> projects aimed at economic diversification are also currently being trialled,including solar energy production at Marble Bar and algae production for bi<strong>of</strong>uel and protein.2.6 The <strong>Shire</strong> in the Pilbara economyMajor resource projectsThere are three major resource companies operating in the <strong>Shire</strong> (Rio Tinto, Woodside Energy Ltd andCitic Pacific Mining). Each company is currently operating or rolling out mining and energy extractioninfrastructure investments worth an estimated $69 billion (Table 9). The most significant include theWoodside operated North West Shelf Venture, Woodside’s Pluto project, Rio Tinto’s expansion <strong>of</strong>Dampier Port, Cape Lambert Port and CP Mining plans for Cape Preston. A total <strong>of</strong> more than 22,000construction jobs and 4,000 permanent jobs are to be created from these projects.ProjectWest Pilbara - Selected Committed Resource Infrastructure ProjectsDevil Creek Development Project Apache Energy/ Santo gasprocessingCapitalInvestmentConstructionWorkforceOperationalWorkforce$896m 200 20Citic Pacific Mining Sino Iron Ore Project US$5.2b 4500 800Chevron Gorgon Joint Venture <strong>of</strong>fshore gas extraction $43b 3500 600Woodside Pluto <strong>of</strong>fshore gas extraction $12b 4000 300Woodside joint venture gas project $7.9b - -Total $69b 12,200+ 1,720+(Data source: Prospect)In addition to this, some $16.8 billion worth <strong>of</strong> investment is under consideration or at pre-feasibility stage.It is noteworthy from the table above that the total operational workforce represents only around 14% <strong>of</strong>the construction workforce.ScaleThe <strong>Shire</strong> contains a very high proportion <strong>of</strong> the Pilbara economy – around 33 % <strong>of</strong> all employment andbetween 30% and 60% <strong>of</strong> most services. It has only 19% <strong>of</strong> all Pilbara employees in the mining sector.It has a higher proportion than the Pilbara average <strong>of</strong> employment in the following sectors: Electricity, Gas, Water & Waste Services; Public Administration & Safety; Construction; Pr<strong>of</strong>essional, Scientific & Technical Services; Retail Trade; Rental, Hiring & Real Estate Services; Financial & Insurance Services; Manufacturing; Transport, Postal & Warehousing; Information Media & Telecommunications; Education & Training; Wholesale Trade; Health Care & Social Assistance; Administrative & Support Services; and Other Services.24

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>This is illustrated in the following graph.Figure 5:<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> – proportion <strong>of</strong> Pilbara total: employmentData Source: PDC / REMPLANInterestingly it has a lower than average employment in arts and recreation services. This is an area thatwill need to be supported to provide the lifestyle values that will be expected by new residents if thepopulation is to expand to those anticipated in the higher level scenarios.Note also that the proportion <strong>of</strong> workers in the construction industry is likely to decline from 2014 unlessmajor new projects are announced.Mining activities in the <strong>Shire</strong> produce over $6,000 m <strong>of</strong> value add, but this is only 23% <strong>of</strong> the Pilbara total.The <strong>Shire</strong> provides 40% – 50 % <strong>of</strong> value add in the region as a whole in a large number <strong>of</strong> servicecategories, with the highest proportions in: Electricity, Gas, Water & Waste Services; Manufacturing; Construction; Public Administration & Safety; Pr<strong>of</strong>essional, Scientific & Technical Services; Retail Trade; Rental, Hiring & Real Estate Services; Financial & Insurance Services; Transport, Postal & Warehousing; Information Media & Telecommunications; Education &Training;25

