Download - Mintek

Download - Mintek

Download - Mintek

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

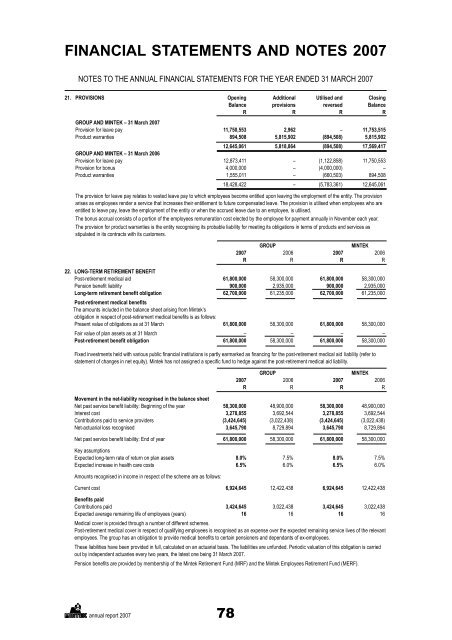

FINANCIAL STATEMENTS AND NOTES 2007NOTES TO THE ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 200721. PROVISIONS Opening Additional Utilised and ClosingBalance provisions reversed BalanceR R R RGROUP AND MINTEK – 31 March 2007Provision for leave pay 11,750,553 2,962 – 11,753,515Product warranties 894,508 5,815,902 (894,508) 5,815,90212,645,061 5,818,864 (894,508) 17,569,417GROUP AND MINTEK – 31 March 2006Provision for leave pay 12,873,411 – (1,122,858) 11,750,553Provision for bonus 4,000,000 – (4,000,000) –Product warranties 1,555,011 – (660,503) 894,50818,428,422 – (5,783,361) 12,645,061The provision for leave pay relates to vested leave pay to which employees become entitled upon leaving the employment of the entity. The provisionarises as employees render a service that increases their entitlement to future compensated leave. The provision is utilised when employees who areentitled to leave pay, leave the employment of the entity or when the accrued leave due to an employee, is utilised.The bonus accrual consists of a portion of the employees remuneration cost elected by the employee for payment annually in November each year.The provision for product warranties is the entity recognising its probable liability for meeting its obligations in terms of products and services asstipulated in its contracts with its customers.GROUPMINTEK2007 2006 2007 2006R R R R22. LONG-TERM RETIREMENT BENEFITPost-retirement medical aid 61,800,000 58,300,000 61,800,000 58,300,000 900,000 2,935,000 900,000 2,935,000 62,700,000 61,235,000 62,700,000 61,235,000The amounts included in the balance sheet arising from <strong>Mintek</strong>’s Present value of obligations as at 31 March 61,800,000 58,300,000 61,800,000 58,300,000Fair value of plan assets as at 31 March – – – – 61,800,000 58,300,000 61,800,000 58,300,000 GROUPMINTEK2007 2006 2007 2006R R R RMovement in the net-liability recognised in the balance sheet 58,300,000 48,900,000 58,300,000 48,900,000Interest cost 3,278,855 3,692,544 3,278,855 3,692,544Contributions paid to service providers (3,424,645) (3,022,438) (3,424,645) (3,022,438)Net-actuarial loss recognised 3,645,790 8,729,894 3,645,790 8,729,894 61,800,000 58,300,000 61,800,000 58,300,000Key assumptionsExpected long-term rate of return on plan assets 8.0% 8.0% Expected increase in health care costs 6.5% 6.5% Amounts recognised in income in respect of the scheme are as follows:Current cost 6,924,645 12,422,438 6,924,645 12,422,438Contributions paid 3,424,645 3,022,438 3,424,645 3,022,438Expected average remaining life of employees (years) 16 16 16 16Medical cover is provided through a number of different schemes.Post-retirement medical cover in respect of qualifying employees is recognised as an expense over the expected remaining service lives of the relevantThese liabilities have been provided in full, calculated on an actuarial basis. The liabilities are unfunded. Periodic valuation of this obligation is carriedout by independent actuaries every two years, the latest one being 31 March 2007.annual report 200778