Premier Bb Series - Prudential Annuities

Premier Bb Series - Prudential Annuities

Premier Bb Series - Prudential Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

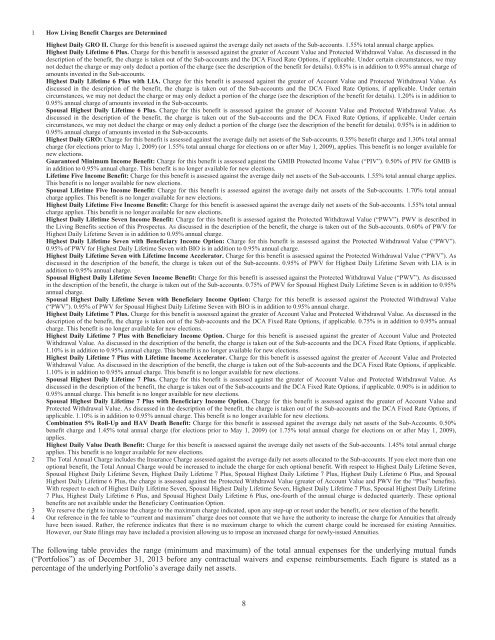

1 How Living Benefit Charges are DeterminedHighest Daily GRO II. Charge for this benefit is assessed against the average daily net assets of the Sub-accounts. 1.55% total annual charge applies.Highest Daily Lifetime 6 Plus. Charge for this benefit is assessed against the greater of Account Value and Protected Withdrawal Value. As discussed in thedescription of the benefit, the charge is taken out of the Sub-accounts and the DCA Fixed Rate Options, if applicable. Under certain circumstances, we maynot deduct the charge or may only deduct a portion of the charge (see the description of the benefit for details). 0.85% is in addition to 0.95% annual charge ofamounts invested in the Sub-accounts.Highest Daily Lifetime 6 Plus with LIA. Charge for this benefit is assessed against the greater of Account Value and Protected Withdrawal Value. Asdiscussed in the description of the benefit, the charge is taken out of the Sub-accounts and the DCA Fixed Rate Options, if applicable. Under certaincircumstances, we may not deduct the charge or may only deduct a portion of the charge (see the description of the benefit for details). 1.20% is in addition to0.95% annual charge of amounts invested in the Sub-accounts.Spousal Highest Daily Lifetime 6 Plus. Charge for this benefit is assessed against the greater of Account Value and Protected Withdrawal Value. Asdiscussed in the description of the benefit, the charge is taken out of the Sub-accounts and the DCA Fixed Rate Options, if applicable. Under certaincircumstances, we may not deduct the charge or may only deduct a portion of the charge (see the description of the benefit for details). 0.95% is in addition to0.95% annual charge of amounts invested in the Sub-accounts.Highest Daily GRO: Charge for this benefit is assessed against the average daily net assets of the Sub-accounts. 0.35% benefit charge and 1.30% total annualcharge (for elections prior to May 1, 2009) (or 1.55% total annual charge for elections on or after May 1, 2009), applies. This benefit is no longer available fornew elections.Guaranteed Minimum Income Benefit: Charge for this benefit is assessed against the GMIB Protected Income Value (“PIV”). 0.50% of PIV for GMIB isin addition to 0.95% annual charge. This benefit is no longer available for new elections.Lifetime Five Income Benefit: Charge for this benefit is assessed against the average daily net assets of the Sub-accounts. 1.55% total annual charge applies.This benefit is no longer available for new elections.Spousal Lifetime Five Income Benefit: Charge for this benefit is assessed against the average daily net assets of the Sub-accounts. 1.70% total annualcharge applies. This benefit is no longer available for new elections.Highest Daily Lifetime Five Income Benefit: Charge for this benefit is assessed against the average daily net assets of the Sub-accounts. 1.55% total annualcharge applies. This benefit is no longer available for new elections.Highest Daily Lifetime Seven Income Benefit: Charge for this benefit is assessed against the Protected Withdrawal Value (“PWV”). PWV is described inthe Living Benefits section of this Prospectus. As discussed in the description of the benefit, the charge is taken out of the Sub-accounts. 0.60% of PWV forHighest Daily Lifetime Seven is in addition to 0.95% annual charge.Highest Daily Lifetime Seven with Beneficiary Income Option: Charge for this benefit is assessed against the Protected Withdrawal Value (“PWV”).0.95% of PWV for Highest Daily Lifetime Seven with BIO is in addition to 0.95% annual charge.Highest Daily Lifetime Seven with Lifetime Income Accelerator. Charge for this benefit is assessed against the Protected Withdrawal Value (“PWV”). Asdiscussed in the description of the benefit, the charge is taken out of the Sub-accounts. 0.95% of PWV for Highest Daily Lifetime Seven with LIA is inaddition to 0.95% annual charge.Spousal Highest Daily Lifetime Seven Income Benefit: Charge for this benefit is assessed against the Protected Withdrawal Value (“PWV”). As discussedin the description of the benefit, the charge is taken out of the Sub-accounts. 0.75% of PWV for Spousal Highest Daily Lifetime Seven is in addition to 0.95%annual charge.Spousal Highest Daily Lifetime Seven with Beneficiary Income Option: Charge for this benefit is assessed against the Protected Withdrawal Value(“PWV”). 