Electricity, Gas, Water & Waste ServicesManufacturingConstructionPublic Administration & SafetyPr<strong>of</strong>essional, Scientific & Technical ServicesRetail TradeRental, Hiring & Real Estate ServicesFinancial & Insurance ServicesTransport, Postal & WarehousingInformation Media & TelecommunicationsEducation &TrainingWholesale TradeTourismHealth Care & Social AssistanceOwnership <strong>of</strong> DwellingsAdministrative & Support ServicesArts & Recreation ServicesOther ServicesMiningAccommodation & Food ServicesAgriculture, Forestry & Fishing<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>Wholesale Trade;Tourism; andHealth Care & Social Assistance.These generally mirror the employment data and indicate the strengths <strong>of</strong> the <strong>Shire</strong> in a regional context.Figure 6:$7,000.00<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> – value add<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> - Value Add70%$6,000.00$5,000.00Value AddProportion <strong>of</strong> Pilbara total60%50%$4,000.0040%$3,000.0030%$2,000.0020%$1,000.0010%$-0%Data Source: PDC / REMPLANTourismTourism is a category <strong>of</strong> economic development that would have an expansion objective and requiresseparate analysis. The Tourism category is an amalgam <strong>of</strong> activities across various industry sectorssuch as retail, accommodation, cafes & restaurants, cultural & recreational services. The tourism industrysector services the activities <strong>of</strong> persons travelling to and staying in places outside their usual environmentfor not more than one consecutive year for leisure, business and other purposes not related to theexercise <strong>of</strong> an activity remunerated from within the place visited.26

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>It currently employs 750 people in the <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> and accounts for 5.1% <strong>of</strong> total employment inthe <strong>Shire</strong>. This is a much lower proportion than in tourist-oriented localities such as the <strong>Shire</strong> <strong>of</strong> Augusta-Margaret River where one sub-category <strong>of</strong> tourism employment (accommodation and food services)accounts for over 13% <strong>of</strong> <strong>Shire</strong> employment.800700Figure 7:Tourism employment in the Pilbara7.0%6.0%6005004003002001005.0%4.0%3.0%2.0%1.0%Tourism employmentProportion <strong>of</strong> LGA totalemployment0Ashburton (S) East Pilbara (S)Port Hedland(T)<strong>Roebourne</strong> (S)0.0%Source: Australian Bureau <strong>of</strong> Statistics National Accounts Tourism Satellite Account.27

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>3 Growth prospects –the global and regionalcontextThe demand for iron ore is expected to grow; one <strong>of</strong> the biggest drivers <strong>of</strong> demand is the growth <strong>of</strong> China.The Bureau <strong>of</strong> Resources and Energy Economics forecasts that iron ore world demand will continue togrow up to nearly 2000 mtpa by 2025. 11In 2011 approximately 410 million tonnes <strong>of</strong> iron ore was exported from the Pilbara at a value <strong>of</strong>AU$60.3b, approximately 45% <strong>of</strong> world iron ore exports.Iron Ore:Based on data provided from the Bureau <strong>of</strong> Resources and Energy Economics and the WA Department<strong>of</strong> State Development, the current identified figures for additional jobs required in the Pilbara between2012 and 2018 are: 27,300 construction jobs; 15,870 operational jobs.Primary risks to the growth <strong>of</strong> the Pilbara iron ore industry are: Change in the Chinese economic outlook; Cost pressures; Lack <strong>of</strong> skilled workers; International competition from Brazil and West Africa; and Infrastructure constraints, ports, roads, housing, power, water.The Pilbara LNG industry is experiencing major growth simultaneously with the iron ore industry andlooking to expand to 30 mtpa by 2015 and 60 mtpa by 2020.LNG:In 2011 the world LNG trade measured 238 million tonnes <strong>of</strong> LNG. Due to location, the growth in the Asiapacific region is most important to the Pilbara and this trade in 2011 was measured at 147 million tonnesannually. Demand for LNG in the region is expect to continue to increase at a 6% yearly average.Based on data provided from the Bureau <strong>of</strong> Resources and Energy Economics and the WA Department<strong>of</strong> State Development, the current identified figures for additional jobs required in the Pilbara between2012 and 2018 are: 11,330 Construction jobs; 708 Operational jobs. 12Primary risks to the growth <strong>of</strong> the Pilbara liquefied natural gas industry are: Demand for skilled labour will outstrip supply; Increase in capital and labour costs; Development <strong>of</strong> alternative fuel sources; and Competition from other suppliers.11(Resource and Energy Quarterly March 2012 BREE)12WA Chamber <strong>of</strong> Minerals and Energy28

