Michel Dacorogna, Tail-Dependence an Essential Factor for

Michel Dacorogna, Tail-Dependence an Essential Factor for

Michel Dacorogna, Tail-Dependence an Essential Factor for

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

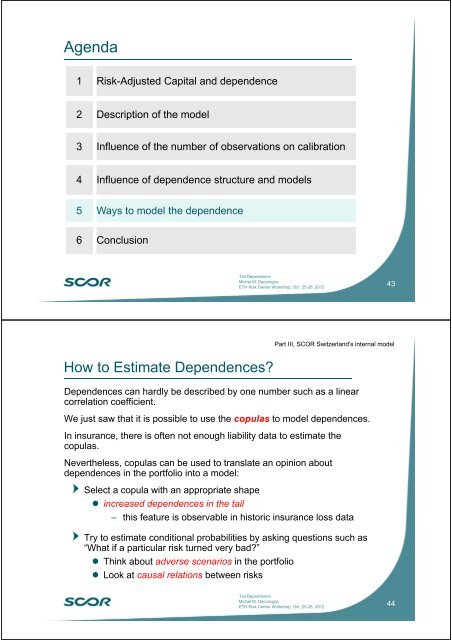

Agenda1 Risk-Adjusted Capital <strong>an</strong>d dependence2 Description of the model3 Influence of the number of observations on calibration4 Influence of dependence structure <strong>an</strong>d models5 Ways to model the dependence6 Conclusion<strong>Tail</strong> <strong>Dependence</strong><strong>Michel</strong> M. <strong>Dacorogna</strong>ETH Risk Center Workshop, Oct. 25-26, 201243How to Estimate <strong>Dependence</strong>s?<strong>Dependence</strong>s c<strong>an</strong> hardly be described by one number such as a linearcorrelation coefficient.We just saw that it is possible to use the copulas to model dependences.In insur<strong>an</strong>ce, there is often not enough liability data to estimate thecopulas.Nevertheless, copulas c<strong>an</strong> be used to tr<strong>an</strong>slate <strong>an</strong> opinion aboutdependences in the portfolio into a model:Part III, SCOR Switzerl<strong>an</strong>d’s internal modelSelect a copula with <strong>an</strong> appropriate shape• increased dependences in the tail– this feature is observable in historic insur<strong>an</strong>ce loss dataTry to estimate conditional probabilities by asking questions such as“What if a particular risk turned very bad?”• Think about adverse scenarios in the portfolio• Look at causal relations between risks<strong>Tail</strong> <strong>Dependence</strong><strong>Michel</strong> M. <strong>Dacorogna</strong>ETH Risk Center Workshop, Oct. 25-26, 201244