Download - Mintek

Download - Mintek

Download - Mintek

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

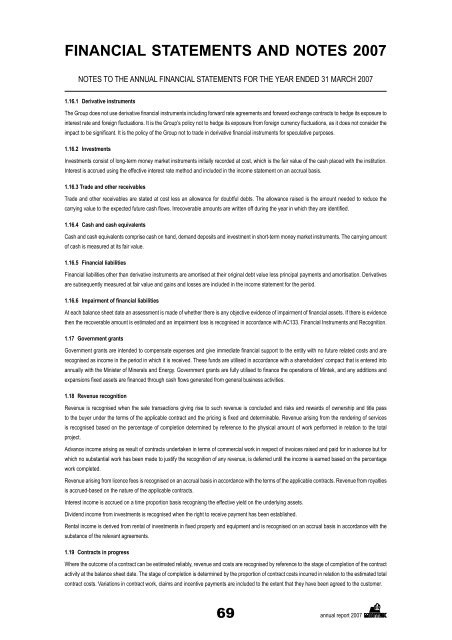

FINANCIAL STATEMENTS AND NOTES 2007NOTES TO THE ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 20071.16.1 Derivative instruments1.16.2 InvestmentsInvestments consist of long-term money market instruments initially recorded at cost, which is the fair value of the cash placed with the institution.Interest is accrued using the effective interest rate method and included in the income statement on an accrual basis.1.16.3 Trade and other receivablesTrade and other receivables are stated at cost less an allowance for doubtful debts. The allowance raised is the amount needed to reduce the1.16.4 Cash and cash equivalentsCash and cash equivalents comprise cash on hand, demand deposits and investment in short-term money market instruments. The carrying amountof cash is measured at its fair value.1.16.5 Financial liabilitiesFinancial liabilities other than derivative instruments are amortised at their original debt value less principal payments and amortisation. Derivativesare subsequently measured at fair value and gains and losses are included in the income statement for the period.then the recoverable amount is estimated and an impairment loss is recognised in accordance with AC133. Financial Instruments and Recognition.1.17 Government grantsrecognised as income in the period in which it is received. These funds are utilised in accordance with a shareholders’ compact that is entered into1.18 Revenue recognitionRevenue is recognised when the sale transactions giving rise to such revenue is concluded and risks and rewards of ownership and title passis recognised based on the percentage of completion determined by reference to the physical amount of work performed in relation to the totalproject.Advance income arising as result of contracts undertaken in terms of commercial work in respect of invoices raised and paid for in advance but forwhich no substantial work has been made to justify the recognition of any revenue, is deferred until the income is earned based on the percentagework completed.Revenue arising from licence fees is recognised on an accrual basis in accordance with the terms of the applicable contracts. Revenue from royaltiesis accrued-based on the nature of the applicable contracts.Interest income is accrued on a time proportion basis recognisng the effective yield on the underlying assets.Dividend income from investments is recognised when the right to receive payment has been established.substance of the relevant agreements.1.19 Contracts in progressWhere the outcome of a contract can be estimated reliably, revenue and costs are recognised by reference to the stage of completion of the contractactivity at the balance sheet date. The stage of completion is determined by the proportion of contract costs incurred in relation to the estimated totalcontract costs. Variations in contract work, claims and incentive payments are included to the extent that they have been agreed to the customer.69annual report 2007