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>Other minerals:Based on data provided from the Bureau <strong>of</strong> Resources and Energy Economics and the WA Department<strong>of</strong> State Development, the current identified figures for additional jobs required in the Pilbara between2012 and 2018 are: 2,176 construction jobs; 915 operational jobs.Given the current investment detailed across all categories <strong>of</strong> minerals and petroleum in the Pilbara it isestimated by the WA Chamber <strong>of</strong> Minerals and Energy that an additional workforce <strong>of</strong> approximately: 40,000 construction workers and; 17,493 operational workers;will be needed between 2012 and 2018.29

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>4 Competitive PositionTo get a better idea <strong>of</strong> how to achieve the Pilbara Cities vision, an investigation <strong>of</strong> the competitive position<strong>of</strong> the Pilbara and <strong>of</strong> the <strong>Shire</strong> is instructive.A range <strong>of</strong> factors largely explain differences in regions’ economic prosperity and growth patterns. Theseinclude differences in resource endowments, the size <strong>of</strong> markets, demography and population dispersion,levels <strong>of</strong> human capital, the extent and incidence <strong>of</strong> taxation and the level and quality <strong>of</strong> publicexpenditure, as well as competition and market settings. It is therefore useful to investigate prospectsfor the region through the prism <strong>of</strong> its economic performance and competitiveness relative to otherregions or wider areas.A competitiveness index developed by the Regional Australia Institute and drawing on the WorldEconomic Forum’s Global Competitiveness Report provides some guidance 13 . The 10 themes <strong>of</strong> regionalcompetitiveness are distinguished between: Those that are essentially fixed in nature and cannot easily be adjusted (such as thepresence <strong>of</strong> natural resources or market size); and Those that can be changed by policy decisions, either directly through a decision to build,invest or change (such as institutions and infrastructure), or at least influenced by policy(such as human capital and labour market efficiency).An assessment <strong>of</strong> the Pilbara on these parameters provides an indication <strong>of</strong> the areas <strong>of</strong> comparativestrength in the region and those that need attention or strategies to deal with them.13Regional Australia Institute: Insight Regional Australia,http://insight.regionalaustralia.org.au/#30

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>In the following section graphs for selected parameters show the relative comparative rankings for thePilbara Region against all 55 Australian Regions identified by Regional Development Australia and usingthe data measures utilised in the Insight project. Note that this includes regions within capital cities. Thegraphs show relative distance from the median rank; 1 represents the highest ranking and -1 the lowestranking amongst the regions.The section also includes comparative rankings for each <strong>of</strong> the Pilbara local government areas againstall 560 local government areas in Australia. These are displayed with similar measures as for the regionalcomparisons. This gives information <strong>of</strong> the ranking <strong>of</strong> the <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> against other Pilbara localgovernment areas as well as giving an Australia–wide comparison.4.1 InstitutionsCompetitiveness IndexElementPilbara SituationRegional governmentinfluence at state andnational levelThe Pilbara is a high pr<strong>of</strong>ile regional location and has very goodexposure at the state government level and, to a lesser extent,nationally.Clear roles andresponsibilities in regionalgovernanceAt the development level there is quite a lot <strong>of</strong> crossover betweenindividual local governments and state agencies and atdevelopment policy level there is some duplication across allthree tiers <strong>of</strong> government.Financial burden <strong>of</strong> localgovernmentThe local governments have very high financial commitments forthe provision <strong>of</strong> infrastructure and services for a rapidlyexpanding population, with a limited rate base and are underconstant financial pressure.The local and regionalassistance available forbusinesses.The local and regional bodies have limited funds available fordirect business assistance, but it ranks amongst the highestamongst Australian regions.Regional governmentindependence (Councils withmore autonomy are moreable to respond to localneeds/demands)Compared with some other Australian jurisdictions, there is ahigh reliance on government decisions made outside <strong>of</strong> theregion, particularly at State government level.31