0.95% of PWV for Spousal Highest Daily Lifetime Seven with BIO is in addition to 0.95% annual charge.Highest Daily Lifetime 7 Plus. Charge for this benefit is assessed against the greater of Account Value and Protected Withdrawal Value. As discussed in thedescription of the benefit, the charge is taken out of the Sub-accounts and the DCA Fixed Rate Options, if applicable. 0.75% is in addition to 0.95% annualcharge. This benefit is no longer available for new elections.Highest Daily Lifetime 7 Plus with Beneficiary Income Option. Charge for this benefit is assessed against the greater of Account Value and ProtectedWithdrawal Value. As discussed in the description of the benefit, the charge is taken out of the Sub-accounts and the DCA Fixed Rate Options, if applicable.1.10% is in addition to 0.95% annual charge. This benefit is no longer available for new elections.Highest Daily Lifetime 7 Plus with Lifetime Income Accelerator. Charge for this benefit is assessed against the greater of Account Value and ProtectedWithdrawal Value. As discussed in the description of the benefit, the charge is taken out of the Sub-accounts and the DCA Fixed Rate Options, if applicable.1.10% is in addition to 0.95% annual charge. This benefit is no longer available for new elections.Spousal Highest Daily Lifetime 7 Plus. Charge for this benefit is assessed against the greater of Account Value and Protected Withdrawal Value. Asdiscussed in the description of the benefit, the charge is taken out of the Sub-accounts and the DCA Fixed Rate Options, if applicable. 0.90% is in addition to0.95% annual charge. This benefit is no longer available for new elections.Spousal Highest Daily Lifetime 7 Plus with Beneficiary Income Option. Charge for this benefit is assessed against the greater of Account Value andProtected Withdrawal Value. As discussed in the description of the benefit, the charge is taken out of the Sub-accounts and the DCA Fixed Rate Options, ifapplicable. 1.10% is in addition to 0.95% annual charge. This benefit is no longer available for new elections.Combination 5% Roll-Up and HAV Death Benefit: Charge for this benefit is assessed against the average daily net assets of the Sub-Accounts. 0.50%benefit charge and 1.45% total annual charge (for elections prior to May 1, 2009) (or 1.75% total annual charge for elections on or after May 1, 2009),applies.Highest Daily Value Death Benefit: Charge for this benefit is assessed against the average daily net assets of the Sub-accounts. 1.45% total annual chargeapplies. This benefit is no longer available for new elections.2 The Total Annual Charge includes the Insurance Charge assessed against the average daily net assets allocated to the Sub-accounts. If you elect more than oneoptional benefit, the Total Annual Charge would be increased to include the charge for each optional benefit. With respect to Highest Daily Lifetime Seven,Spousal Highest Daily Lifetime Seven, Highest Daily Lifetime 7 Plus, Spousal Highest Daily Lifetime 7 Plus, Highest Daily Lifetime 6 Plus, and SpousalHighest Daily Lifetime 6 Plus, the charge is assessed against the Protected Withdrawal Value (greater of Account Value and PWV for the “Plus” benefits).With respect to each of Highest Daily Lifetime Seven, Spousal Highest Daily Lifetime Seven, Highest Daily Lifetime 7 Plus, Spousal Highest Daily Lifetime7 Plus, Highest Daily Lifetime 6 Plus, and Spousal Highest Daily Lifetime 6 Plus, one-fourth of the annual charge is deducted quarterly. These optionalbenefits are not available under the Beneficiary Continuation Option.3 We reserve the right to increase the charge to the maximum charge indicated, upon any step-up or reset under the benefit, or new election of the benefit.4 Our reference in the fee table to “current and maximum” charge does not connote that we have the authority to increase the charge for <strong>Annuities</strong> that alreadyhave been issued. Rather, the reference indicates that there is no maximum charge to which the current charge could be increased for existing <strong>Annuities</strong>.However, our State filings may have included a provision allowing us to impose an increased charge for newly-issued <strong>Annuities</strong>.The following table provides the range (minimum and maximum) of the total annual expenses for the underlying mutual funds(“Portfolios”) as of December 31, 2013 before any contractual waivers and expense reimbursements. Each figure is stated as apercentage of the underlying Portfolio’s average daily net assets.8