Premier Bb Series - Prudential Annuities

Premier Bb Series - Prudential Annuities

Premier Bb Series - Prudential Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

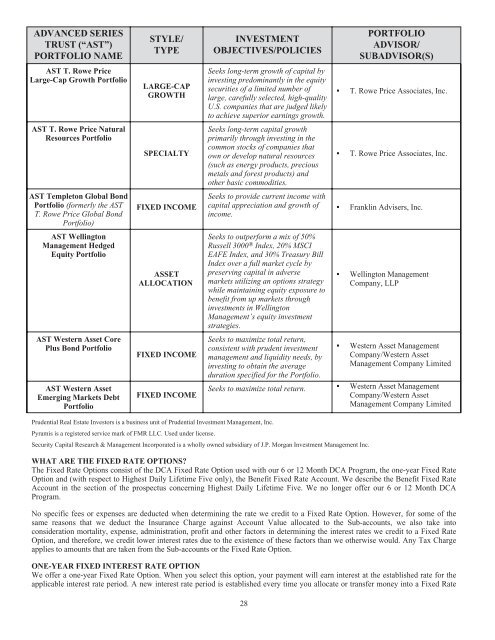

ADVANCED SERIESTRUST (“AST”)PORTFOLIO NAMEAST T. Rowe PriceLarge-Cap Growth PortfolioAST T. Rowe Price NaturalResources PortfolioAST Templeton Global BondPortfolio (formerly the ASTT. Rowe Price Global BondPortfolio)AST WellingtonManagement HedgedEquity PortfolioAST Western Asset CorePlus Bond PortfolioAST Western AssetEmerging Markets DebtPortfolioSTYLE/TYPELARGE-CAPGROWTHSPECIALTYFIXED INCOMEASSETALLOCATIONFIXED INCOMEFIXED INCOMEINVESTMENTOBJECTIVES/POLICIESSeeks long-term growth of capital byinvesting predominantly in the equitysecurities of a limited number oflarge, carefully selected, high-qualityU.S. companies that are judged likelyto achieve superior earnings growth.Seeks long-term capital growthprimarily through investing in thecommon stocks of companies thatown or develop natural resources(such as energy products, preciousmetals and forest products) andother basic commodities.Seeks to provide current income withcapital appreciation and growth ofincome.Seeks to outperform a mix of 50%Russell 3000 ® Index, 20% MSCIEAFE Index, and 30% Treasury BillIndex over a full market cycle bypreserving capital in adversemarkets utilizing an options strategywhile maintaining equity exposure tobenefit from up markets throughinvestments in WellingtonManagement’s equity investmentstrategies.Seeks to maximize total return,consistent with prudent investmentmanagement and liquidity needs, byinvesting to obtain the averageduration specified for the Portfolio.▪▪▪▪▪PORTFOLIOADVISOR/SUBADVISOR(S)T. Rowe Price Associates, Inc.T. Rowe Price Associates, Inc.Franklin Advisers, Inc.Wellington ManagementCompany, LLPWestern Asset ManagementCompany/Western AssetManagement Company LimitedSeeks to maximize total return. ▪ Western Asset ManagementCompany/Western AssetManagement Company Limited<strong>Prudential</strong> Real Estate Investors is a business unit of <strong>Prudential</strong> Investment Management, Inc.Pyramis is a registered service mark of FMR LLC. Used under license.Security Capital Research & Management Incorporated is a wholly owned subsidiary of J.P. Morgan Investment Management Inc.WHAT ARE THE FIXED RATE OPTIONS?The Fixed Rate Options consist of the DCA Fixed Rate Option used with our 6 or 12 Month DCA Program, the one-year Fixed RateOption and (with respect to Highest Daily Lifetime Five only), the Benefit Fixed Rate Account. We describe the Benefit Fixed RateAccount in the section of the prospectus concerning Highest Daily Lifetime Five. We no longer offer our 6 or 12 Month DCAProgram.No specific fees or expenses are deducted when determining the rate we credit to a Fixed Rate Option. However, for some of thesame reasons that we deduct the Insurance Charge against Account Value allocated to the Sub-accounts, we also take intoconsideration mortality, expense, administration, profit and other factors in determining the interest rates we credit to a Fixed RateOption, and therefore, we credit lower interest rates due to the existence of these factors than we otherwise would. Any Tax Chargeapplies to amounts that are taken from the Sub-accounts or the Fixed Rate Option.ONE-YEAR FIXED INTEREST RATE OPTIONWe offer a one-year Fixed Rate Option. When you select this option, your payment will earn interest at the established rate for theapplicable interest rate period. A new interest rate period is established every time you allocate or transfer money into a Fixed Rate28