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>Regional Relative Strengths: InstitutionsRegional government influence at state/nationallevel<strong>Local</strong> government assistance for businessesClear roles and responsibilities in regionalgovernanceTransparency <strong>of</strong> local government policyFinancial burden <strong>of</strong> local governmentPublic service: % <strong>of</strong> workforce employed in thepublic service-1 -0.75 -0.5 -0.25 0 0.25 0.5 0.75 1Relative StrengthOverall:In comparative terms the Pilbara is in a strong institutional position: its influence at state andnational level is comparatively high and regional governance is relatively transparent withreasonable clarity <strong>of</strong> roles However, regional autonomy is quite low: local capabilities arehighly dependent on continuing influence and good relations with the state government (inparticular) and national government for resources; there is limited ability to raise funds locallyfor expansion projects. The relatively low proportion <strong>of</strong> people working in the public sectorhas positive and negative aspects to it: there is reduced understanding amongst the variouslevels <strong>of</strong> the bureaucracy <strong>of</strong> regional conditions, but a higher reliance on private sectoractivity to drive the economy.4.2 Infrastructure and servicesCompetitiveness IndexElementPilbara Situation Road infrastructure The region contains part <strong>of</strong> the intrastate regional road network - giventhe relative remoteness <strong>of</strong> the Pilbara it is a high quality connection. Aviation infrastructure The region has several large airports, including two that have regularinterstate connections and are capable <strong>of</strong> expansion to regularinternational operations.Access to highereducation.There is only limited access to higher education – the Pilbara Instituteprovides a range <strong>of</strong> vocational education and training courses, butthere is virtually no access to tertiary education Port infrastructure The region contains some <strong>of</strong> the largest and busiest bulk portsanywhere. It has no or limited capacity for general cargo. A commonuser facility is planned but not yet executed. This would enable32

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>Competitiveness IndexElementPilbara Situationservicing <strong>of</strong> new projects outside <strong>of</strong> the region, either <strong>of</strong>f-shore or inthe Canning Basin. Land cost Land cost generally is very high for all classes <strong>of</strong> accommodation. Themedian cost <strong>of</strong> buying a house in December 2012 was $747,000 inKarratha; $844,000 in Port Hedland; $840,000 in Newman and$890,000 in Onslow. It was $495,000 in Perth.Access to hospitalservices and to alliedhealth servicesWith the establishment <strong>of</strong> the Nickol Bay Hospital in Karratha and theSouth Hedland Health Campus, there are good quality district andregional hospitals, but limited specialist services. There is evidencethat people need to leave the region for long periods for specialisttreatment. There is limited aged care available.Police services: Number <strong>of</strong> people employed in policeservices per capitaAccess to tertiary education services: (% <strong>of</strong> working agepopulation attending)Access to hospital services: Number <strong>of</strong> people employedin hospitals in a region per capitaAccess to GP services: Number <strong>of</strong> per capitaAccess to technical or further education (% <strong>of</strong> working agepopulation attending)Access to allied health services: % <strong>of</strong> workforce employedin health services (excl hospitals)Regional Relative Strengths: Essential Services-1 -0.75 -0.5 -0.25 0 0.25 0.5 0.75 1Relative Strength33

