Download - Mintek

Download - Mintek

Download - Mintek

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

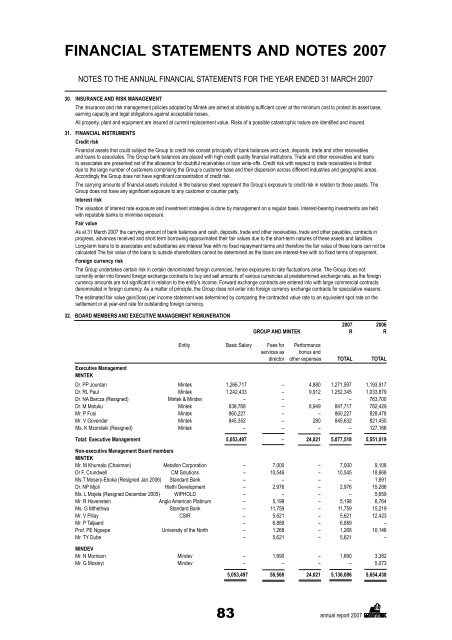

FINANCIAL STATEMENTS AND NOTES 2007NOTES TO THE ANNUAL FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 200730. INSURANCE AND RISK MANAGEMENTearning capacity and legal obligations against acceptable losses.31. FINANCIAL INSTRUMENTSCredit riskFinancial assets that could subject the Group to credit risk consist principally of bank balances and cash, deposits, trade and other receivablesto associates are presented net of the allowance for doubtful receivables or loan write-offs. Credit risk with respect to trade receivables is limiteddue to the large number of customers comprising the Group’s customer base and their dispersion across different industries and geographic areas.Interest riskThe valuation of interest rate exposure and investment strategies is done by management on a regular basis. Interest-bearing investments are heldwitn reputable banks to minimise exposure.Fair valueAs at 31 March 2007 the carrying amount of bank balances and cash, deposits, trade and other receivables, trade and other payables, contracts inprogress, advances received and short term borrowing approximated their fair values due to the short-term natures of these assets and liabilities.Foreign currency risk currently enter into forward foreign exchange contracts to buy and sell amounts of various currencies at predetermined exchange rate, as the foreigndenominated in foreign currency. As a matter of principle, the Group does not enter into foreign currency exchange contracts for speculative reasons.The estimated fair value gain/(loss) per income statement was determined by comparing the contracted value rate to an equivalent spot rate on thesettlement or at year-end rate for outstanding foreign currency.32. BOARD MEMBERS AND EXECUTIVE MANAGEMENT REMUNERATION2007 2006GROUP AND MINTEK R REntity Basic Salary Fees for Performanceservices as bonus anddirector other expenses TOTAL TOTAL MINTEKDr. PP Jourdan <strong>Mintek</strong> 1,266,717 – 4,880 1,271,597 1,193,917Dr. RL Paul <strong>Mintek</strong> 1,242,433 – 9,912 1,252,345 1,033,879Dr. NA Barcza (Resigned) <strong>Mintek</strong> & Mindev – – – – 763,700Dr. M Motuku <strong>Mintek</strong> 838,768 – 8,949 847,717 782,429Mr. P Fusi <strong>Mintek</strong> 860,227 – – 860,227 828,478Mr. V Govender <strong>Mintek</strong> 845,352 – 280 845,632 821,450Ms. K Mzondeki (Resigned) <strong>Mintek</strong> – – – – 127,166 – 24,021 5,077,518 5,551,019 MINTEKMr. M Khumalo (Chairman) Metallon Corporation – 7,000 – 7,000 9,108Dr F. Crundwell CM Solutions – 10,546 – 10,545 18,668Ms.T Mosery-Eboka (Resigned Jan 2006) Standard Bank – – – – 1,691Dr. NP Mjoli Hlathi Development – 2,976 – 2,976 15,286Ms. L Mojela (Resigned December 2005) WIPHOLD – – – – 5,659Mr. R Havenstein Anglo American Platinum – 5,198 – 5,198 6,764Ms. G Mthethwa Standard Bank – 11,759 – 11,759 15,219Mr. V Pillay CSIR – 5,621 – 5,621 12,423Mr. P Taljaard – 6,889 – 6,889 –Prof. PE Ngoepe University of the North – 1,268 – 1,268 10,146Mr. TY Dube – 5,621 – 5,621 –MINDEVMr. N Morrison Mindev – 1,690 – 1,690 3,382Mr. G Mosinyi Mindev – – – – 5,0735,053,497 58,568 24,021 5,136,086 5,654,43883annual report 2007