Premier Bb Series - Prudential Annuities

Premier Bb Series - Prudential Annuities

Premier Bb Series - Prudential Annuities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

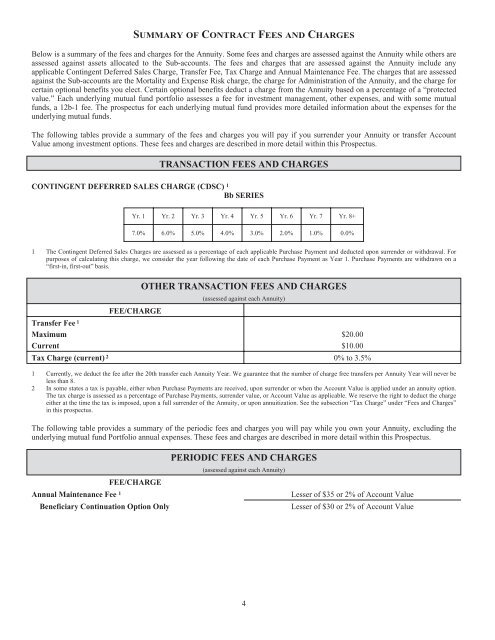

SUMMARY OF CONTRACT FEES AND CHARGESBelow is a summary of the fees and charges for the Annuity. Some fees and charges are assessed against the Annuity while others areassessed against assets allocated to the Sub-accounts. The fees and charges that are assessed against the Annuity include anyapplicable Contingent Deferred Sales Charge, Transfer Fee, Tax Charge and Annual Maintenance Fee. The charges that are assessedagainst the Sub-accounts are the Mortality and Expense Risk charge, the charge for Administration of the Annuity, and the charge forcertain optional benefits you elect. Certain optional benefits deduct a charge from the Annuity based on a percentage of a “protectedvalue.” Each underlying mutual fund portfolio assesses a fee for investment management, other expenses, and with some mutualfunds, a 12b-1 fee. The prospectus for each underlying mutual fund provides more detailed information about the expenses for theunderlying mutual funds.The following tables provide a summary of the fees and charges you will pay if you surrender your Annuity or transfer AccountValue among investment options. These fees and charges are described in more detail within this Prospectus.TRANSACTION FEES AND CHARGESCONTINGENT DEFERRED SALES CHARGE (CDSC) 1 <strong>Bb</strong> SERIESYr. 1 Yr. 2 Yr. 3 Yr. 4 Yr. 5 Yr. 6 Yr. 7 Yr. 8+7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0%1 The Contingent Deferred Sales Charges are assessed as a percentage of each applicable Purchase Payment and deducted upon surrender or withdrawal. Forpurposes of calculating this charge, we consider the year following the date of each Purchase Payment as Year 1. Purchase Payments are withdrawn on a“first-in, first-out” basis.OTHER TRANSACTION FEES AND CHARGES(assessed against each Annuity)FEE/CHARGETransfer Fee 1Maximum $20.00Current $10.00Tax Charge (current) 2 0% to 3.5%1 Currently, we deduct the fee after the 20th transfer each Annuity Year. We guarantee that the number of charge free transfers per Annuity Year will never beless than 8.2 In some states a tax is payable, either when Purchase Payments are received, upon surrender or when the Account Value is applied under an annuity option.The tax charge is assessed as a percentage of Purchase Payments, surrender value, or Account Value as applicable. We reserve the right to deduct the chargeeither at the time the tax is imposed, upon a full surrender of the Annuity, or upon annuitization. See the subsection “Tax Charge” under “Fees and Charges”in this prospectus.The following table provides a summary of the periodic fees and charges you will pay while you own your Annuity, excluding theunderlying mutual fund Portfolio annual expenses. These fees and charges are described in more detail within this Prospectus.FEE/CHARGEAnnual Maintenance Fee 1Beneficiary Continuation Option OnlyPERIODIC FEES AND CHARGES(assessed against each Annuity)Lesser of $35 or 2% of Account ValueLesser of $30 or 2% of Account Value4