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>Police services: Number <strong>of</strong> people employed inpolice services per capitaAccess to hospital services: Number <strong>of</strong> peopleemployed in hospitals in a region per capitaAccess to technical or further education (% <strong>of</strong>working age population attending)Access to tertiary education services: (% <strong>of</strong> workingage population attending)Access to allied health services: % <strong>of</strong> workforceemployed in health services (excl hospitals)Access to GP services: Number <strong>of</strong> per capitaLGA Relative Strengths: Essential ServicesEast PilbaraAshburtonPort Hedland<strong>Roebourne</strong> <strong>Shire</strong>-1 -0.75 -0.5 -0.25 0 0.25 0.5 0.75 1Relative StrengthOverall:The region has good transport connections and infrastructure. However it ranks poorly in allaspects <strong>of</strong> access to health services and education services. These are critical areas if thepopulation is to be to retained and expanded. Extended GP, specialist and aged servicesare required to service population growth and to meet Pilbara Cities objectives. There is acritical need for vastly expanded access to tertiary education and also technical and furthereducation.The <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> matches the regional pattern across all measures, with low rankingsfor all essential services except police services. On a per capita basis, Port Hedland ranksmuch higher than The <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> for access to health services.4.3 Macroeconomic conditionsCompetitiveness IndexElementPilbara Situation Population churn The population turnover is high. This makes it difficult to develop alarge and consistent group <strong>of</strong> regional ‘champions’.Stability <strong>of</strong> the localeconomy (local inflation)Building approvals – value<strong>of</strong> new investment<strong>Local</strong> inflation is high – local costs generally are high comparedwith elsewhere in the country.The rate <strong>of</strong> building approvals is generally high, showing goodevidence <strong>of</strong> business willingness to invest in the local community. Total income per person The average income is much higher than the national average,with a very high proportion <strong>of</strong> individual workers earning very highincomes.34

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>Overall:Average incomes are high, meaning there is wealth in the community and latent demandfor new business initiatives; however the cost base is very high.4.4 Human capitalCompetitiveness IndexElementMedian age <strong>of</strong> theworkforcePilbara SituationGenerally the workforce is younger than the national average, witha high proportion in the 25 to 44 year age groups. Workforce education levels The region has a lower proportion <strong>of</strong> people with tertiary educationin the workforce, even compared with other resources regions inAustralia.Early school leavers % <strong>of</strong> adult population that completedyear 12Health: Adults with none <strong>of</strong> the risk factors <strong>of</strong> smoking,harmful use <strong>of</strong> alcohol, physical inactivity, obesityLifelong learning: % <strong>of</strong> working age population participatingin education and trainingTechnical qualification: % <strong>of</strong> working age population withcertificate and diploma qualificationsUniversity qualification: % <strong>of</strong> working age population withuniversity qualificationsSchool performance - Secondary: % students in top 2 Bands(literacy and numeracy)School performance - Primary: % students in top 2 Bands(literacy and numeracy)Regional Relative Strengths: Human CapitalEarly childhood performance: % <strong>of</strong> childrendevelopmentally vulnerableEnglish pr<strong>of</strong>iciency: % population with English as firstlanguage or speaks English well-1 -0.75 -0.5 -0.25 0 0.25 0.5 0.75 1Relative Strength35

