Premier Bb Series - Prudential Annuities

Premier Bb Series - Prudential Annuities

Premier Bb Series - Prudential Annuities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

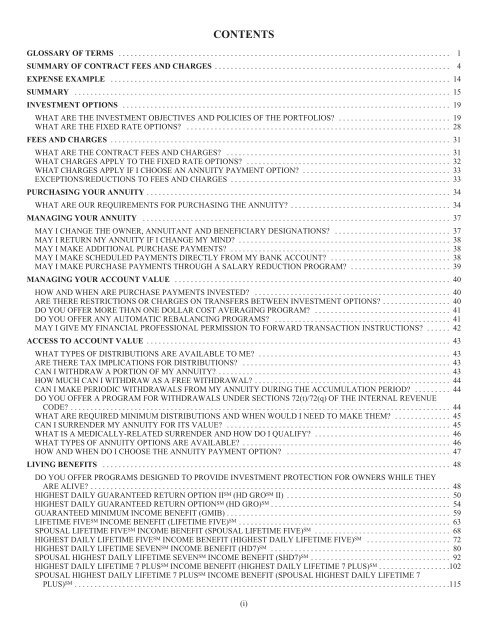

CONTENTSGLOSSARY OF TERMS ................................................................................... 1SUMMARY OF CONTRACT FEES AND CHARGES ........................................................... 4EXPENSE EXAMPLE ..................................................................................... 14SUMMARY .............................................................................................. 15INVESTMENT OPTIONS .................................................................................. 19WHAT ARE THE INVESTMENT OBJECTIVES AND POLICIES OF THE PORTFOLIOS? ............................ 19WHAT ARE THE FIXED RATE OPTIONS? .................................................................. 28FEES AND CHARGES ..................................................................................... 31WHAT ARE THE CONTRACT FEES AND CHARGES? ........................................................ 31WHAT CHARGES APPLY TO THE FIXED RATE OPTIONS? ................................................... 32WHAT CHARGES APPLY IF I CHOOSE AN ANNUITY PAYMENT OPTION? ..................................... 33EXCEPTIONS/REDUCTIONS TO FEES AND CHARGES ....................................................... 33PURCHASING YOUR ANNUITY ............................................................................ 34WHAT ARE OUR REQUIREMENTS FOR PURCHASING THE ANNUITY? ........................................ 34MANAGING YOUR ANNUITY ............................................................................. 37MAY I CHANGE THE OWNER, ANNUITANT AND BENEFICIARY DESIGNATIONS? ............................. 37MAY I RETURN MY ANNUITY IF I CHANGE MY MIND? ..................................................... 38MAY I MAKE ADDITIONAL PURCHASE PAYMENTS? ....................................................... 38MAY I MAKE SCHEDULED PAYMENTS DIRECTLY FROM MY BANK ACCOUNT? .............................. 38MAY I MAKE PURCHASE PAYMENTS THROUGH A SALARY REDUCTION PROGRAM? ......................... 39MANAGING YOUR ACCOUNT VALUE ..................................................................... 40HOW AND WHEN ARE PURCHASE PAYMENTS INVESTED? ................................................. 40ARE THERE RESTRICTIONS OR CHARGES ON TRANSFERS BETWEEN INVESTMENT OPTIONS? ................. 40DO YOU OFFER MORE THAN ONE DOLLAR COST AVERAGING PROGRAM? .................................. 41DO YOU OFFER ANY AUTOMATIC REBALANCING PROGRAMS? ............................................ 41MAY I GIVE MY FINANCIAL PROFESSIONAL PERMISSION TO FORWARD TRANSACTION INSTRUCTIONS? ...... 42ACCESS TO ACCOUNT VALUE ............................................................................ 43WHAT TYPES OF DISTRIBUTIONS ARE AVAILABLE TO ME? ................................................ 43ARE THERE TAX IMPLICATIONS FOR DISTRIBUTIONS? .................................................... 43CAN I WITHDRAW A PORTION OF MY ANNUITY? .......................................................... 43HOW MUCH CAN I WITHDRAW AS A FREE WITHDRAWAL? ................................................. 44CAN I MAKE PERIODIC WITHDRAWALS FROM MY ANNUITY DURING THE ACCUMULATION PERIOD? ......... 44DO YOU OFFER A PROGRAM FOR WITHDRAWALS UNDER SECTIONS 72(t)/72(q) OF THE INTERNAL REVENUECODE? ............................................................................................... 44WHAT ARE REQUIRED MINIMUM DISTRIBUTIONS AND WHEN WOULD I NEED TO MAKE THEM? .............. 45CAN I SURRENDER MY ANNUITY FOR ITS VALUE? ........................................................ 45WHAT IS A MEDICALLY-RELATED SURRENDER AND HOW DO I QUALIFY? .................................. 46WHAT TYPES OF ANNUITY OPTIONS ARE AVAILABLE? .................................................... 46HOW AND WHEN DO I CHOOSE THE ANNUITY PAYMENT OPTION? ......................................... 47LIVING BENEFITS ....................................................................................... 48DO YOU OFFER PROGRAMS DESIGNED TO PROVIDE INVESTMENT PROTECTION FOR OWNERS WHILE THEYARE ALIVE? .......................................................................................... 48HIGHEST DAILY GUARANTEED RETURN OPTION II SM (HD GRO SM II) ......................................... 50HIGHEST DAILY GUARANTEED RETURN OPTION SM (HD GRO) SM ............................................. 54GUARANTEED MINIMUM INCOME BENEFIT (GMIB) ........................................................ 59LIFETIME FIVE SM INCOME BENEFIT (LIFETIME FIVE) SM ..................................................... 63SPOUSAL LIFETIME FIVE SM INCOME BENEFIT (SPOUSAL LIFETIME FIVE) SM .................................. 68HIGHEST DAILY LIFETIME FIVE SM INCOME BENEFIT (HIGHEST DAILY LIFETIME FIVE) SM ..................... 72HIGHEST DAILY LIFETIME SEVEN SM INCOME BENEFIT (HD7) SM ............................................. 80SPOUSAL HIGHEST DAILY LIFETIME SEVEN SM INCOME BENEFIT (SHD7) SM ................................... 92HIGHEST DAILY LIFETIME 7 PLUS SM INCOME BENEFIT (HIGHEST DAILY LIFETIME 7 PLUS) SM ..................102SPOUSAL HIGHEST DAILY LIFETIME 7 PLUS SM INCOME BENEFIT (SPOUSAL HIGHEST DAILY LIFETIME 7PLUS) SM ..............................................................................................115(i)