Premier Bb Series - Prudential Annuities

Premier Bb Series - Prudential Annuities

Premier Bb Series - Prudential Annuities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

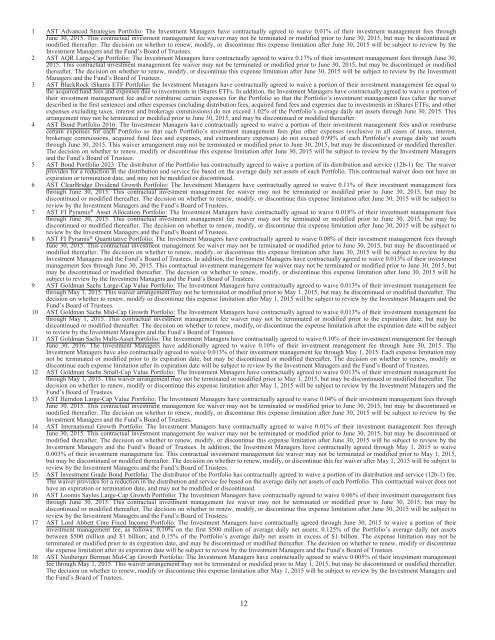

1 AST Advanced Strategies Portfolio: The Investment Managers have contractually agreed to waive 0.01% of their investment management fees throughJune 30, 2015. This contractual investment management fee waiver may not be terminated or modified prior to June 30, 2015, but may be discontinued ormodified thereafter. The decision on whether to renew, modify, or discontinue this expense limitation after June 30, 2015 will be subject to review by theInvestment Managers and the Fund’s Board of Trustees.2 AST AQR Large-Cap Portfolio: The Investment Managers have contractually agreed to waive 0.17% of their investment management fees through June 30,2015. This contractual investment management fee waiver may not be terminated or modified prior to June 30, 2015, but may be discontinued or modifiedthereafter. The decision on whether to renew, modify, or discontinue this expense limitation after June 30, 2015 will be subject to review by the InvestmentManagers and the Fund’s Board of Trustees.3 AST BlackRock iShares ETF Portfolio: the Investment Managers have contractually agreed to waive a portion of their investment management fee equal tothe acquired fund fees and expenses due to investments in iShares ETFs. In addition, the Investment Managers have contractually agreed to waive a portion oftheir investment management fee and/or reimburse certain expenses for the Portfolio so that the Portfolio’s investment management fees (after the waiverdescribed in the first sentence) and other expenses (including distribution fees, acquired fund fees and expenses due to investments in iShares ETFs, and otherexpenses excluding taxes, interest and brokerage commissions) do not exceed 1.02% of the Portfolio’s average daily net assets through June 30, 2015. Thisarrangement may not be terminated or modified prior to June 30, 2015, and may be discontinued or modified thereafter.4 AST Bond Portfolio 2016: The Investment Managers have contractually agreed to waive a portion of their investment management fees and/or reimbursecertain expenses for each Portfolio so that each Portfolio’s investment management fees plus other expenses (exclusive in all cases of taxes, interest,brokerage commissions, acquired fund fees and expenses, and extraordinary expenses) do not exceed 0.99% of each Portfolio’s average daily net assetsthrough June 30, 2015. This waiver arrangement may not be terminated or modified prior to June 30, 2015, but may be discontinued or modified thereafter.The decision on whether to renew, modify or discontinue this expense limitation after June 30, 2015 will be subject to review by the Investment Managersand the Fund’s Board of Trustees.5 AST Bond Portfolio 2023: The distributor of the Portfolio has contractually agreed to waive a portion of its distribution and service (12b-1) fee. The waiverprovides for a reduction in the distribution and service fee based on the average daily net assets of each Portfolio. This contractual waiver does not have anexpiration or termination date, and may not be modified or discontinued.6 AST ClearBridge Dividend Growth Portfolio: The Investment Managers have contractually agreed to waive 0.11% of their investment management feesthrough June 30, 2015. This contractual investment management fee waiver may not be terminated or modified prior to June 30, 2015, but may bediscontinued or modified thereafter. The decision on whether to renew, modify, or discontinue this expense limitation after June 30, 2015 will be subject toreview by the Investment Managers and the Fund’s Board of Trustees.7 AST FI Pyramis ® Asset Allocation Portfolio: The Investment Managers have contractually agreed to waive 0.018% of their investment management feesthrough June 30, 2015. This contractual investment management fee waiver may not be terminated or modified prior to June 30, 2015, but may bediscontinued or modified thereafter. The decision on whether to renew, modify, or discontinue this expense limitation after June 30, 2015 will be subject toreview by the Investment Managers and the Fund’s Board of Trustees.8 AST FI Pyramis ® Quantitative Portfolio: The Investment Managers have contractually agreed to waive 0.08% of their investment management fees throughJune 30, 2015. This contractual investment management fee waiver may not be terminated or modified prior to June 30, 2015, but may be discontinued ormodified thereafter. The decision on whether to renew, modify, or discontinue this expense limitation after June 30, 2015 will be subject to review by theInvestment Managers and the Fund’s Board of Trustees. In addition, the Investment Managers have contractually agreed to waive 0.013% of their investmentmanagement fees through June 30, 2015. This contractual investment management fee waiver may not be terminated or modified prior to June 30, 2015, butmay be discontinued or modified thereafter. The decision on whether to renew, modify, or discontinue this expense limitation after June 30, 2015 will besubject to review by the Investment Managers and the Fund’s Board of Trustees.9 AST Goldman Sachs Large-Cap Value Portfolio: The Investment Managers have contractually agreed to waive 0.013% of their investment management feethrough May 1, 2015. This waiver arrangement may not be terminated or modified prior to May 1, 2015, but may be discontinued