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>Early school leavers % <strong>of</strong> adult population that completedyear 12Health: Adults with none <strong>of</strong> the risk factors <strong>of</strong> smoking,harmful use <strong>of</strong> alcohol, physical inactivity, obesityLifelong learning: % <strong>of</strong> working age populationparticipating in education and trainingTechnical qualification: % <strong>of</strong> working age population withcertificate and diploma qualificationsUniversity qualification: % <strong>of</strong> working age population withuniversity qualificationsSchool performance - Secondary: % students in top 2Bands (literacy and numeracy)School performance - Primary: % students in top 2 Bands(literacy and numeracy)LGA Relative Strengths: Human CapitalEarly childhood performance: % <strong>of</strong> childrendevelopmentally vulnerableEnglish pr<strong>of</strong>iciency: % population with English as firstlanguage or speaks English wellEast PilbaraAshburtonPort Hedland<strong>Roebourne</strong> <strong>Shire</strong>-1 -0.75 -0.5 -0.25 0 0.25 0.5 0.75 1Relative StrengthOverall:The region has a relatively young, healthy and energetic workforce. However, the regionranks comparatively poorly on other measures <strong>of</strong> human capital, with a lower than averageincidence <strong>of</strong> trade qualifications and <strong>of</strong> tertiary education amongst the workforce. The highproportion <strong>of</strong> FIFO workers limits the ability <strong>of</strong> this part <strong>of</strong> the workforce to contribute toregional expansion beyond the specific project on which they are working. Of particular noteis the relatively low school performance scores at both primary and secondary level. This isa key factor that must be improved if population retention and growth is to be achieved.At the LGA level, both the <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> and Port Hedland have higher than averagerankings in population health measures and lifelong learning and the <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong>has good scores on early childhood performance. These are good signs that there is a level<strong>of</strong> comparative attraction on some key measures in Karratha.4.5 Labour Market EfficiencyCompetitiveness IndexElementPilbara Situation Wage/labour costs Very highUnemployment rates in theregionLevels <strong>of</strong> labour forceparticipation in each regionGenerally lowGenerally high36

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong> Youth unemployment Generally low Skilled labour Generally very low Welfare dependence Generally low (except for indigenous community)Regional Relative Strengths: Labour Market EfficiencyYoung unemploymentUnemployment rateWelfare dependence: % <strong>of</strong> population usingGovernment support main source incomeParticipation rate: % working age population in thelabour forceSkilled labour: % <strong>of</strong> workforce employed asmanagers and pr<strong>of</strong>essionals-1 -0.75 -0.5 -0.25 0 0.25 0.5 0.75 1Relative StrengthLGA Relative Strengths: Labour Market EfficiencyYoung unemploymentUnemployment rateWelfare dependence: % <strong>of</strong> population usingGovernment support main source incomeParticipation rate: % working age population in thelabour forceSkilled labour: % <strong>of</strong> workforce employed asmanagers and pr<strong>of</strong>essionalsEast PilbaraAshburtonPort Hedland<strong>Roebourne</strong> <strong>Shire</strong>-1 -0.75 -0.5 -0.25 0 0.25 0.5 0.75 1Relative StrengthOverall:In comparative terms the labour force is relatively engaged, flexible and mobile.However, the participation rate is quite low, possibly partly reflecting the indigenouspopulation , but also possibly reflecting the lower than average participation <strong>of</strong> partners<strong>of</strong> people working in major projects who might regard their time in the Pilbara as relativelyshort term and not have employment that meets their needs or expectations. The level<strong>of</strong> skilled labour (i.e. people employed as managers and pr<strong>of</strong>essionals) is amongst thelowest in the country.At the LGA level both the Sire <strong>of</strong> <strong>Roebourne</strong> and Port Hedland have lower thanaverage levels <strong>of</strong> welfare dependency.37

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>4.6 Technological readiness:Regional business and individual effectiveness using information and communication technologies(ICT); Preparedness for technological developmentCompetitiveness IndexElementPilbara Situation Government IT investment Karratha and Port Hedland are served by the Telstra fibre optictrunk cableHigh-speed broadbandavailability Mobile phone coverage Adequate in the major centresBusinesses in technologyrelated industriesLarge parts <strong>of</strong> the major centres already have NBN commencedor are on the three-year rollout programAverage for a regional centreRegional Relative Strengths: Technological ReadinessBroadband connections: % Households and businesseswith broadband internetWorkers in ICT and electronics: % employed as ICT andelectronics specialistsInternet connection: % <strong>of</strong> households with internetconnectionBusinesses in technology and related industries: % <strong>of</strong>workforce employed by technology related businesses-1 -0.75 -0.5 -0.25 0 0.25 0.5 0.75 1Relative Strength38

