Shire of Roebourne Local Planning Strategy

Shire of Roebourne Local Planning Strategy

Shire of Roebourne Local Planning Strategy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

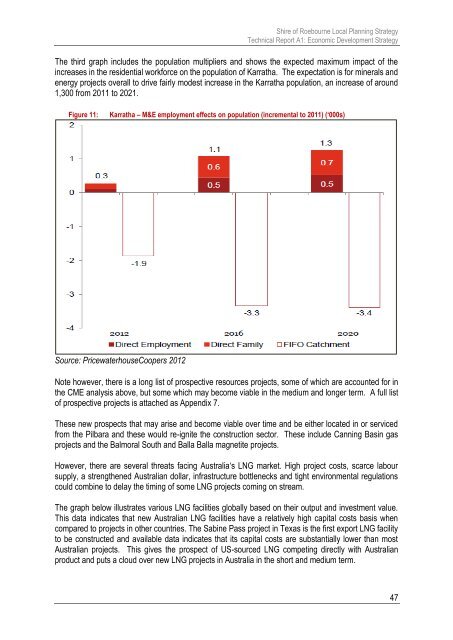

<strong>Shire</strong> <strong>of</strong> <strong>Roebourne</strong> <strong>Local</strong> <strong>Planning</strong> <strong>Strategy</strong>Technical Report A1: Economic Development <strong>Strategy</strong>The third graph includes the population multipliers and shows the expected maximum impact <strong>of</strong> theincreases in the residential workforce on the population <strong>of</strong> Karratha. The expectation is for minerals andenergy projects overall to drive fairly modest increase in the Karratha population, an increase <strong>of</strong> around1,300 from 2011 to 2021.Figure 11:Karratha – M&E employment effects on population (incremental to 2011) (‘000s)Source: PricewaterhouseCoopers 2012Note however, there is a long list <strong>of</strong> prospective resources projects, some <strong>of</strong> which are accounted for inthe CME analysis above, but some which may become viable in the medium and longer term. A full list<strong>of</strong> prospective projects is attached as Appendix 7.These new prospects that may arise and become viable over time and be either located in or servicedfrom the Pilbara and these would re-ignite the construction sector. These include Canning Basin gasprojects and the Balmoral South and Balla Balla magnetite projects.However, there are several threats facing Australia‘s LNG market. High project costs, scarce laboursupply, a strengthened Australian dollar, infrastructure bottlenecks and tight environmental regulationscould combine to delay the timing <strong>of</strong> some LNG projects coming on stream.The graph below illustrates various LNG facilities globally based on their output and investment value.This data indicates that new Australian LNG facilities have a relatively high capital costs basis whencompared to projects in other countries. The Sabine Pass project in Texas is the first export LNG facilityto be constructed and available data indicates that its capital costs are substantially lower than mostAustralian projects. This gives the prospect <strong>of</strong> US-sourced LNG competing directly with Australianproduct and puts a cloud over new LNG projects in Australia in the short and medium term.47