or modified thereafter. Thedecision on whether to renew, modify or discontinue this expense limitation after May 1, 2015 will be subject to review by the Investment Managers and theFund’s Board of Trustees.10 AST Goldman Sachs Mid-Cap Growth Portfolio: The Investment Managers have contractually agreed to waive 0.013% of their investment management feethrough May 1, 2015. This contractual investment management fee waiver may not be terminated or modified prior to the expiration date, but may bediscontinued or modified thereafter. The decision on whether to renew, modify, or discontinue the expense limitation after the expiration date will be subjectto review by the Investment Managers and the Fund’s Board of Trustees.11 AST Goldman Sachs Multi-Asset Portfolio: The Investment Managers have contractually agreed to waive 0.10% of their investment management fee throughJune 30, 2016. The Investment Managers have additionally agreed to waive 0.10% of their investment management fee through June 30, 2015. TheInvestment Managers have also contractually agreed to waive 0.013% of their investment management fee through May 1, 2015. Each expense limitation maynot be terminated or modified prior to its expiration date, but may be discontinued or modified thereafter. The decision on whether to renew, modify ordiscontinue each expense limitation after its expiration date will be subject to review by the Investment Managers and the Fund’s Board of Trustees.12 AST Goldman Sachs Small-Cap Value Portfolio: The Investment Managers have contractually agreed to waive 0.013% of their investment management feethrough May 1, 2015. This waiver arrangement may not be terminated or modified prior to May 1, 2015, but may be discontinued or modified thereafter. Thedecision on whether to renew, modify or discontinue this expense limitation after May 1, 2015 will be subject to review by the Investment Managers and theFund’s Board of Trustees.13 AST Herndon Large-Cap Value Portfolio: The Investment Managers have contractually agreed to waive 0.04% of their investment management fees throughJune 30, 2015. This contractual investment management fee waiver may not be terminated or modified prior to June 30, 2015, but may be discontinued ormodified thereafter. The decision on whether to renew, modify, or discontinue this expense limitation after June 30, 2015 will be subject to review by theInvestment Managers and the Fund’s Board of Trustees.14 AST International Growth Portfolio: The Investment Managers have contractually agreed to waive 0.01% of their investment management fees throughJune 30, 2015. This contractual investment management fee waiver may not be terminated or modified prior to June 30, 2015, but may be discontinued ormodified thereafter. The decision on whether to renew, modify, or discontinue this expense limitation after June 30, 2015 will be subject to review by theInvestment Managers and the Fund’s Board of Trustees. In addition, the Investment Managers have contractually agreed through May 1, 2015 to waive0.003% of their investment management fee. This contractual investment management fee waiver may not be terminated or modified prior to May 1, 2015,but may be discontinued or modified thereafter. The decision on whether to renew, modify, or discontinue this fee waiver after May 1, 2015 will be subject toreview by the Investment Managers and the Fund’s Board of Trustees.15 AST Investment Grade Bond Portfolio: The distributor of the Portfolio has contractually agreed to waive a portion of its distribution and service (12b-1) fee.The waiver provides for a reduction in the distribution and service fee based on the average daily net assets of each Portfolio. This contractual waiver does nothave an expiration or termination date, and may not be modified or discontinued.16 AST Loomis Sayles Large-Cap Growth Portfolio: The Investment Managers have contractually agreed to waive 0.06% of their investment management feesthrough June 30, 2015. This contractual investment management fee waiver may not be terminated or modified prior to June 30, 2015, but may bediscontinued or modified thereafter. The decision on whether to renew, modify, or discontinue this expense limitation after June 30, 2015 will be subject toreview by the Investment Managers and the Fund’s Board of Trustees.17 AST Lord Abbett Core Fixed Income Portfolio: The Investment Managers have contractually agreed through June 30, 2015 to waive a portion of theirinvestment management fee, as follows: 0.10% on the first $500 million of average daily net assets; 0.125% of the Portfolio’s average daily net assetsbetween $500 million and $1 billion; and 0.15% of the Portfolio’s average daily net assets in excess of $1 billion. The expense limitation may not beterminated or modified prior to its expiration date, and may be discontinued or modified thereafter. The decision on whether to renew, modify or discontinuethe expense limitation after its expiration date will be subject to review by the Investment Managers and the Fund’s Board of Trustees.18 AST Neuberger Berman Mid-Cap Growth Portfolio: The Investment Managers have contractually agreed to waive 0.005% of their investment managementfee through May 1, 2015. This waiver arrangement may not be terminated or modified prior to May 1, 2015, but may be discontinued or modified thereafter.The decision on whether to renew, modify or discontinue this expense limitation after May 1, 2015 will be subject to review by the Investment Managers andthe Fund’s Board of Trustees.12