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>LGA Relative Strengths: Technological ReadinessBroadband connections: % Households andbusinesses with broadband internetWorkers in ICT and electronics: % employed as ICTand electronics specialistsInternet connection: % <strong>of</strong> households with internetconnectionBusinesses in technology and related industries: % <strong>of</strong>workforce employed by technology related…East PilbaraAshburtonPort Hedland<strong>Roebourne</strong> <strong>Shire</strong>-1 -0.75 -0.5 -0.25 0 0.25 0.5 0.75 1Relative StrengthOverall:There is coming to be good access to high speed broadband in most parts <strong>of</strong> the region andparticularly in the main settlements. This is not a barrier to growth. There is no particularexpertise amongst the business community for technology related industries.At the LGA level, the <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> has the highest relative proportion <strong>of</strong> workers inICT occupations than other Pilbara shires, except for the much smaller <strong>Shire</strong> <strong>of</strong> East Pilbara.4.7 Business sophisticationCompetitiveness IndexElementQuality <strong>of</strong> region’s overallbusiness networksDominance <strong>of</strong> largeemployers - number <strong>of</strong> largefirms in the region.Pilbara SituationSmall business networks and local chambers <strong>of</strong> commerce existand can be expanded.Economy is dominated by a very small number <strong>of</strong> very largeemployers Exports High proportion <strong>of</strong> imports in all sectors (except for mining),particularly services Economic diversification Low Access to local finance All channelled through Perth and elsewhereIncome source – ownbusinessRelatively small SME sector39

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>Regional Relative Strengths: Business SophisticationExports: % business sales revenue earned from exportsIncome source - Own businessEconomic diversificationAccess to local finance: Number <strong>of</strong> banks/lendinginstitutions as a share <strong>of</strong> total businessesExporters, importers, wholesalers: % employedDominance <strong>of</strong> large employers-1 -0.75 -0.5 -0.25 0 0.25 0.5 0.75 1Relative StrengthAccess to local finance: Number <strong>of</strong> banks/lendinginstitutions as a share <strong>of</strong> total businessesExporters, importers, wholesalers: % employedLGA Relative Strengths: Business SophisticationIncome source - Own businessEconomic diversificationDominance <strong>of</strong> large employersEast PilbaraAshburtonPort Hedland<strong>Roebourne</strong> <strong>Shire</strong>-1 -0.75 -0.5 -0.25 0 0.25 0.5 0.75 1Relative StrengthOverall:The region is dominated by very large employers and has a small and underdeveloped smalland medium business sector. With several exceptions there is not a tradition <strong>of</strong> newenterprise creation.The <strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> shows the most diverse and sophisticated business environment inthe Pilbara, with the highest level <strong>of</strong> income sourced form own business, the highest levels<strong>of</strong> economic diversification and reasonable access to local finance.40

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>4.8 InnovationCompetitiveness IndexElementHuman resources in scienceand technologyPresence <strong>of</strong> researchorganisationsPilbara SituationComparatively lowVery low Patents Very lowExpenditure on research anddevelopmentVery low, except for within major companies as part <strong>of</strong> theiroperations research; this explains the high overall ranking.Presence <strong>of</strong> research organisations: % <strong>of</strong> researchorganisations out <strong>of</strong> all businessesRegional Relative Strengths: InnovationExpenditure on research and development:Average expenditure on R&D per businessHuman resources in science and technologyResearch and development managers: % employed-1 -0.75 -0.5 -0.25 0 0.25 0.5 0.75 1Relative StrengthOverall:Amongst the major minerals and resources companies the level <strong>of</strong> leading edge researchand development is very high and its application in the region is widespread, resulting incontinuous innovation and globally competitive operations. This presents an opportunity forthe future <strong>of</strong> the region. It provides a level <strong>of</strong> skill and expertise that can be applied to otherregional enterprises and also opportunity for supply chain and spin-<strong>of</strong>f enterprises.41