Premier Bb Series - Prudential Annuities

Premier Bb Series - Prudential Annuities

Premier Bb Series - Prudential Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

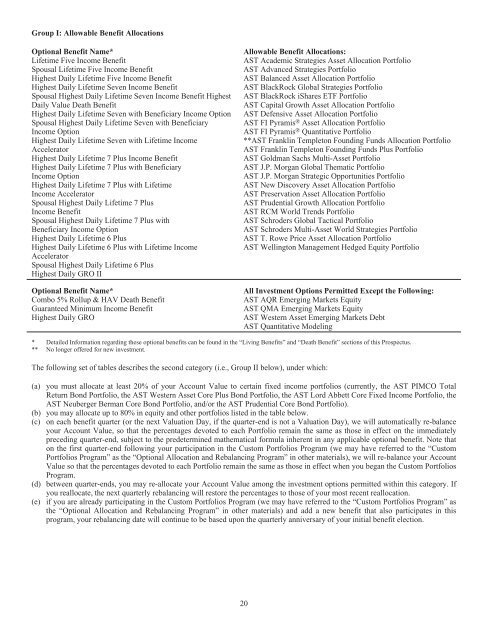

Group I: Allowable Benefit AllocationsOptional Benefit Name*Lifetime Five Income BenefitSpousal Lifetime Five Income BenefitHighest Daily Lifetime Five Income BenefitHighest Daily Lifetime Seven Income BenefitSpousal Highest Daily Lifetime Seven Income Benefit HighestDaily Value Death BenefitHighest Daily Lifetime Seven with Beneficiary Income OptionSpousal Highest Daily Lifetime Seven with BeneficiaryIncome OptionHighest Daily Lifetime Seven with Lifetime IncomeAcceleratorHighest Daily Lifetime 7 Plus Income BenefitHighest Daily Lifetime 7 Plus with BeneficiaryIncome OptionHighest Daily Lifetime 7 Plus with LifetimeIncome AcceleratorSpousal Highest Daily Lifetime 7 PlusIncome BenefitSpousal Highest Daily Lifetime 7 Plus withBeneficiary Income OptionHighest Daily Lifetime 6 PlusHighest Daily Lifetime 6 Plus with Lifetime IncomeAcceleratorSpousal Highest Daily Lifetime 6 PlusHighest Daily GRO IIOptional Benefit Name*Combo 5% Rollup & HAV Death BenefitGuaranteed Minimum Income BenefitHighest Daily GROAllowable Benefit Allocations:AST Academic Strategies Asset Allocation PortfolioAST Advanced Strategies PortfolioAST Balanced Asset Allocation PortfolioAST BlackRock Global Strategies PortfolioAST BlackRock iShares ETF PortfolioAST Capital Growth Asset Allocation PortfolioAST Defensive Asset Allocation PortfolioAST FI Pyramis ® Asset Allocation PortfolioAST FI Pyramis ® Quantitative Portfolio**AST Franklin Templeton Founding Funds Allocation PortfolioAST Franklin Templeton Founding Funds Plus PortfolioAST Goldman Sachs Multi-Asset PortfolioAST J.P. Morgan Global Thematic PortfolioAST J.P. Morgan Strategic Opportunities PortfolioAST New Discovery Asset Allocation PortfolioAST Preservation Asset Allocation PortfolioAST <strong>Prudential</strong> Growth Allocation PortfolioAST RCM World Trends PortfolioAST Schroders Global Tactical PortfolioAST Schroders Multi-Asset World Strategies PortfolioAST T. Rowe Price Asset Allocation PortfolioAST Wellington Management Hedged Equity PortfolioAll Investment Options Permitted Except the Following:AST AQR Emerging Markets EquityAST QMA Emerging Markets EquityAST Western Asset Emerging Markets DebtAST Quantitative Modeling* Detailed Information regarding these optional benefits can be found in the “Living Benefits” and “Death Benefit” sections of this Prospectus.** No longer offered for new investment.The following set of tables describes the second category (i.e., Group II below), under which:(a) you must allocate at least 20% of your Account Value to certain fixed income portfolios (currently, the AST PIMCO TotalReturn Bond Portfolio, the AST Western Asset Core Plus Bond Portfolio, the AST Lord Abbett Core Fixed Income Portfolio, theAST Neuberger Berman Core Bond Portfolio, and/or the AST <strong>Prudential</strong> Core Bond Portfolio).(b) you may allocate up to 80% in equity and other portfolios listed in the table below.(c) on each benefit quarter (or the next Valuation Day, if the quarter-end is not a Valuation Day), we will automatically re-balanceyour Account Value, so that the percentages devoted to each Portfolio remain the same as those in effect on the immediatelypreceding quarter-end, subject to the predetermined mathematical formula inherent in any applicable optional benefit. Note thaton the first quarter-end following your participation in the Custom Portfolios Program (we may have referred to the “CustomPortfolios Program” as the “Optional Allocation and Rebalancing Program” in other materials), we will re-balance your AccountValue so that the percentages devoted to each Portfolio remain the same as those in effect when you began the Custom PortfoliosProgram.(d) between quarter-ends, you may re-allocate your Account Value among the investment options permitted within this category. Ifyou reallocate, the next quarterly rebalancing will restore the percentages to those of your most recent reallocation.(e) if you are already participating in the Custom Portfolios Program (we may have referred to the “Custom Portfolios Program” asthe “Optional Allocation and Rebalancing Program” in other materials) and add a new benefit that also participates in thisprogram, your rebalancing date will continue to be based upon the quarterly anniversary of your initial benefit election.20